Artrya has built its story around a simple but powerful problem. Heart disease remains the world’s leading killer, yet the diagnostic toolkit used to detect vulnerable coronary plaque has barely changed in decades. The company’s flagship product, Artrya Salix, uses artificial intelligence to analyse CT scans and detect high-risk plaque that traditional methods often miss. On paper, it is one of those rare pieces of technology that could shift an entire category of care. But as investors know, great medical innovation does not automatically translate into commercial success. The big question for Artrya now is whether it can convert a technically impressive AI platform into a scalable, revenue-generating business model before its cash runway tightens.

This investment analysis reviews the opportunity, the execution challenges, and how Artrya is positioned heading into 2026.

Company Overview

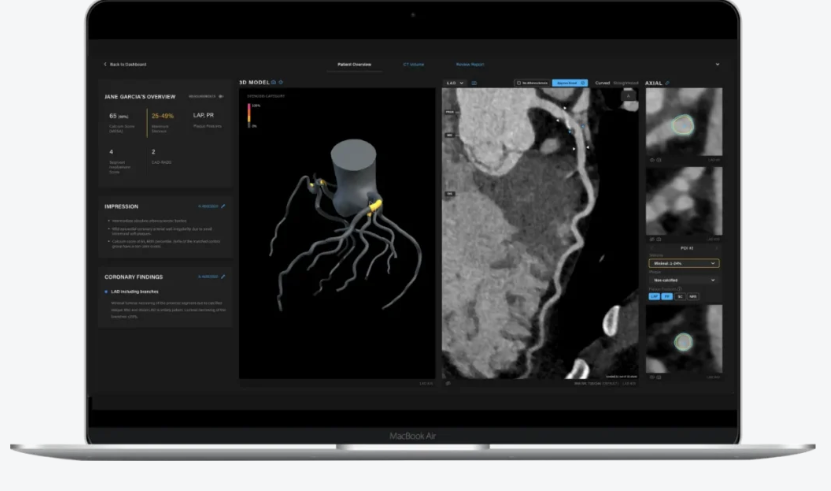

Artrya is a Perth based medical technology company focused on AI-driven cardiovascular diagnostics. Its core product, Artrya Salix, applies machine learning to CT coronary angiography images to identify features associated with major adverse cardiac events. The software is designed to improve accuracy, speed, and clinical confidence in identifying vulnerable plaque, a known precursor to sudden cardiac episodes.

The company operates with two distinct arms.

• A regulated diagnostics business targeting hospitals, radiology groups, and cardiology providers.

• A research analytics platform that delivers population-level insights for public health systems and insurers.

Artrya is operating in a global cardiovascular imaging market worth over US$3 billion, and growing steadily as healthcare systems look for more predictive, preventative tools.

The Product Suite

Artrya Salix

Salix is the centrepiece of the commercial strategy. It provides an automated diagnostic report that identifies plaque burden, lesion characteristics, high-risk features, and patient-level cardiac risk. The platform aims to reduce reporting times from up to 30 minutes to less than two minutes. In markets where cardiology workloads continue to increase, this value proposition is meaningful. Shorter turnaround times create more capacity, while improved detection accuracy supports better clinical decision making.

Artrya Analytics

A secondary but strategic product, Artrya Analytics aggregates data to support public health modelling and research programs. This enterprise-level analytics offering deepens relationships with government health systems and insurers, potentially opening doors to broader population-health contracts.

Regulatory Progress and Market Access

Regulation remains one of the biggest hurdles for any medtech business. Artrya has made material progress over the past two years, securing:

• TGA clearance for its products in Australia

• CE approval in Europe

• Advancing its FDA 510(k) pathway in the United States

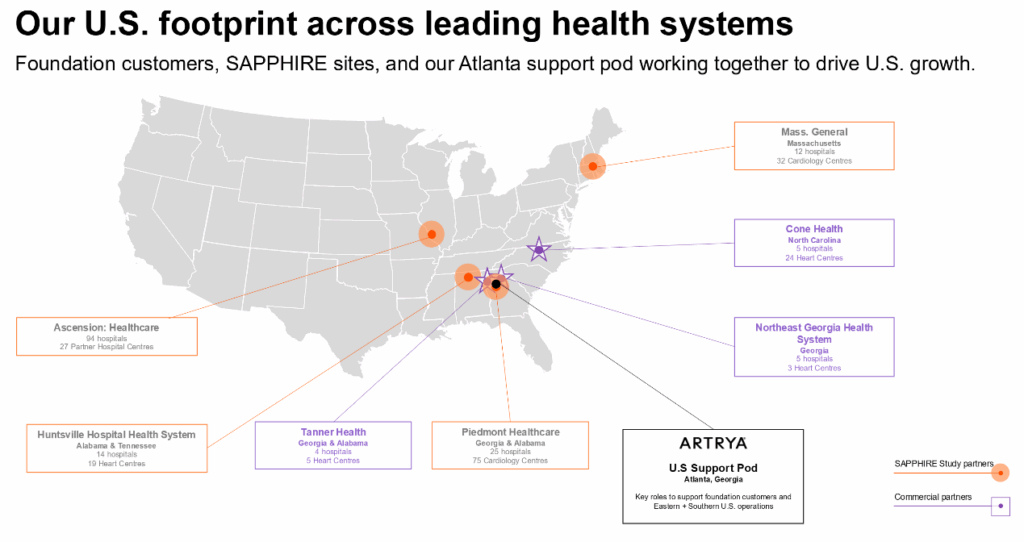

The U.S. market presents the greatest revenue opportunity, but also the greatest regulatory complexity. The company expects further FDA engagement across 2025 and early 2026. Any approval will become a major inflection point for investor sentiment because it unlocks the world’s largest cardiovascular diagnostics market.

Clinical Adoption and Commercial Pipeline

Artrya is still in the early stages of commercial rollout. Key activity includes:

• Clinical pilots with hospitals and imaging groups

• Multi-site trials underway in Australia, the UK, and parts of Europe

• Progress in reimbursement discussions across several regions

• Expansion into population research programs with health departments

Clinician acceptance is trending positively, but adoption cycles in cardiology are slow. Most providers require significant evidence, workflow integration, and peer-reviewed data before committing to paid contracts. The company is banking on early adopters converting into scalable commercial agreements in 2026.

Partnerships and Strategic Positioning

Artrya has formed partnerships with radiology groups, cardiac specialists, and research institutions to strengthen market credibility. Several agreements, including European provider networks and Australian health system collaborations, are intended to support distribution and validation.

Partnerships with major imaging equipment manufacturers also remain a potential future lever. Integrating Salix into existing workflows through OEM channels would significantly accelerate adoption, but such partnerships typically depend on regulatory momentum and large scale clinical validation.

Financial Performance and Balance Sheet

Artrya remains a pre-revenue company with limited commercial income to date. Most spending has gone into research, clinical studies, and regulatory advancement. As of the most recent financials:

• Cash reserves provide a runway into late 2025

• Operating losses remain elevated, in line with early stage medtech norms

• R&D expenditure continues to represent a significant portion of cash burn

• No debt, providing financial flexibility but heightening reliance on capital markets

The company will likely require additional funding unless accelerated commercial traction occurs. This is a central risk factor for investors.

Investment Case: Why Some Investors Remain Interested

1. Large, Global Addressable Market: Heart disease diagnostics represent a multi-billion dollar global market with strong secular tailwinds. Any clinically validated tool that improves accuracy and reduces time burden has real commercial potential.

2. Differentiated Technology: The AI-driven detection of vulnerable plaque is a meaningful clinical advance that addresses a clear gap in cardiovascular risk assessment.

3. Regulatory Momentum: Australian and European approvals, combined with progress toward FDA clearance, improve long-term visibility.

4. Attractive Strategic Optionality: Larger imaging and diagnostic firms often acquire emerging innovators rather than build competing products internally. Artrya could become a future acquisition candidate if clinical data continues to validate its platform.

Key Risks and Considerations

1. Slow Commercial Adoption: Cardiology is conservative by nature. Clinicians require significant proof before altering diagnostic pathways. This creates long lead times for revenue.

2. High Cash Burn: Without meaningful commercial sales in 2025, the company will likely need to raise capital.

3. Competitive Pressures: AI in medical imaging is rapidly expanding. Several global players, including HeartFlow and Cleerly, have deeper capital reserves and broader validation.

4. Regulatory Uncertainty in the U.S.: FDA approval is critical for scale. Delays or additional studies could slow the commercial timeline.

5. Reimbursement Pathway: Even with regulatory clearance, reimbursement is often the gating factor for uptake in hospitals.

Outlook and Conclusion

Artrya sits at an important crossroads. The technology is well defined, the clinical need is real, and regulatory wins have been meaningful. However, the investment narrative now shifts from innovation to execution.

Investors will be watching four milestones closely in 2025 and 2026:

- FDA progress and clarity on the regulatory pathway

- Conversion of pilot sites into paid commercial agreements

- Evidence of reimbursement traction

- Management of cash burn and capital strategy

If Artrya can deliver meaningful progress across these areas, the investment story becomes materially stronger. For now, Artrya remains a high potential, high risk medtech that requires patient, risk-tolerant investors who understand the typical timeline of commercialising regulated healthcare technology.

Artrya is a high-risk, high-reward growth stock with strong recent gains driven by FDA approvals and commercial contracts, earning a 3-star investment rating for investors focused on long-term upside potential in AI-driven cardiac diagnostics.