A Landmark Move by One of the World’s Most Disciplined Investors

The Warren Buffett Google investment has become one of the most talked-about shifts in global markets this year. Berkshire Hathaway revealed a $4.3 billion stake in Alphabet during the third quarter of 2025, a move that surprised almost everyone given Buffett’s long reluctance to back major technology companies. It feels like a genuine turning point for both Buffett and Berkshire Hathaway, and it says a lot about how central artificial intelligence and cloud computing have become in shaping long-term value.

A Longstanding Reluctance to Back Tech Stocks

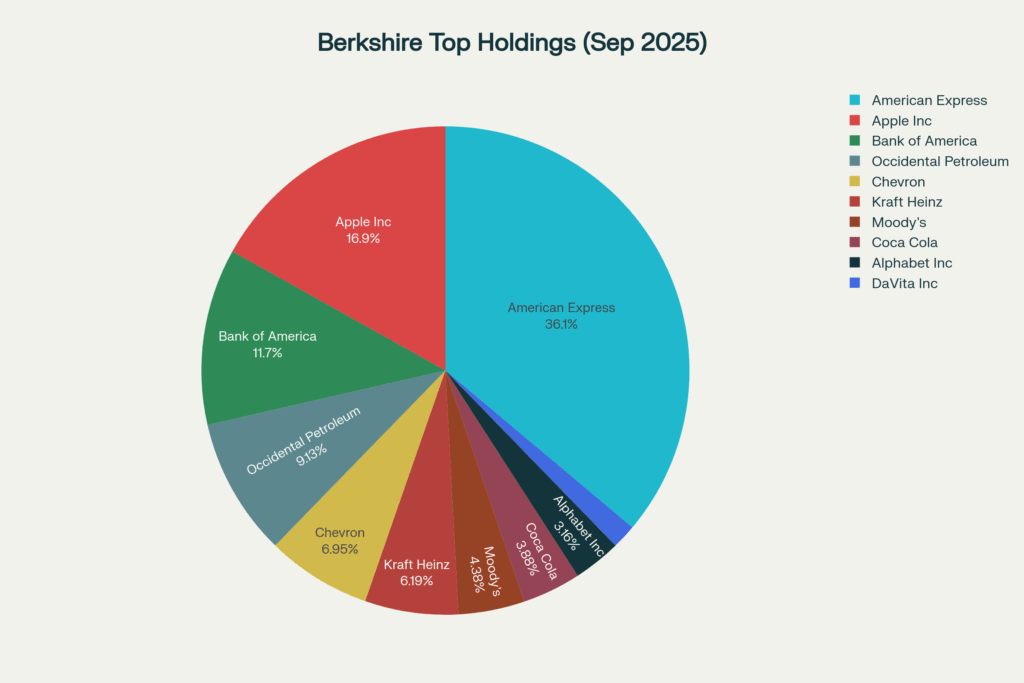

Buffett has always preferred stable industries where he can clearly understand long term economics. Insurance, banking, rail, and consumer goods formed the backbone of Berkshire’s success. He often described technology as outside his circle of competence because the pace of change made cash flows harder to predict. Yet Berkshire’s purchase of seventeen point eight million Alphabet shares now places Google firmly inside its top equity positions. It is a clear signal that the business has reached a level of maturity and predictability that even Buffett can get behind.

A Decision Shaped by Timing and Leadership Transition

The move also comes at a pivotal moment. Buffett will step down as CEO at the end of 2025, handing the reins to Greg Abel. Some market watchers believe this investment reflects Buffett’s final major call. Others suspect the influence of Berkshire’s next generation of investment managers, who have steadily pushed the portfolio toward more growth oriented opportunities. Either way, the timing suggests this is part of setting the tone for Berkshire’s future.

Why Google, and Why Now

Alphabet’s appeal is simple. It holds commanding positions across search, digital advertising, cloud computing, and artificial intelligence infrastructure. Its work in autonomous vehicles through Waymo adds another long horizon growth driver. With the stock rising more than forty six percent year to date in 2025, Google has proven its ability to convert long term R and D into real commercial momentum. For Berkshire, it is one of the few tech companies that combines scale, defensibility, and enormous cash generation.

What the Investment Means for Both Companies

Berkshire’s endorsement offers Alphabet a rare form of validation. Investors view a Buffett backed position as a vote of confidence in both leadership and financial discipline. For Berkshire, the investment helps modernise the portfolio and gives shareholders exposure to an industry that will shape global markets for decades. Alphabet fits Buffett’s long held criteria: a durable competitive advantage, consistent earnings power, and the ability to reinvest at scale.

A Symbolic Step That Connects Buffett’s Legacy to the Future

Buffett’s investment in Google is more than a portfolio adjustment. It reflects a bridge between classic value investing and a world increasingly defined by artificial intelligence and digital infrastructure. As Berkshire transitions to a new chapter, this move signals that enduring value and technological innovation are no longer at odds but can sit comfortably side by side. For investors, it reframes how the market thinks about mature tech companies and the long term opportunities they represent.