2026 is emerging as a difficult yet pivotal year for BYD, marked by weakening domestic sales, rapid international expansion, and mounting pressure to translate its massive scale into consistent, sustainable profitability. It has been a bumpy ride; however, there are also massive scaling opportunities.

BYD Business Summary

BYD Co. Ltd., headquartered in China, operates as a diversified manufacturer with a core focus on transportation and advanced energy technologies. Its primary business segments span new‑energy automobiles, mobile device components and assembly, rechargeable battery systems, and photovoltaic solutions. Within its automotive division, the company markets passenger vehicles under two flagship brand families, Dynasty and Ocean, positioning itself across multiple price and performance tiers. Dynasty and Ocean legs play a crucial role for the business.

Electric Vehicle (EV) Market Outlook

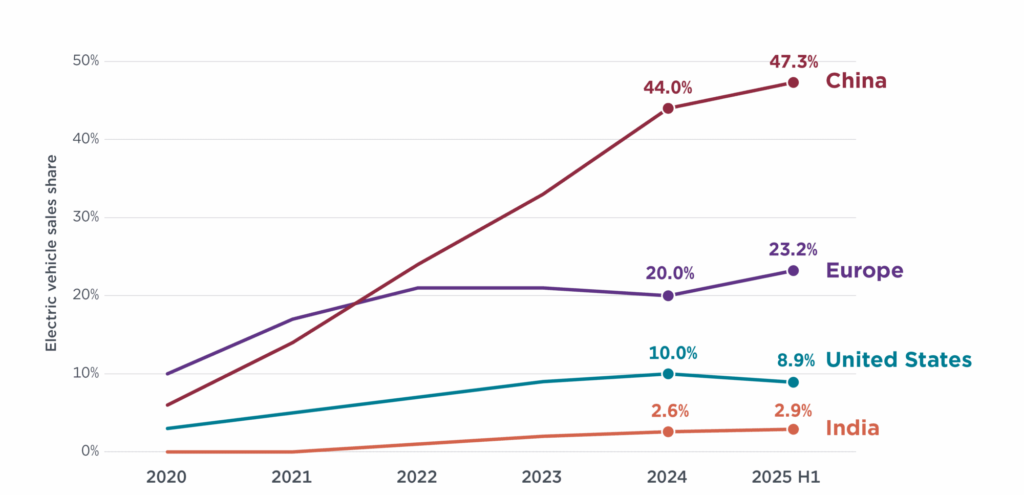

Global EV sales were expected to exceed 20 million units in 2025, though final data is pending. Early‑year momentum was strong, with first‑quarter sales up 35% year‑on‑year across major markets. China maintained incentives for retiring older vehicles, and falling EV prices should lift EVs to about 60% of national sales. In Europe and the United Kingdom, stricter emissions rules will force manufacturers to increase zero‑emission vehicle offerings throughout 2025

BYD’s 2025 Triumph?

BYD emerged as the world’s largest electric‑vehicle manufacturer in 2025, surpassing Tesla in annual sales—a milestone that underscores its rapid ascent in the global EV landscape. Yet the achievement comes against the backdrop of an industry that spent much of the year in turmoil. BYD’s dominance has been driven largely by its exceptionally low production costs and aggressive pricing strategy, enabling it to capture more than 20% of the global EV market. This picture looks quite attractive on the face of it, alas! It is not all daisies and dandelions. The potential problems they could face this year are as follows:

- Tariff increases and trade barriers

- Dropping local market sales momentum

- Potential EV price war in China

- Execution and Supply chain risks

The Silver Lining for BYD

BYD faces several challenges, many of which stem from conditions in its domestic market, even as China’s EV sales continue to grow rapidly. One promising path forward, as the data above suggests, is deeper expansion into Europe in 2026. With manufacturing hubs already established across the region and with European producers facing higher labor and component costs. BYD is well‑positioned to compete aggressively on price. India represents another potential growth avenue, but current analysis indicates the market is not yet ready for large‑scale EV adoption, limiting near‑term opportunities there. Going forward, a stronger link in the supply chain could help take BYD to the next phase of growth.