Company Overview

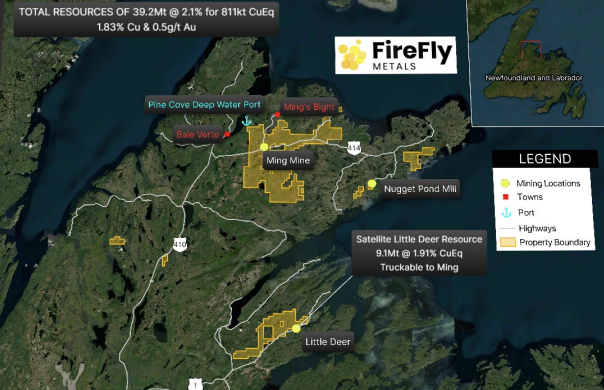

This FireFly Metals investment analysis explores how FireFly Metals (ASX: FFM, TSX: FFM), an Australian-based copper-gold explorer and developer with a growing international footprint. The company’s flagship asset is the Green Bay Copper-Gold Project in Newfoundland & Labrador, Canada, complemented by the Pickle Crow Gold Project in Ontario and a majority stake in the Limestone Well Vanadium-Titanium Project in Western Australia.

As of November 2025, FireFly expanded Green Bay’s total resource base to 59Mt at 2% CuEq (JORC 2012), supported by over 130,000m of diamond drilling targeting both scale and grade.

Board and Leadership

The board combines deep mining expertise and capital markets experience:

- Steve Parsons – Managing Director

- Kevin Tomlinson – Independent Non-Executive Chairman

- Michael Naylor – Executive Director

- Leanne Heywood – Independent Non-Executive Director (appointed Nov 2025)

- Renée Roberts – Independent Non-Executive Director

Supporting management includes CEO Darren Cooke, CCDO Jessie Liu-Ernsting, and CFOChen Sun, alongside senior specialists in geology, metallurgy, and environmental safety — collectively steering FireFly through its next growth phase.

Investment Thesis

This FireFly Metals investment analysis highlights a high-conviction exploration story backed by exceptional drilling results. The convergence of VMS and Footwall Zone mineralisation continues to deliver impressive intercepts, strengthening the case for Green Bay as a top-tier copper-gold development project. FireFly’s transition from exploration to early-stage commercialisation marks a key inflection point, supported by a strong cash position and a track record of delivering high-impact resource growth without excessive dilution.

Historical Performance

The company’s share price performance underscores growing market confidence. In 2025, FireFly’s stock gained nearly 99%, and over 170% across three years. The rally, from A$1.03 in June to A$1.76 by October, was driven by sustained positive drill results and momentum in resource definition. While still loss-making, the focus remains on resource expansion and value creation rather than short-term profitability.

Portfolio Overview and Key Projects

FireFly’s portfolio is diversified across copper, gold, and vanadium-titanium assets:

- Green Bay Copper-Gold Project (Canada): Flagship development with global-scale potential.

- Pickle Crow Gold Project (Ontario): High-grade gold asset under strategic review for divestment or JV.

- Limestone Well Vanadium-Titanium Project (WA): Brownfield exploration with 90% ownership.

This mix provides optionality between near-term copper growth and longer-term diversification.

Acquisitions and Corporate Activity

FireFly continues to consolidate its position at Green Bay, acquiring adjacent tenements to enhance its resource footprint. A review of Pickle Crow is underway, with a potential sale or JV that could recycle capital toward Green Bay’s development. No major corporate acquisitions have occurred since the company’s rebranding from AuTECO, with funds largely directed toward exploration and drilling expansion.

Financial Health

As of FY25, FireFly Metals reported net cash of approximately A$99.9 million and shareholder equity of A$343.6 million. Revenue remains negligible (A$0.4 million), consistent with its exploration status, while the balance sheet reflects prudent cash management and minimal debt. The company raised A$84 million through placements and a share purchase plan, ensuring ample liquidity to sustain multi-year development programs. No dividends have been declared as capital is prioritised for growth.

Fundamental and Valuation Analysis

At current prices, FireFly trades at a premium price-to-book ratio of 3.7x, compared with the industry average of 2.2x. Valuation models estimate a base intrinsic value around A$0.15, implying the market is pricing in substantial future resource expansion and commercialisation success. However, this optimism carries risk, future value depends heavily on resource conversion, project economics, and copper price support.

Technical Analysis

FireFly’s share price has delivered exceptional momentum, up nearly 100% in the past 12 months. Technical indicators such as EMA and MACD show a sustained uptrend, while RSI levels indicate near-term overbought conditions. Trading volume spikes on drill result announcements reinforce strong speculative interest, though short-term pullbacks remain likely.

Risks and Considerations

Investors should be aware of:

- Exploration uncertainty and resource conversion risk

- Potential dilution from future equity raisings

- Commodity price sensitivity (copper, gold)

- Execution risk in transitioning from exploration to production

These factors could amplify volatility in the near term despite strong project fundamentals.

Outlook and Conclusion

FireFly Metals stands out as one of the most promising copper-gold exploration stories on the ASX. With continued drilling success, a robust cash position, and an experienced board, the company is well-positioned for future development.

Broker forecasts, including from Macquarie, indicate potential upside of up to 47% over the next year, contingent on further resource growth and commercial progress. For investors seeking speculative exposure to high-grade copper-gold assets, FireFly offers strong upside with corresponding risk.

FireFly Metals is a high-potential, pre-revenue explorer with impressive assets, cash backing, and a well-structured growth path, best suited to investors comfortable with elevated risk-reward profiles.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.