Index funds and ETFs have grown steadily in popularity over the past few decades. A handful of investors remain skeptical, often due to past experiences, and prefer to keep their money in the bank earning annual interest. Others, however, have witnessed the long‑term value that index funds can generate. At their core, these funds replicate a broad market basket, effectively serving as a reflection of a nation’s or even the global economy.

Index Funds and the Superannuation Conflict

Superannuation has long been the cornerstone of Australia’s retirement system, and because it is compulsory. It has fostered an “I’m already covered” mindset among many Australians. Knowing that a portion of their income is automatically invested by professional fund managers reduces the perceived need to engage in DIY investing. It is a form of cultural conditioning where people are taught to rely on Super.

Why does the population prefer Super?

- Super already provides stock market diversification.

- It is mandatory and automatic.

- The illiquid nature of super may discourage investors from investing in the market in parallel.

- The psychology: Super feels safer to the population who may not be financially literate.

- Professional management with no additional fees.

Despite the above hindrances, index funds and passive investing have continued to gain popularity. Both retail and institutional investors are increasingly allocating money to index‑tracking products. Many retail investors have also come to recognize the liquidity constraints of superannuation and are therefore choosing to invest in individual stocks or index funds outside the super system.

Index fund performance

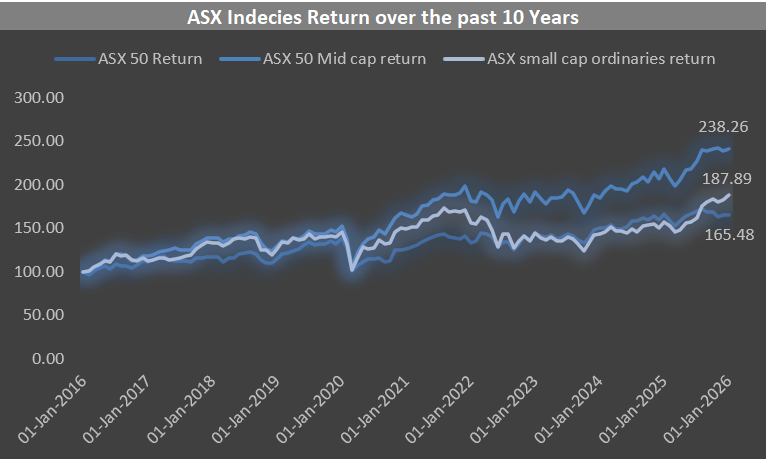

Source: Data sourced from LSEG Workspace

Above are the returns for 3 different index funds, ASX 50, ASX 50 midcap, and ASX smallcap ordinaries, across two different timelines. The five-year timeline was created to screen out effects of the covid-19 pandemic, and the numbers still seem promising. The large caps in the 5-year period have performed fairly well, with the mid-cap index being the clear winner. The ten-year returns provide a rather clearer picture of each of the 3 indexes, with the large-cap index providing a return of 88% and the mid-cap providing a return of an astounding 138%. This is owing to the rebalancing of the index. The small-cap ordinaries in the ten-year period provided the least return, of 65.5%, mostly attributed to non-survivorship bias.

The Main benefit of investing passive and outlook

Based on the Australian economic system and having discussed how the super effects passive investing. However, the flip side of the coin is that it also benefits indexing. Australian investors would need a really strong case to invest in active funds. Is paying additional management fees worth it? For most probably not, because professionals are already managing their super for less to nothing. To top it all off, passive investing solves the liquidity constraint for investors. Looking forward, if the economy continues to grow at this gradual rate, index investing should provide investors with positive returns.

Disclaimer

This investment recommendation is prepared for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. Investors should conduct their own due diligence or seek professional advice before making investment decisions.