Gold prices recently regains momentum as investors reassess the outlook for interest rates, the U.S. dollar and global economic and political risks. After a strong rally earlier in the year, gold remains sensitive to shifts in bond yields, central-bank demand and safe-haven flows. With markets increasingly becoming more focused on the timing of potential rate cuts from the fed and signs of a cooling economy, gold’s next move will hinge on a small number of key drivers. Here’s what investors should be watching:

Key factors driving gold prices direction

- Interest-rates & real yields: Comments from Fed Chair Jerome Powell opened the door to additional rate cuts, causing renewed buying in gold as markets are increasingly expecting a rate cut in December meaning softer real yields, making non-yielding assets like gold more attractive.

- Central-bank & institutional demand: The World Gold Council reported global demand reached ~1,249 t in Q2 2025, with central-bank buying still high with 166 t purchased in Q2. This means gold has a strong institutional floor underneath it as central banks accumulate gold for diversification and are not sensitive to short-term volatility.

- Safe-haven & macro risk flows: Geo-economic uncertainty, geopolitical tensions, concerns with US fiscal policy and strength and weak economic data are feeding gold with safe-haven flows. Evident with gold jumping 2.8% when data pointed to U.S. labour-market weaker than expected and rising uncertainty in the US economy and trade policy.

- Dollar strength & technicals: A weaker dollar makes gold cheaper for global buyers which supports demand and leads to higher prices, while a stronger dollar weakens demand and limit gains. With markets expecting Fed rate cuts, large us deficit, trade pressures, weaker US labour market and economic uncertainty, the dollar has started to soften, which could provide another boost for gold if that trend continues.

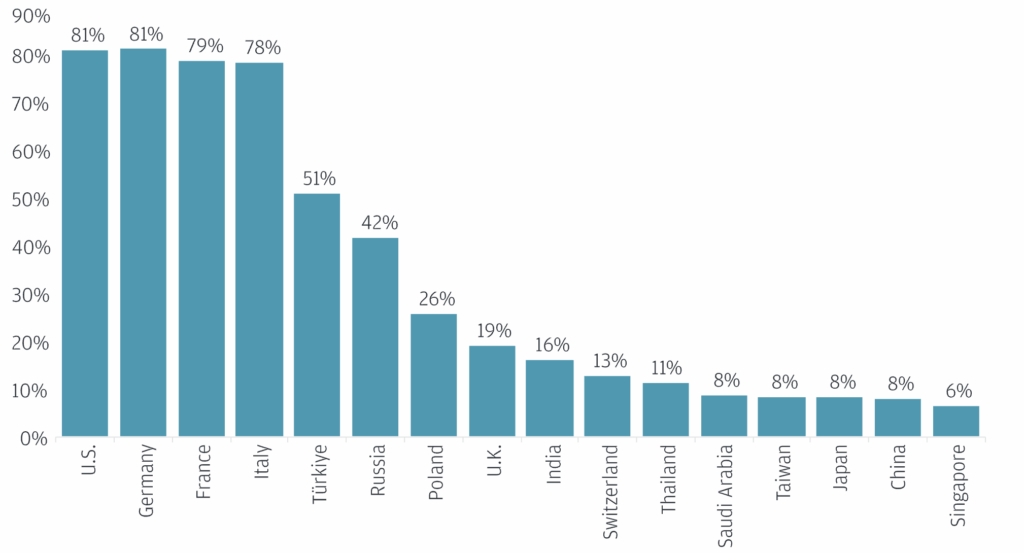

Central banks remain strong buyers of gold, led by the U.S., which has 81% of its total holdings in gold.

Source: WGC, IMF, J.P Morgan Commodities Research

What investors should be monitoring

- Real yields & Fed expectations: Watch the odds of a January/February rate cut and movements in Treasury yields.

- US dollar moves: A weaker US dollar helps gold, while a stronger US dollar can weaken gains.

- Economic Data: Jobs numbers, inflation and confidence data will drive safe-haven demand and short-term swings.

- Other Metals: Strength in silver and other precious metals can confirm broader momentum in the sector.

- Central bank Buying: Quarterly World Gold Council updates show how much gold central banks are adding to reserves. High buying adds an institutional floor under prices.

Disclaimer

This investment recommendation is prepared for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. Investors should conduct their own due diligence or seek professional advice before making investment decisions.