Business Snapshot

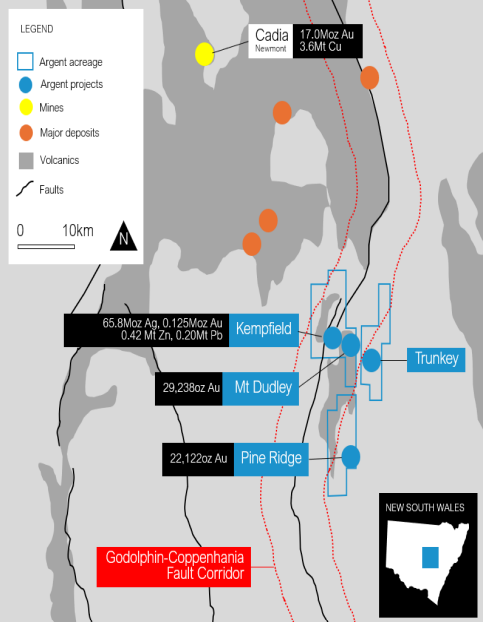

Argent Minerals is an Australian exploration company chasing polymetallic resources across NSW and WA. Its flagship Kempfield Project in New South Wales is the headline act, home to what Argent calls Australia’s second-largest undeveloped silver deposit. The project hosts silver, gold, lead, and zinc, and sits in a mining-friendly region with established infrastructure.

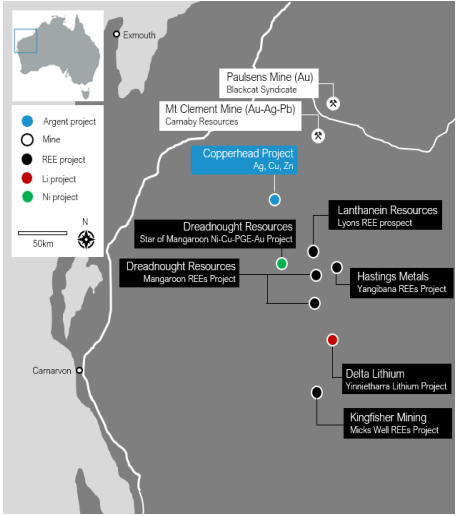

The company also holds ground in Western Australia’s Gascoyne region (Copperhead). The project shows strong signs of Copper mineralisation, ironstone and carbonatite-hosted rare earth potential, with over 50 high-priority REE targets already identified and under assessment.

Led by CEO and geologist Pedro Kastellorizos, Argent’s goal is clear: shift from pure explorer to early-stage producer by advancing Kempfield through systematic drilling and resource expansion.

What We Know on the Numbers

Argent remains firmly in the exploration phase, no meaningful revenue yet just incidental income. The company raised A$4.85 million in a recent, oversubscribed placement to fund drilling and fieldwork at Kempfield and regional targets.

From publicly disclosed data (per the company’s site and ASX updates):

- Resource base: ~63.7 Mt containing 142.8 Moz AgEq (JORC 2012).

- Contained metals: ~65.8 Moz silver, ~125 koz gold, ~207 kt lead, ~420 kt zinc.

- Balance sheet: debt-free, with a modest cash buffer from recent capital raisings.

Financially, Argent’s approach is conservative, keep the balance sheet clean, raise capital as needed, and pour most of it back into drilling. Argent Minerals (ARD) offers a speculative, high-risk entry into Australian polymetallic exploration. Kempfield remains the key value driver, targeting silver, gold, lead, and zinc.

Investment Thesis

While Argent maintains exploration momentum and a lean balance sheet, persistent net losses, minimal revenue, and dilution risk cap valuation upside in the short term. The share price is up more than 70 % year-on-year reflecting retail enthusiasm for small-cap explorers rather than clear operational milestones.

The investment case rests on two levers: exploration success and strategic optionality, whether through partnerships, farm-ins, or eventual acquisition. With supportive gold and silver pricing and no debt, Argent is positioned to re-rate quickly if drilling confirms scale and grade continuity. Until then, it sits firmly in speculative territory.

Market Moves & Valuation

ARD’s share price has been moving in tandem with exploration news and broader metals sentiment. Like most junior explorers, it’s volatile, strong spikes on drill results, steep drops when momentum fades. Traditional valuation metrics (like P/E ratios) don’t apply; this is a “potential energy” story, not an earnings one. At a market cap around A$60 million, the market is effectively pricing in optimism — a belief that Kempfield’s scale could justify development if upcoming drill results stack up.

Catalysts to Watch

- Drilling Results – Ongoing Kempfield assays remain the key trigger. A few standout intercepts could re-rate the stock overnight.

- Commodity Prices – Silver and gold prices in AUD terms have been firm. Sustained strength lifts sentiment and potential economics.

- Capital Management – Argent has executed placements cleanly so far; continued discipline here matters.

- Strategic Partnerships – Any JV, farm-in, or offtake interest could shift perception from pure explorer to emerging developer.

Risks (and There Are Plenty)

- Exploration risk: results may not confirm commercial scale or grade.

- Funding risk: further raises likely mean dilution.

- Market volatility: ARD trades like most explorers, big moves both ways.

- Operational and permitting risk: NSW approvals can drag; timelines can stretch.

Our Take

Argent Minerals is a classic small-cap explorer, clean structure, credible management, big target, no guarantees. The company’s upside hinges on Kempfield delivering sustained, high-grade results that justify its “second-largest undeveloped silver deposit” label.

With supportive metal prices and fresh funding, Argent has time to prove its case. Whether it delivers commercial discovery, or just good headlines will determine how long the recent share price momentum lasts.

For investors comfortable with early-stage risk, ARD offers leveraged exposure to the next leg of silver and gold exploration in Australia. For everyone else, it’s one to watch from the sidelines, volatile, but interesting.

Disclaimer

This content is for informational and educational purposes only and should not be taken as financial advice.