Late Payments Starve SMEs of Vital Working Capital

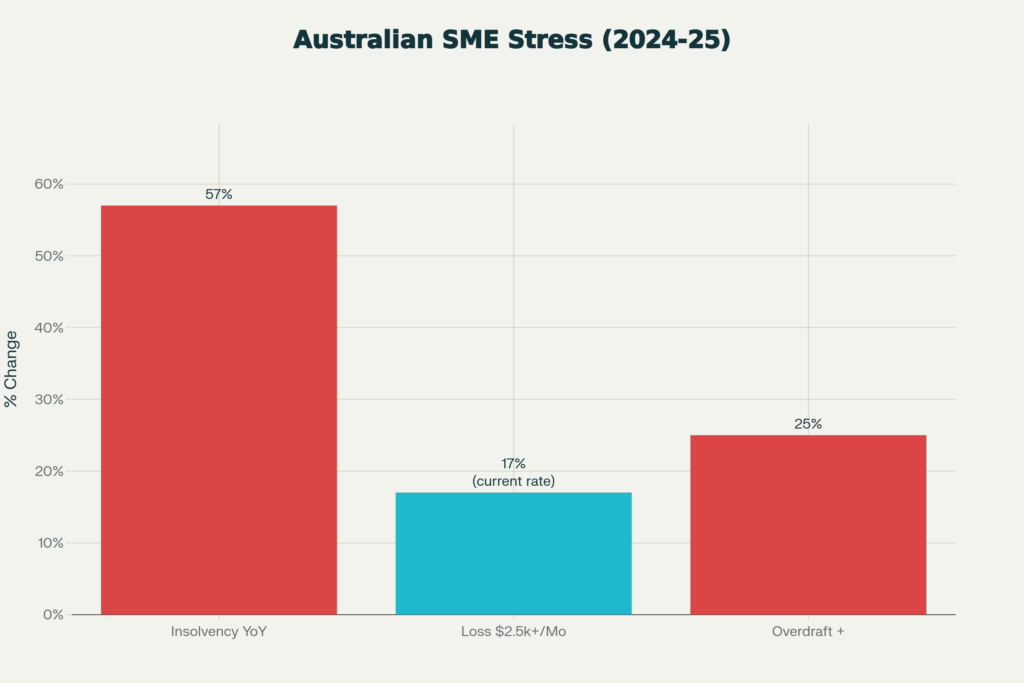

Australian small and medium businesses are now facing their toughest cashflow pressure since 2021. Late payments from large clients are dragging out for 30 to 90 days, starving SMEs of critical working capital. Seventeen percent of small businesses are losing more than 2,500 dollars each month because invoices are not being paid on time. The impact is most severe across construction, manufacturing and hospitality, where seasonal volatility and thin margins amplify the pain. Insolvencies have jumped 57 percent year on year as ATO debt recovery intensifies and order volumes soften during the holiday period.

This pressure comes even as national GDP posts better than expected growth. Sticky operating costs and softer consumer spending are creating a tougher environment beneath the headline numbers. Overdraft usage has climbed sharply as SMEs draw down credit lines to stay liquid, despite government incentives such as the instant asset write off.

Why Late Payments Are Choking SMEs Now

Big businesses officially operate on payment terms of about forty five days, yet real world delays often stretch well beyond sixty. For small suppliers, this creates a damaging working capital gap precisely when December’s peak demand requires more stock, more staff and more upfront investment. Surveys show that forty percent of SMEs are waiting more than thirty days as a routine part of doing business, a delay that quietly erodes margins by five to ten percent each year.

Holiday stockpiling adds another layer of pressure. Retailers delay payments while accelerating inventory purchases, leaving small suppliers to carry the financial burden. Meanwhile, the ATO has stepped up recoveries on more than forty billion dollars in outstanding debt, using director penalty notices to force repayment. Construction remains the hardest hit sector, accounting for roughly a quarter of all business failures. The Payment Times Reporting Scheme was designed to improve transparency, yet enforcement remains weak, with very few penalties issued.

The Economic Drag and The Christmas Trap

The macro impact is not small. Productivity drops as business owners spend time chasing overdue invoices rather than investing in growth or staff. Economists estimate that late payments cost the economy around twenty billion dollars annually. Christmas creates a misleading sense of strength, with higher sales masking deeper financial fragility. Thirty percent of SMEs expect to face cash shortages by January as bonus obligations and early year planning collide with slow repayments.

Regional businesses are even more exposed. Without access to diversified client bases or large anchor customers, they absorb payment delays more directly than firms based in Sydney or Melbourne. Although the RBA is holding interest rates steady, the higher for longer rate environment is keeping borrowing costs elevated. Unit labour pressures in the latest GDP data also confirm that relief is unlikely in the near term. SMEs account for one third of Australia’s GDP but represent seventy percent of corporate liquidations, making this a systemic concern rather than a niche issue.

Government Responses Are Not Solving the Core Problem

Policy support has helped at the edges. Instant asset write offs up to twenty thousand dollars and targeted energy rebates provide short term relief, but neither tackles the fundamental issue of payment asymmetry between big corporates and small suppliers. This has led to stronger calls for mandatory thirty day payment terms on all government contracts and tougher enforcement of the Payment Times Reporting Scheme.

Although federal budgets include more than 1.5 billion dollars in small business support measures, uptake remains inconsistent. Many SMEs either do not know the programs exist or lack the administrative bandwidth to apply. Export oriented businesses are cushioning some of the pressure through global contracts, but most domestic only operators remain exposed.

Practical Strategies SMEs Can Use Now

There is practical help available. SMEs can improve cashflow stability by working with experienced strategic finance advisers or virtual CFO teams who specialise in tightening working capital cycles. These teams regularly unlock fifteen to thirty percent improvements in days sales outstanding through targeted interventions.

Useful strategies include automated invoice communications paired with early payment incentives, invoice financing arrangements that advance eighty five to ninety five percent of receivables at far lower costs than overdrafts, supplier negotiations or group purchasing arrangements that deliver ten to twenty percent savings, and structured scenario planning that maps Christmas burn rates with at least a three month runway. Skilled advisers can also negotiate directly with ATO creditors, restructure payment plans and benchmark cashflow performance against industry peers. These improvements typically deliver a measurable return within months by reducing financial stress and freeing owners to shift their focus from survival back to growth.

Looking Ahead

SMEs cannot wait for policy reform. Resilience depends on proactive cashflow management, early intervention and access to the right financial tools. With the right systems in place, business owners can stabilise operations and position themselves for a stronger 2026, even as macro headwinds persist.