The Australian Securities Exchange (ASX) IPO landscape in 2025 marks a decisive transition, from recovery to refinement. After several years of subdued activity shaped by elevated interest rates, macroeconomic uncertainty, and investor selectivity, the market is finding its rhythm again. This time, however, the rebound is defined by fundamentals over frenzy, as investors reward resilient, earnings-backed listings and shun speculative hype.

The State of ASX IPOs in 2025

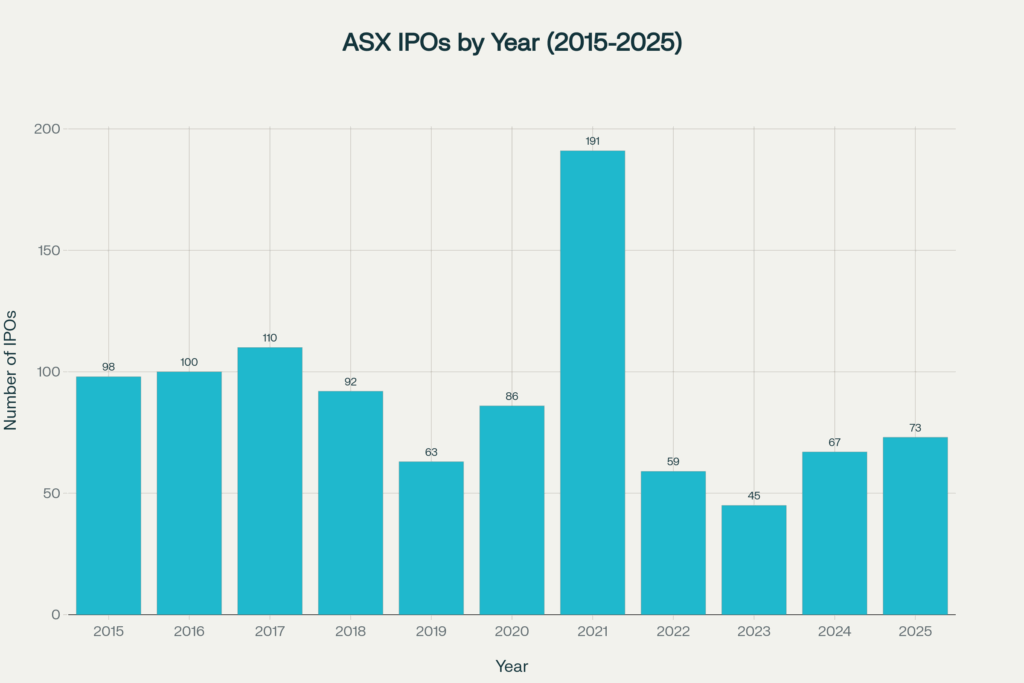

By the third quarter of 2025, the ASX recorded 73 IPOs, up from 67 in 2024 and 45 in 2023—an encouraging signal of returning market confidence. More than $1.5 billion has been raised through new listings, supported by easing interest rates and a gradual improvement in liquidity conditions. Analysts note that while the quantity of IPOs is rising, the quality of listings has improved markedly.

Resources remain the heartbeat of the ASX. Gold, copper, and critical minerals continue to dominate the pipeline, though investors are now favouring mature assets with credible production pathways and disciplined valuations rather than early-stage exploration stories. This represents a shift toward institutional-grade offerings over momentum-driven floats.

A Decade in Numbers

The past decade underscores the cyclicality of Australia’s IPO market. After a steady run through the mid-2010s, activity peaked in 2021 with 191 listings, fuelled by post-pandemic stimulus and record-low rates. The subsequent correction was sharp, just 59 listings in 2022 and 45 in 2023, before the current rebound took hold.

While volumes remain below peak levels, the structural quality of listings has improved. Investors are positioning for long-term exposure to sectors with durable tailwinds such as renewables, aged care, and advanced resources, marking a more mature phase for the ASX.

Winners and Under performers

Among 2025 listings, Robex Resources (ASX: RXR) delivered standout gains of over 30% in its first quarter, underpinned by stronger gold prices and institutional buying. Marimaca Copper (ASX: MC2) also drew substantial attention from critical minerals investors.

Conversely, Virgin Australia’s relisting disappointed, with post-IPO margin pressure and inflationary costs eroding sentiment. Smaller-cap tech and biotech names such as VBX Technologies underperformed, reflecting the market’s preference for proven revenue models and profitability visibility.

Market Drivers of the 2025 Cycle

Several macro and regulatory factors have underpinned the 2025 IPO cycle:

- Easing interest rates have revived equity demand and lifted valuations for income-oriented investments.

- Commodity strength—notably in copper and gold—has bolstered confidence in resource-linked listings.

- ASIC’s two-year fast-track IPO trial has streamlined listing processes for qualified issuers, enhancing capital market efficiency.

Together, these dynamics are reinforcing Australia’s standing as a global mid-cap growth hub, particularly for resource, energy, and technology ventures.

Upcoming IPOs to Watch (Late 2025)

The ASX upcoming floats page (as of October 21, 2025) highlights several notable listings:

- Black Pearl Group Ltd (ASX: BPG) – Technology / SaaS

Scheduled for 28 November 2025, this New Zealand-based software firm targets SMEs with data-driven productivity tools, underscoring growing regional tech integration. - Equus Energy Ltd (ASX: EQU) – Oil & Gas Exploration

Confirmed for 24 November 2025, raising $15 million for petroleum projects backed by BW Equities and Unified Capital. - Black Horse Mining Ltd (ASX: BHL) – Gold and Base Metals Exploration

Set to list 21 November 2025, aiming to raise $8 million to progress Australian resource projects. - Right Resources Ltd (ASX: RRE) – Mineral Exploration

Listing 28 October 2025, focusing on strategic domestic mineral development. - Sentinel Minerals Ltd (ASX: SNM) – Mineral Exploration

Targeting a 27 October 2025 IPO with ambitions to develop high-potential mining assets.

Additional candidates such as CarMarket Australia Ltd and Pacifico Gold Ltd have announced late-2025 listing intentions, pending ASX confirmation.

Lessons and Outlook

The 2025 IPO environment reflects a more disciplined, fundamentals-first market. Investor selectivity, coupled with supportive regulation and easing financial conditions, has laid the groundwork for a sustainable pipeline.

The next phase for the ASX will hinge on whether this newfound discipline can coexist with growth. If macro conditions remain supportive, 2026 could mark the transition from rebound to renewal, where quality listings define Australia’s capital market leadership in the Asia-Pacific region.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.