Australian businesses closed out 2025 with a notable lift in financial confidence, as business credit demand rose 5.1% year on year in December, according to Equifax. A 6.1% jump in loan applications marked the strongest December reading in recent years and suggests many companies have moved beyond capital preservation and back toward measured reinvestment.

For ASX investors, this matters less as a backward looking data point and more as a forward indicator. Business credit demand typically leads actual capital expenditure by several quarters, making the late year acceleration an early signal that a capex recovery may be forming beneath the surface as 2026 approaches.

December Credit Data Shows Confidence Broadening

Equifax’s Business Market Pulse, which tracks credit enquiries and borrowing behaviour across the economy, captured a clear shift in intent. Businesses were increasingly applying for funding tied to expansion, equipment upgrades and operational restocking rather than short term liquidity support.

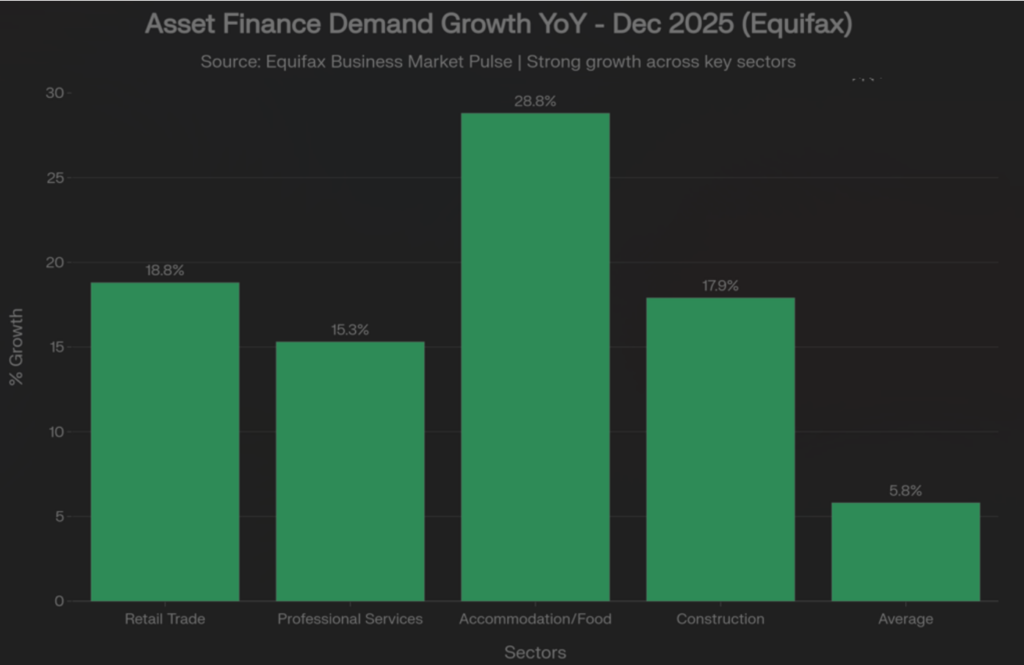

Asset finance demand climbed 5.8% over the year, pointing to renewed spending on machinery, vehicles and technology. Trade credit enquiries, often a proxy for inventory rebuilds and supplier confidence, also lifted sharply, reinforcing the idea that balance sheets are stabilising.

Sector level data reveals where confidence is strongest. Retail trade recorded an 18.8% increase in asset finance, reflecting investment in point of sale systems, warehousing and distribution ahead of expected normalisation in consumer spending. Professional, scientific and technical services followed with 15.3% growth, signalling rising demand for software, consulting tools and R&D infrastructure. Accommodation and food services enquiries jumped 28.8%, while construction trade credit demand rose 17.9%, pointing to project restocking and early pipeline activation.

Importantly, payment behaviour improved as well. Average days beyond terms fell 14% to just 3.37 days, indicating tighter cash conversion cycles and healthier working capital management across the SME and mid market universe.

Why Credit Momentum Matters for 2026 Capex

Business credit growth is one of the more reliable leading indicators for capital expenditure. Firms typically secure funding before committing to equipment purchases, system upgrades or fleet expansion, making December’s strength a signal of intent rather than reaction.

Equifax General Manager Brad Walters described the shift as businesses moving from preservation to preparation, a characterisation that fits well with broader macro conditions. Inflation pressures have eased, wage growth is more predictable and companies appear increasingly willing to invest for efficiency rather than simply absorb higher costs.

For listed companies, this has direct earnings implications. Capex cycles support revenue growth for suppliers of equipment, technology and infrastructure inputs, while also improving productivity for the firms doing the investing. That combination tends to underpin margin resilience as growth broadens.

ASX Sector Implications to Watch

Industrials and capital equipment suppliers are direct beneficiaries of asset finance momentum. Companies exposed to machinery, transport fleets, mining services and logistics equipment tend to see order books lift early in the cycle.

Technology and software providers also stand to gain. The surge in professional services credit demand points to investment in SaaS platforms, cybersecurity, workflow automation and data tools as businesses digitise operations and chase productivity gains.

Retail and consumer discretionary names benefit more selectively. POS upgrades, fulfilment investment and supply chain efficiency favour operators with scale and balance sheet flexibility, rather than highly leveraged players reliant on volume alone.

Construction and infrastructure suppliers gain from restocking and trade credit expansion, particularly materials providers and subcontractors positioned to service residential and commercial pipelines once approvals translate into activity.

Banks capture the financing uplift through higher volumes, although competitive pressure from non bank lenders may cap margin expansion. The more interesting signal sits with loan growth rather than pricing.

Positioning for an Emerging Reinvestment Cycle

December’s credit surge does not guarantee a smooth capex upswing, but it provides a constructive starting point for 2026 positioning. Investors should focus on sectors and companies that convert borrowing into productive assets and free cash flow, rather than those simply levering balance sheets late in the cycle.

Improving payment discipline strengthens the case. Faster cash cycles reduce reliance on external funding and support internally funded growth, which historically separates durable compounders from cyclical disappointments. Confirmation will come through February capex data, company trading updates and guidance commentary, but the directional signal is clear. Australian businesses are starting to lean forward again, and for ASX investors, that shift often marks the early innings of a broader earnings recovery.