The RBA says this easing cycle began from the tightest starting point in at least 45 years, demand already brushing up against supply, a still-firm labour market, and underlying inflation at the top of target. That combination narrows the room to cut, shifts focus to productivity and capex, and raises the bar for earnings-led equity upside

What’s Happening

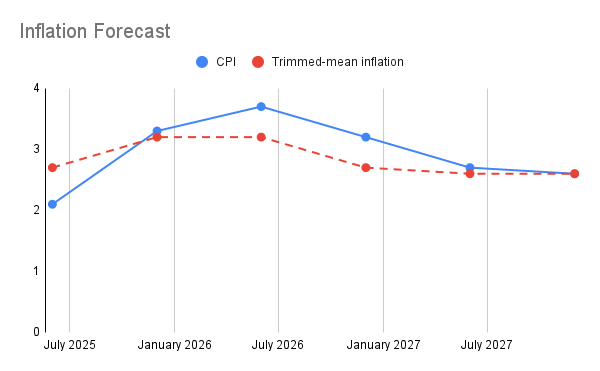

Deputy Governor Andrew Hauser framed an “unusual challenge” for 2025: the Bank cut pre-emptively to cushion a growth slowdown, but the recovery started from an economy already near capacity. Two-thirds of the recent inflation firming came from volatile categories (travel, fuel), but one-third is underlying demand pressure. With the cash rate on hold at 3.60% and trimmed-mean inflation back at ~3%, the RBA’s scope to ease further is constrained unless supply expands or demand cools. Hauser laid out two paths:

- Track A (dovish-leaning): Labour demand is weaker than it looks; the inflation pop is transitory; more cuts are possible next year.

- Track B (hawkish-leaning): The economy is growing at its speed limit; productivity is the binding constraint; limited room to ease without rekindling inflation.

AMP leans toward track A (labour market slack showing up in job ads/vacancies), while others, Judo Bank, see Track B as more plausible, with disinflation having “at best, stopped.”

The Core Macro Read-Through

- Tight starting point = higher hurdle for stimulus. When demand approximately meets potential output, policy support risks re-heating inflation unless supply improves.

- Productivity is policy. Without faster productivity, non-inflationary GDP trend is closer to ~2%, a “far from spectacular” pace that caps earnings and wage growth without price pressure returning.

- Supply-side growth > demand management. The RBA is effectively signalling to the private sector: investment, execution, and capacity matter more than incremental basis points of rates.

Sector Implications

Banks & Diversified Financials

Net interest income tailwinds from prior hikes are fading; with the rate path less certain, loan demand may remain patchy. If Track B dominates (capacity bind), credit growth is steady but unspectacular and asset quality should hold if unemployment rises only gradually. Capital-light fee income and productivity investments (automation, straight-forward processing) become bigger earnings levers. A Track A outcome (weaker labour) would soften credit demand and raise arrears risk, but would also steepen cut expectations, supportive for duration-sensitive bank multiples.

Rate-Sensitives (REITs, Housing, Consumer)

A “boxed-in” RBA tilts the near-term balance toward stable-to-higher real rates, keeping cap rates under pressure where NOI growth is thin. Residential volumes can improve if sentiment firmed, but abroad affordability constraints and sticky services inflation keep a lid on price/multiple expansion. High-quality REITs with embedded development margins or index-linked leases look better placed than leverage-heavy, low-growth assets.

Industrials, Infrastructure, Logistics

This is where Hauser’s call to invest matters most. Firms that expand capacity, shorten build cycles, and digitise ops can grow without stoking inflation, gaining share as others stall. For listed contractors and operators, the opportunity is in execution alpha: fixed-price backlog discipline, labour sourcing, and working-capital control. Policy signals around planning/zoning and permitting become material catalysts.

Resources & Energy

If Track B holds (capacity-constrained Australia, steady global demand), terms-of-trade support persists but volume growth is limited by permitting, labour, and power bottlenecks. Capital will favour brownfield debottlenecking and electrification (lower unit costs, lower emissions) over greenfield risk. For energy, the mix shifts to reliability and grid investment, benefiting equipment/services with visible order books. If Track A materialises (growth cools), bulk demand softens cyclically, but high quality, low-cost producers keep relative advantage.

Technology & productivity enablers

The RBA’s message implicitly re-rates productivity vendors: software and services that demonstrably lift throughput per head, inventory turns or energy efficiency. The market will pay for measured ROI and time-to-value, not just AI narratives. Watch for procurement pivoting toward tools that compress cycle times (ERP modernisation, AI-assisted ops, supply-chain visibility).

What It Means For Investors

- Style: own cash-compounders that self-fund growth. If policy room is narrow, the market rewards businesses that expand supply capacity (units sold, throughput) without stretching balance sheets. Free-cash-flow conversion and capex discipline outrank top-line “aspiration.”

- Quality over beta in rate-sensitives. Lean toward REITs/infrastructure with pricing power, indexation, or brownfield pipelines; avoid long-dated cash flows with weak NOI growth and high refinancing needs.

- Productivity is the new multiple. Re-rate potential accrues to names with credible pathways to labour efficiency, automation, and energy productivity. Evidence beats promises: pilots moving to rollout, KPI lift (units/employee, on-time delivery), and customer churn down.

- Watched the labour data, not just CPI. The track that wins, A or B, will show up first in vacancies, hours worked, and private-sector hiring, then in services inflation. If vacancies slide and services cool, duration and defensives work; if not, stick with quality cyclicals and cost-advantaged producers.

Risks and Signposts

- Left-tail: A renewed inflation pulse (services/wages) with activity still firm; the market must re-price a longer plateau in rates.

- Right-tail: Faster productivity from capex and tech adoption lifts potential growth; the RBA gets room to cut without reflating prices.

- Signposts to track: job ads vs. vacancies, unit labour costs, services CPI, business investment intentions, construction backlogs, grid/energy project approvals.

Outlook: A Narrow but Investable Path

Hauser’s speech reframes the debate. This is not a classic “cut and rip” cycle; it’s a capacity-first expansion where the winners are companies that create their own slack, throughput, automation, and smarter capex, rather than those waiting for cheaper money. For portfolios, lean into earnings quality, productivity lift, and supply-side credibility. Policy can smooth the path, but the heavy lifting now sits with business investment and execution. “Seize that opportunity,” he said. The market will pay up for those who do.

Disclaimer

General information only. This is not financial advice and does not take into account your objectives, financial situation or needs. Consider your own circumstances or seek professional advice before acting.