Weekly Overview

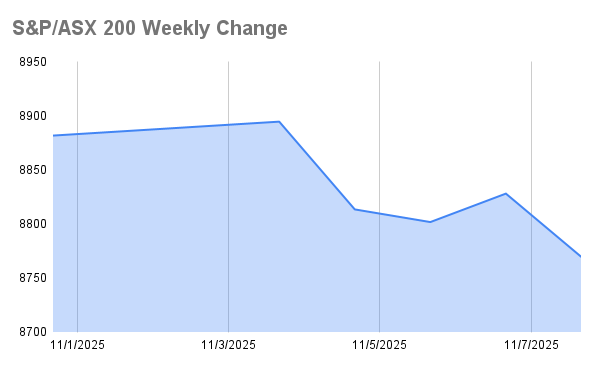

The ASX notched a second straight weekly decline, with the S&P/ASX 200 finishing Friday at 8769.7 (-1.0% w/w). Tuesday’s RBA hold reset the market’s path for cuts: a 2025 easing is no longer fully priced, and higher-for-higher rates are back in the narrative. That shift lifted the hurdle for earnings and pressured duration-sensitive names even as six of eleven sectors closed higher on the day.

- Weekly Overview

- Policy Backdrop: From “when” to “if”

- Sector Moves: financials and tech did the damage

- Stock movers: earnings beats and misses matter again

- Commodities: gold resilience vs iron ore softness

- China Check: exports blink, sentiment cools

- Critical Minerals: a firmer tone in rare earths

- Tech/AI Sentiment: proof over promises

- What It Means For Investors

Policy Backdrop: From “when” to “if”

Local rates markets moved away from a near-term cut after Governor Bullock’s hawkish tone. The message to equities was simple: multiple expansion needs help from delivery, not dovish hopes. Globally, softer China data and a tech wobble in the US compounded the risk tone.

Sector Moves: financials and tech did the damage

Financials were the main drag. Macquarie (-5.7%) missed by ~10% versus consensus on its September-half profit, while CBA (-1.5%) eased and NAB (+~1%) clawed back some ground. Technology tracked the Nasdaq lower. Iren (-12%), WiseTech (-2.7%), Life360 (-3.6%), and Xero (-2.5%) extended recent weakness as investors rotated out of higher-multiple growth after a soft US tape.

Stock movers: earnings beats and misses matter again

- Block (Afterpay) -15.8%: Q3 revenue US$6.11bn vs US$6.34bn expected; the market is giving little latitude to misses.

- Qantas -6.6%: guided domestic unit revenue to the low end and flagged slower non-resources corporate demand.

- Alliance Aviation -42.7%: trading resumed with a sharp downgrade tied to aircraft/engine/maintenance costs; founder exits board.

- News Corp +3%: better-than-expected quarterly revenue (US$2.14bn) as Dow Jones and REA offset weaker local prints.

- REA -1%: revenue +4% y/y; EBITDA ex-associates +5% to $254m, solid, but not enough to lift the stock after the run.

- James Hardie +1.4%: modest rebound after MSCI removal-related selling.

Commodities: gold resilience vs iron ore softness

Gold pressed back toward US$4,000/oz, lifting Newmont (+1.8%) and feeding evident domestic demand queues, queues at ABC Bullion and hiring across the bullion ecosystem. Iron ore slipped to ~US$102-103/t, with Rio Tinto and Fortescue off ~1.5%. China steel margins fell below 40% of mills profitable (Mysteel), utilisation ticked down, and shipments remain ample (Brazil at record run-rates). The set-up argues for caution chasing bounces into a seasonally softer period, especially with Guinea’s Simandou on the 2026-27 horizon.

China Check: exports blink, sentiment cools

October exports fell 1.1% y/y, the first drop since February, undercutting the “reacceleration” story Shanghai port volumes eased to the lowest since April. For Australia, that weak read plus thin steel margins is a headwind for bulks and risk assets tied to China growth.

Critical Minerals: a firmer tone in rare earths

After profit-taking earlier in the week, Lynas (+3.6%), Iluka (+2.8%) and Australian Rare Earths (+8.2%) bounced. Strategists remain constructive on ex-China supply chains as Western policy support slowly accumulates; the medium-term thesis is policy led scarcity and pricing power rather than near-term demand strength.

Tech/AI Sentiment: proof over promises

Macro and micro both demanded proof. US growth tech wobbled, and local AI-adjacent narratives de-rated unless tied to cash flow, utilisation ramps, or contracted backlog. The message for story stocks: financing and delivery now matter more than total addressable market.

What It Means For Investors

- Positioning: tilt to cash-generative leaders with pricing power; be selective in tech and AI-adjacent names unless utilisation, take-or-pay, or gross-margin lift is visible.

- Resources mix: hold quality gold exposure as a hedge; stay disciplined in bulks given China steel profitability and export softness. Rare earths remain a structural allocation, but expect volatility.

- Earnings lens: the tape is rewarding execution and penalising misses/guide downs. Focus on balance sheets, conversion of bookings to cash, and cost discipline.

Near-Term Outlook

Higher-for-longer local rates, softer China prints, and tighter global financial conditions keep risk-reward balanced. Absent a clear domestic disinflation surprise or a global growth upside shock, the ASX looks like a grind with dispersion: defensives and cash-rich compounders over index-beta. Expect headline-driven swings around China data, commodity prices, and US tech earnings.

Key Risks & Supports

- Risks: a deeper China slowdown; further de-rating in global tech; persistent domestic services inflation that delays RBA easing; cost inflation in aviation and capex-heavy sectors.

- Supports: strong household balance sheets at the top end, resilience employment, ongoing policy sponsorship for critical minerals, and a high terms-of-trade starting point.

Data & Events to Watch

- Australia: consumer and business surveys; next CPI partials and retail trade for signs of demand cooling.

- China: industrial production, retail sales, steel utilisation/margins; port throughput.

- Commodities: iron ore futures vs mill profitability; gold ETF flows and local mint sales anecdotes.

- US: mega-cap prints, payroll trends and rates path rhetoric.

The market has shifted from “multiple on hope” to “multiple on delivery.” Own the names that can bridge today’s operating reality to tomorrow’s cash flows; treat everything else as trading stock, not core holdings.

Disclaimer

General information only. This is not financial advice and does not take into account your objectives, financial situation or needs. Consider your own circumstances or seek professional advice before acting.