- Can Breakthrough Lung Imaging Become a Durable Growth Engine?

- Platform Expansion and Strategic Direction

- Board and Management Depth

- Investment Thesis and Key Catalysts

- Historical Performance and Market Behaviour

- Product Suite and Commercial Leverage

- Financial Position and Capital Discipline

- Fundamental Perspective

- Technical and Trading Context

- Capital Structure and Dilution Considerations

- Outlook and Conclusion

Can Breakthrough Lung Imaging Become a Durable Growth Engine?

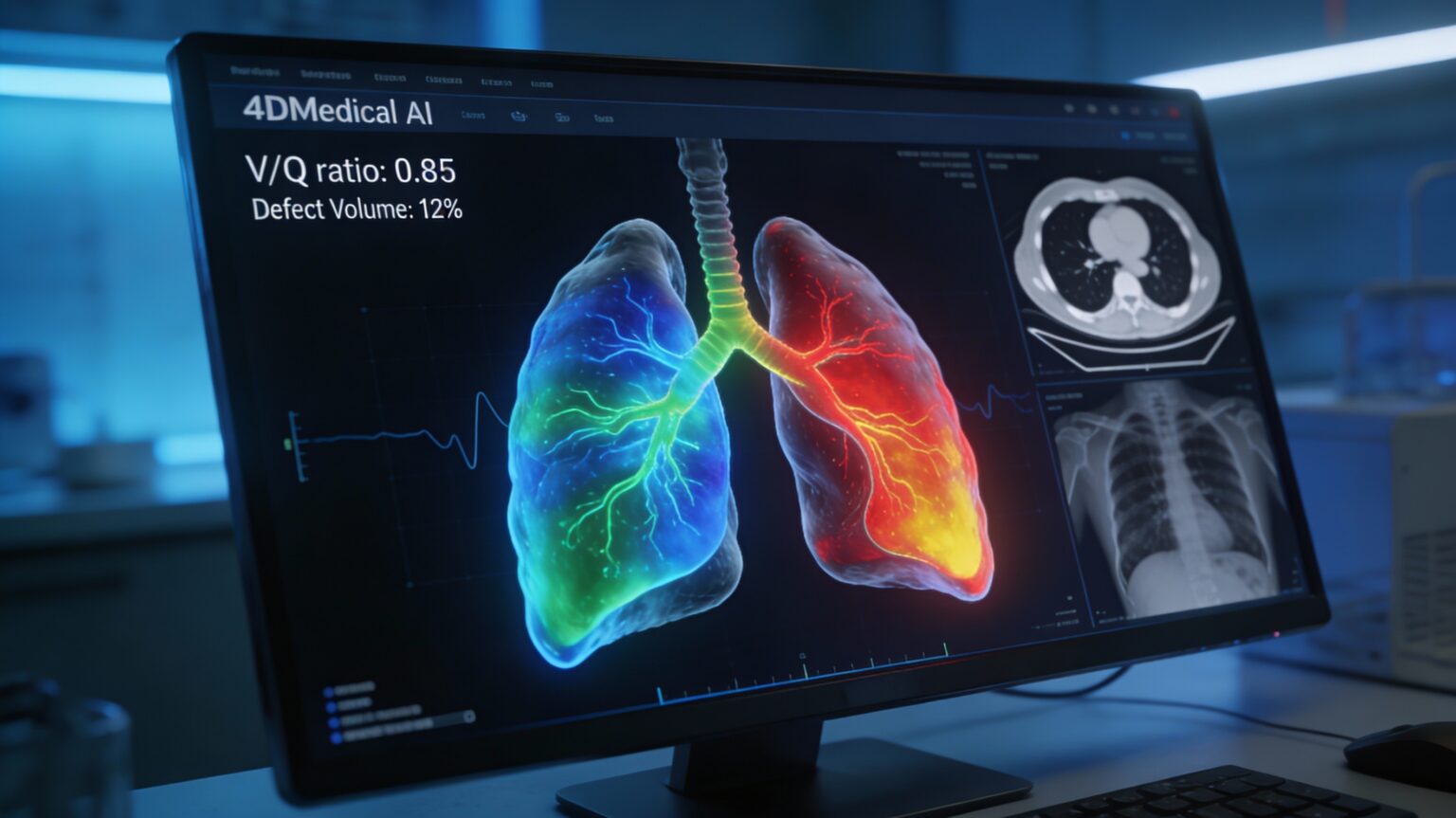

4DMedical Limited is attempting something ambitious but increasingly credible, turning highly specialised lung imaging science into a repeatable, software driven healthcare business at global scale. The Australian founded med tech group commercialises proprietary imaging software that quantifies regional lung ventilation and perfusion using standard X ray and CT infrastructure, avoiding the need for expensive new scanners in most clinical settings. Its XV Technology platform underpins products such as XV Lung Ventilation Analysis Software, CT LVAS and CT:VQ, delivered via a SaaS model that integrates directly into hospital PACS systems and existing scanners. With operations spanning Australia and the US, the company is targeting large and growing markets in respiratory and cardiothoracic disease diagnosis, monitoring and treatment optimisation.

The strategic challenge now is less about technical credibility and more about execution, specifically whether regulatory approvals, reference sites and OEM partnerships can translate into recurring, system wide adoption rather than isolated centres of excellence.

Platform Expansion and Strategic Direction

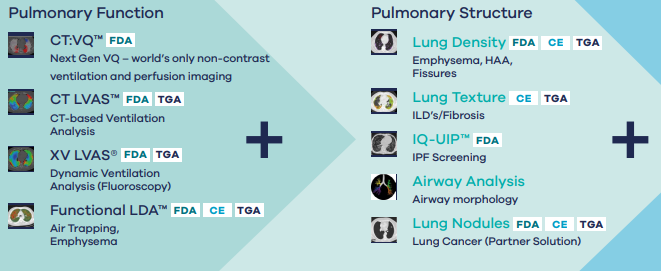

The acquisition of Imbio broadened the platform materially, adding AI driven cardiothoracic imaging tools that extend 4DMedical’s reach beyond ventilation into chronic lung and heart related disease pathways. This matters because it increases both clinical relevance and cross sell potential within hospital systems, shifting the company closer to a platform vendor rather than a single product supplier.

Management’s priority is clear, move from grant supported pilots and flagship academic deployments toward scaled SaaS revenue across broader hospital networks. Regulatory clearances are largely in place, clinical validation is deepening and the commercial focus has now shifted decisively to distribution leverage and sales execution.

Board and Management Depth

Governance remains a strength relative to many early stage ASX med tech peers. Founder and CEO Andreas Fouras continues to lead the company, providing continuity between technology development and commercial strategy. Chair Lil Bianchi brings governance and commercial oversight, supported by non executive directors with deep experience across US healthcare systems, imaging and capital markets. The recent appointment of Julian Sutton as CFO and Executive Director strengthens financial leadership at a critical scaling phase. Combined with an experienced commercial and medical leadership team, the company now appears structurally better equipped to execute in the US market than at any prior point.

Investment Thesis and Key Catalysts

The 4DMedical investment case is best described as an inflection point story. The upside is driven by a differentiated, software based imaging platform entering commercial scale in the US, supported by regulatory clearance, reference sites and balance sheet strength. The downside remains execution risk, ongoing losses and dilution if adoption fails to accelerate.

Recent catalysts have meaningfully reduced near term risk. CT:VQ received FDA clearance in September 2025 and is now deployed at leading US institutions including Stanford, the University of Miami and Cleveland Clinic. These sites matter not only for revenue but for validation, data generation and broader health system credibility. In December 2025, the expanded Philips distribution agreement marked a step change, securing a minimum US$10 million CT:VQ order commitment across 2026 and 2027. Tying a global imaging OEM to volume throughput materially strengthens the commercial pathway and reduces go to market friction.

January 2026 brought the largest catalyst of all. A A$150 million equity raise at A$3.80 per share, explicitly funding US sales expansion and CT:VQ rollout. This followed a strong funding cadence through 2025 including A$22.6 million from option exercises, a A$10 million strategic investment from Pro Medicus and a A$6 million R&D tax incentive. Pro forma liquidity is now substantial, giving management time to execute rather than survive.

Historical Performance and Market Behaviour

4DMedical has historically prioritised R&D, clinical trials and regulatory approvals over profitability. This resulted in sustained losses but a growing technology moat. Revenue has increased from a low base as deployments expanded, though not yet at a scale that offsets operating costs.

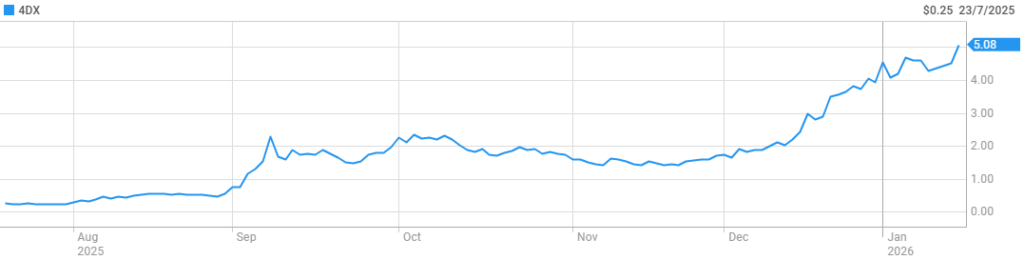

The share price has reflected this profile, volatile and highly sensitive to news flow. Regulatory milestones, partnerships and capital raises have driven sharp rallies, while dilution events and risk off sentiment toward loss making growth stocks have triggered pullbacks. This volatility is likely to persist until revenue visibility improves.

Product Suite and Commercial Leverage

Rather than a portfolio of financial investments, 4DMedical’s value sits in its integrated product suite. XV LVAS provides X ray based lung ventilation analysis, CT LVAS extends this capability into CT imaging, and CT:VQ combines ventilation and perfusion into a more complete functional assessment. All products are delivered via a cloud based SaaS model that overlays existing hospital equipment, a critical adoption advantage. The Imbio platform adds AI enabled cardiothoracic tools that widen clinical relevance and increase wallet share per customer. Commercial leverage is amplified through partnerships, where the expanded agreement embeds minimum order commitments across the next two years.

Financial Position and Capital Discipline

Following the January 2026 placement, 4DMedical’s balance sheet is materially stronger than at any prior point. While historical data shows periods of tight liquidity and reliance on equity funding, the combination of option exercises, strategic investment, R&D rebates and the A$150 million raise has significantly extended runway. The company carries minimal traditional debt and remains entirely focused on reinvestment. It is not an income vehicle and dividend distributions are not part of the capital allocation framework for the foreseeable future.

Fundamental Perspective

On traditional valuation metrics, 4DMedical remains difficult to anchor. The market is paying for optionality around US scale rather than current earnings. Independent valuation models have previously suggested the share price embeds aggressive adoption assumptions. This highlights the sensitivity of returns to execution outcomes. The bull case rests on a large addressable market, highly differentiated functional imaging data, strong reference customers and OEM distribution leverage. The bear case centres on sustained operating losses and the risk that adoption remains slower and narrower than hoped.

Technical and Trading Context

From a technical perspective, the stock has exhibited strong momentum following recent news flow. Prices trade above key moving averages and momentum indicators remain positive, though often in overbought territory. This configuration supports trend continuation but also raises the risk of consolidation or pullbacks. Given the company’s history, volatility around catalysts should be expected and position sizing remains critical.

Capital Structure and Dilution Considerations

4DMedical’s capital structure is equity heavy by design. Recent option exercises and the January placement have increased issued capital meaningfully, reducing funding risk but diluting existing holders. The trade off is clear, greater certainty of execution runway in exchange for lower near term per share leverage.

Further dilution cannot be ruled out if commercial scaling takes longer than expected. The balance sheet is now strong enough to absorb setbacks without immediate recourse to markets.

Outlook and Conclusion

4DMedical is better positioned today than at any point in its history to convert technological leadership into commercial scale. FDA clearance, blue chip US reference sites, a global OEM partnership with minimum commitments and a strengthened balance sheet materially improve the probability of success. That said, this remains a high beta, execution sensitive investment. The transition from elite academic centres to broad hospital system adoption will determine whether 4DMedical becomes a durable SaaS compounder or remains a capital dependent innovator.

Consensus price targets for 4DX average around A$7.50, implying roughly 47% upside from current levels near A$5.08. FY26 expectations centre on US CT:VQ revenue ramp-up via Philips partnership, pro forma cash runway supporting commercial scaling, and path to EBITDA positivity as SaaS adoption broadens. For investors, 4DMedical offers leveraged exposure to med-tech commercialisation inflection, offset by dilution and execution risk in US hospital rollout; accumulation on weakness below A$4.40 may suit those seeking growth in functional lung imaging with recent A$150m funding tailwinds.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.