Company Overview

CSL is one of the world’s largest biotechnology companies, operating across three main business segments. Founded in Australia as a government-owned business, it has since evolved into a global player, generating roughly half of its revenue in North America and about a quarter in Europe. The company develops, manufactures, and supplies innovative therapies in areas such as immunology, hemophilia and bleeding disorders, influenza vaccines (through its subsidiary Seqirus), and other rare and serious diseases. Its worldwide operations span research and development, plasma collection, manufacturing, and commercialization, with a presence in more than 60 countries.

Change in Management

CSL recorded a sharp decline in half-year net profit, dropping from $2 billion in the second half of FY2024 to just $384 million for the July–December 2025 period. This deterioration was largely due to substantial one-off items, including $715 million in restructuring costs and $1.1 billion in write-offs from the books, both to be recorded in the company’s FY2026 financial statements ending in June.

Management stated that the result was well below expectations, with CFO Ken Lim highlighting that unfavorable government policy changes further weighed on earnings. Owing to this, CSL’s board abruptly announced that longtime CEO Paul McKenzie would retire with immediate effect. The company would appoint veteran Gordon Naylor as interim CEO. This step reflects investor dissatisfaction with recent financial performance and the board’s desire for leadership better aligned with the company’s strategic priorities going forward.

Share Price and Metrics

Share Price

Over the past five years, CSL Limited has shifted from relative stability to a downturn in its share price. Between 2021 and mid‑2024, the stock traded within a broad range, reflecting steady investor confidence despite volatility. From late 2024, however, the trajectory turned decisively negative, with losses accelerating through 2025 as weaker earnings, significant impairments, and strategic uncertainty eroded sentiment. By early 2026, CSL’s valuation had fallen sharply from prior highs, underscoring a clear deterioration in market confidence compared with its position five years earlier.

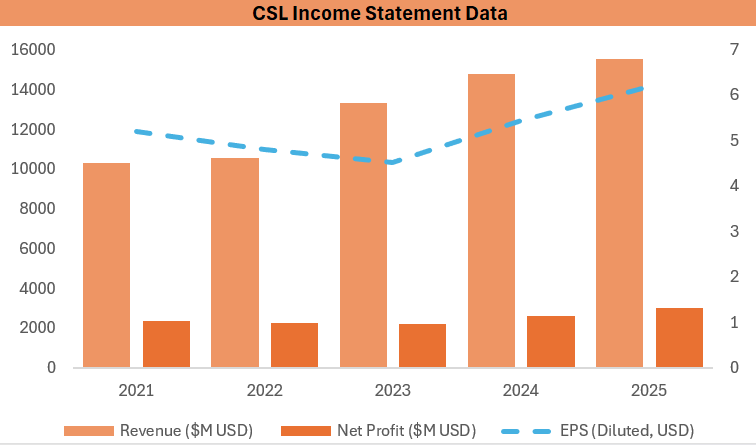

Income statement

Revenue rises steadily from about US$10.3 billion to US$15.6 billion, demonstrating strong top-line growth. Net profit also increases over the period, though at a more moderate and uneven rate, indicating that higher sales did not fully translate into proportional earnings gains. EPS declines between 2021 and 2023 before rebounding in 2024 and 2025, suggesting earlier margin pressure followed by improved profitability in the later years.

The Metrics Look Good, So What’s the Problem?

The revenues have been rising steadily, as well as the EPS. However, a company’s story isn’t always good, owing to the fact that top-line numbers are strong. Yes, EPS has been increasing, but the real fact of the matter is that the stock price has plunged by over 40% in the past 5 years. Investors are focusing more on the quality of earnings rather than just plain earnings. Investors get skeptical when a sizeable portion of earnings comes from other sources rather than just operations. Which is the case with CSL. This price decline could also be attributed to the fact that the company was trading at a higher multiple than its peers, suggesting a correction in the market.

Uncertainty also emerged from delays to the planned spin-off of its influenza vaccine division, Seqirus, raising concerns about strategic direction and future earnings. These pressures were compounded by regulatory and policy changes in key markets that squeezed margins. Revenues have been rising; however, gross profit and net profit have not been rising commensurately. Another sign that the company has been struggling to scale. This seems like a rather unorthodox situation to be in considering the company is strongly positioned with regard to competition scales such as Porter’s five forces.

What Can We Expect in the Future?

The share price of CSL Limited has declined significantly over recent years, prompting investors to question whether the stock now represents a buying opportunity. In valuation terms, CSL appears to sit around the middle of its peer group, suggesting it is neither clearly cheap nor excessively expensive. This relative positioning offers some comfort, as it indicates the stock is not trading at extreme levels. However, there are important risks to consider. Investors still need time to build confidence in the new CEO, and upcoming FY2026 results will reflect substantial impairments, which could further weigh on sentiment. Overall, while CSL remains a market leader in its industry, its share price is likely to remain volatile over the next year.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.