Over the past several decades, exchange‑traded funds (ETFs) have evolved dramatically, moving well beyond their original role as simple, conventional investment vehicles. Initially regarded as a tool for passive investing, ETFs have since become a cornerstone of modern portfolio construction and institutional fund management. Their versatility now spans a wide range of asset classes and strategies, offering investors exposure to equities, fixed income, commodities, and even alternative investments. In addition to traditional index‑tracking products, the market now includes actively managed ETFs, thematic funds, and vehicles tailored to both domestic and international markets. This breadth of choice has transformed ETFs into one of the most dynamic and influential instruments in global investing, reshaping how capital is allocated across industries and geographies.

The Global ETF Market

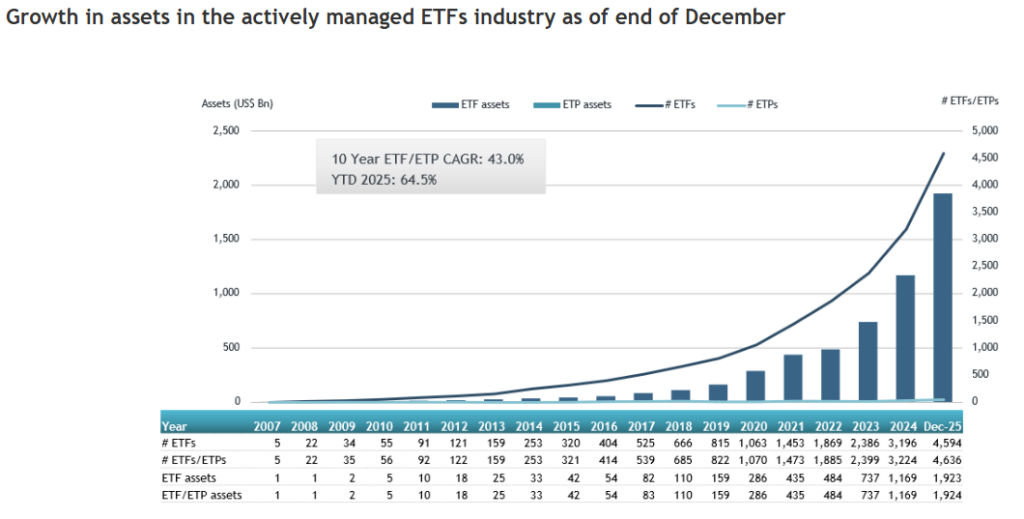

The ETF industry entered 2026 on a high note, crossing the $13 trillion AUM threshold. This landmark was fueled by a wave of innovation, with over 1,100 new funds debuting in 2025, a clear reflection of investor enthusiasm and asset managers’ confidence. For the second year running, annual inflows surpassed $1 trillion, highlighting the enduring appeal of ETFs across investor segments. Even December, often a slower month, contributed $330.7 million in net inflows, showing that momentum remains strong as the industry continues to evolve.

ETF Market Leaders (Assets Under Management)

- Vanguard—US$ 833B

- BlackRock—iShares – US$ 760B

- State Street—US$ 712B

ETF Market in Australia

Australians seeking to build wealth are increasingly relying on exchange-traded funds (ETFs) as a central investment vehicle. Reflecting this momentum, the ASX recently celebrated the launch of its 400th ETF. The Global X S&P Australia GARP ETF, while total funds under management (FUM) crossed the $300 billion threshold. The pace of expansion has been remarkable: FUM grew by more than $80 billion in just twelve months, rising from $219 billion in September 2024 to over $300 billion by September 2025. Over five years, the market has transformed, with FUM rising more than fourfold from $71 billion in 2020 and ETF listings nearly doubling from 216 to over 400. For both investors and advisers, ETFs remain attractive for their cost efficiency, diversification, and accessibility across asset classes

What is causing this growth

- Pivot from Mutual Funds to ETFs—Though the concept is similar, investors want a lower cost and more tax-efficient alternative, which ETFs provide.

- ETFs and Innovations—ETFs, originally regarded as purely passive investments, have evolved to include a wide range of active and alternative funds, delivering greater diversity to investors.

- Globalisation of ETFs—ETFs have gone global—no longer U.S.-centric, their worldwide adoption has fueled deeper markets and boosted liquidity.

The Risks Associated with ETFs

While the ETF market has grown at an impressive pace, several structural challenges continue to shape its evolution. A large share of investor capital is still directed toward a relatively small group of dominant ETFs, which can reduce the practical benefits of product diversity and leave portfolios exposed to similar market risks. At the same time, the speed of market expansion can heighten price fluctuations, particularly in thematic and niche funds that tend to attract momentum-driven flows and are therefore more vulnerable to rapid shifts in investor sentiment. In addition, the increasing popularity of active and alternative ETFs introduces greater complexity in portfolio construction and risk management, making strong regulatory oversight essential to ensure clear disclosure, fair pricing, and consistent standards of transparency.

ETFs Outlook for 2026

Investing in ETFs today offers a simple and cost-effective way to access diversified portfolios across shares, bonds, and alternative assets. They provide liquidity, transparency, and flexibility, making them suitable for both long-term wealth building and tactical investment strategies in an increasingly uncertain market environment. The ETF market is ever-growing, and the number of new funds has been rising exponentially over the past decade. The inflows have crossed US$ 1 trillion for 2 consecutive years and potentially could continue to do so in the following years.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.