- Australian ETF Market 2026, Why the ETF Boom Is Reshaping the ASX

- The Structural Drivers Behind ETF Growth

- From Plain Vanilla to Product Proliferation

- How ETFs Are Changing ASX Market Dynamics

- What This Means for Different Types of Investors

- The Road to $400 Billion and Beyond

- The Bottom Line for ASX Investors

Australian ETF Market 2026, Why the ETF Boom Is Reshaping the ASX

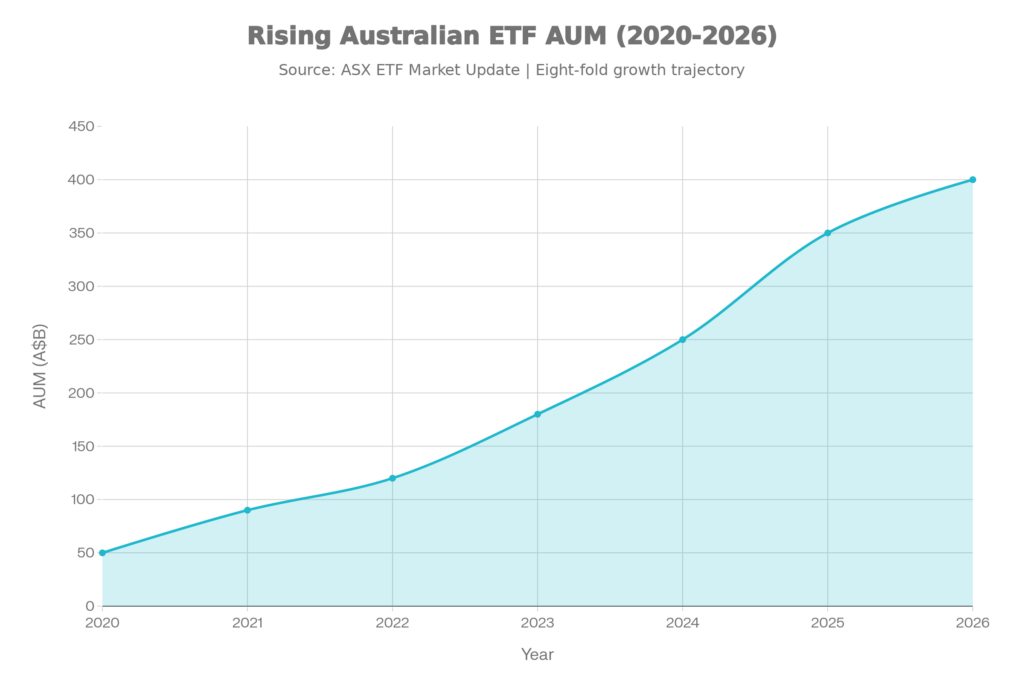

The Australian ETF market 2026 is approaching a structural milestone, with assets under management on track to double toward $400 billion after a record $53 billion of inflows last year. This is no longer a niche trend or a cyclical burst of enthusiasm. It reflects a durable shift in how Australians invest, how capital moves through the ASX, and how market leadership is reinforced.

For ASX investors, the ETF boom is quietly changing liquidity patterns, sector leadership and the balance between passive exposure and active stock selection. Understanding those mechanics matters far more than debating whether ETFs are “good” or “bad”.

The Structural Drivers Behind ETF Growth

The acceleration in ETF adoption is being driven by several reinforcing forces. Younger investors, particularly millennials and Gen Z, have embraced ETFs for their simplicity and transparency. Rather than building portfolios stock by stock, they prefer single trade exposure to broad indices, income strategies or global growth themes. For many, ETFs are the entry point into markets rather than a complement to active investing.

Financial advisers have also shifted decisively. ETFs now form the core of many client portfolios, delivering market returns at fees typically between 0.2% and 0.5%, well below the 1%+ still common in active funds. That fee gap compounds over time and has become impossible to ignore in a low return world. SMSFs have added fuel to the trend. Trustees are increasingly rotating away from high cost platforms and fragmented direct holdings into ETFs that provide income, diversification and liquidity with minimal administration. For many SMSFs, ETFs now act as the portfolio spine rather than a satellite holding.

From Plain Vanilla to Product Proliferation

What began as simple index tracking has evolved into a broad product ecosystem. Core funds such as Vanguard’s VAS and BetaShares’ A200 continue to dominate flows, anchoring portfolios with low cost exposure to the ASX 300. Around them, however, growth has come from more targeted strategies.

Global equity ETFs tracking the NASDAQ 100 or concentrated quality growth baskets have drawn strong inflows as Australian investors look offshore for earnings depth and scale. High yield dividend ETFs appeal to retirees and income focused investors seeking smoother cash flow. Commodity ETFs, particularly gold and broad resources, have grown as inflation hedges, while cash and ultra short duration ETFs have exploded as tactical parking tools during periods of market uncertainty. The result is a market where ETFs are no longer passive in behaviour, even if they are passive in construction.

How ETFs Are Changing ASX Market Dynamics

The growing dominance of ETFs is reshaping how the ASX trades. As passive ownership deepens, particularly among the top 50 stocks, liquidity improves and bid ask spreads tighten. The largest index constituents benefit from a constant structural bid, independent of short term fundamentals. Names such as the major banks, BHP, CSL and Wesfarmers collectively represent roughly 40% of the ASX 200’s market capitalisation and capture a disproportionate share of ETF inflows.

For smaller stocks, the dynamic cuts the other way. To attract passive support, companies must grow earnings, improve market capitalisation and climb index weightings. Those that fail to do so are increasingly left behind, reinforcing a quality bias across the market. This helps explain why index leadership has narrowed and why dispersion between winners and losers has increased.

What This Means for Different Types of Investors

The ETF boom affects investor groups differently. Retail investors benefit from cheap diversification, but risk becoming overly concentrated in index heavyweights without realising it. SMSFs and family offices increasingly anchor 70% to 80% of portfolios in ETFs, reserving active risk for high conviction small and mid cap opportunities where genuine alpha still exists.

For active fund managers, ETFs are now unavoidable tools. They serve as benchmarks, liquidity sleeves, tactical sector exposure and volatility dampeners. The line between active and passive is blurring, even if the incentives remain distinct.

The Road to $400 Billion and Beyond

Looking into 2026, the growth runway remains intact. Product innovation continues, with active ETFs, options based income strategies and leveraged products gaining traction. Global diversification remains a powerful tailwind as investors reduce reliance on domestic cyclicals. Regulatory settings also remain supportive, with ASIC streamlining disclosure and superannuation frameworks continuing to favour low cost default options. By the time the $400 billion milestone is reached, ETFs will be firmly embedded as the default vehicle for Australian market beta.

The Bottom Line for ASX Investors

The rise of ETFs does not kill stock picking, but it raises the bar. Passive strategies now dominate core exposure. That means active returns must come from areas where ETFs are structurally weaker, smaller companies, under researched sectors and genuine idiosyncratic change. Investors who accept this reality, using ETFs for efficiency and reserving risk for differentiated opportunities, are best positioned to compound capital in an increasingly index driven market.