PayPal has been on the hot list of the Wall Street Journal for the past several months. Their story is an interesting one. If an investor were to just look at book metrics, PayPal would seem like a great investment. However, there have been a few questionable decisions by the company as well. For those who are slightly unaware of what exactly PayPal does, they are a tech platform that offers products that are designed to enable digital payments and simplify commerce experiences for consumers and merchants. PayPal runs a global two‑sided network linking consumers and merchants, with 434 million active accounts across nearly 200 markets. Its portfolio includes PayPal, Braintree, Venmo, Xoom, Hyperwallet, Zettle, Honey, and Paidy. The company also provides financing solutions through PayPal Working Capital and PayPal Business Loan programs.

The Ecosystem has Upgraded

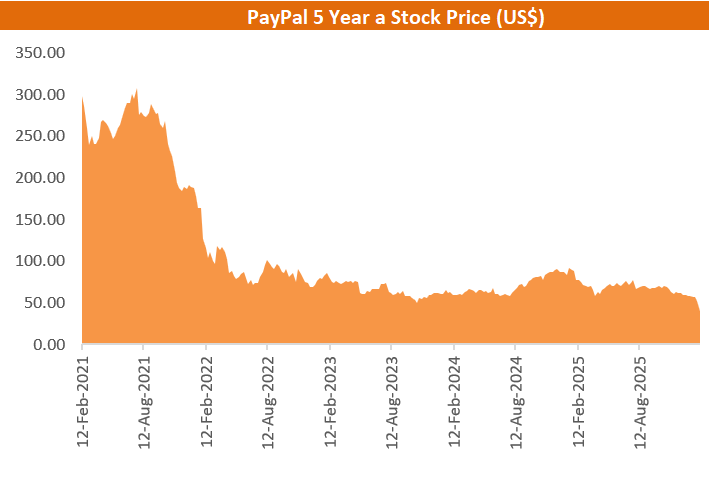

PayPal was at its peak in 2021 with a market cap of over US $300 billion. Currently, it is down to almost its IPO share price and has fallen below eBay in terms of size. Analysts have been skeptical about the Honey acquisition, and it’s no secret that they were facing leadership problems. But what’s really caused this drop? Well, the ecosystem and business environment have evolved. PayPal was first to market in terms of payments of this sort; however, companies like Apple and Google have created their ‘Double Click to Pay,’ with EFTPOS payments being one of the quickest and most common ways to make payments. This seems to be much easier as opposed to PayPal’s 3rd-party wallet, which seems to be getting obsolete.

On paper they are thriving; in practice might be struggling

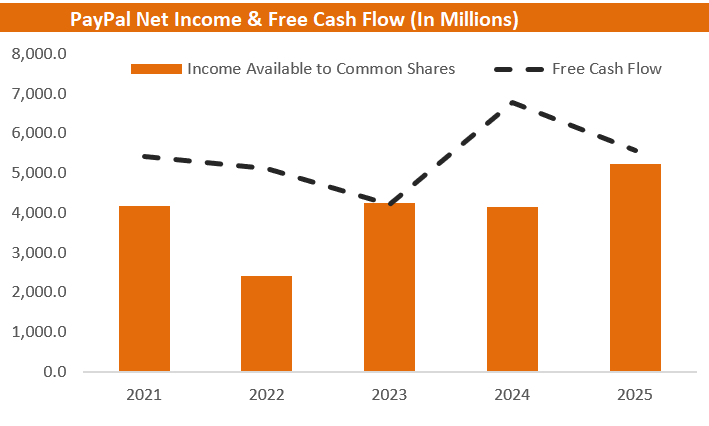

PayPal reached an all‑time high of $300 in July 2021, but the company has struggled to sustain that valuation in the years since. Investors once embraced a paradigm of paying steep premiums for high‑growth technology stocks, yet PayPal has not fully capitalized on the favorable conditions. On paper, the fundamentals appear strong; revenue has continued to climb, earnings per share peaked, and free cash flow hit record levels.

Key Takeaways

Three to four years ago, PayPal was at the height of its success and appeared on track for a potential trillion-dollar valuation. Instead, a blend of structural missteps, management decisions, and intensifying competition has driven the stock back toward its IPO-era levels. The acquisition of Honey raised concerns among investors and analysts over its strategic fit and was widely viewed as underleveraged. Which created integration and return challenges. More recently, PayPal appointed a new CEO from HP, marking a significant leadership shift. While the change brings fresh perspective, it also raises questions about whether the company is focusing on solving core fintech challenges or applying industrial-style management to a technology-driven business. This dilemma is common among former high-growth companies: markets do not reward past achievements but rather future potential. Ultimately, investor confidence will depend on PayPal’s ability to reposition itself for what it can become by 2030, not what it achieved in 2012, making its next strategic moves critical as it navigates a more competitive landscape.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.