- Investment Analysis Cobram Estate – Premium Product, Premium Expectations

- Company Overview

- Board and Leadership

- Investment Thesis

- Historical Performance

- Portfolio Composition and Key Assets

- Financial Health and Capital Allocation

- Fundamental and Valuation View

- Technical Considerations

- Key Risks

- Outlook and Conclusion

Investment Analysis Cobram Estate – Premium Product, Premium Expectations

Cobram Estate Olives has evolved from a regional Australian grower into a vertically integrated, branded olive oil business with growing international scale. After an extended period of heavy capital investment, the company is now generating record earnings and cash flow, while positioning for a potentially transformative expansion in the United States.

The proposed acquisition of California Olive Ranch marks a step change in scale and ambition. It also introduces new execution risks at a time when the market has already re-rated the stock aggressively. For The Investor Standard, Cobram sits firmly in the quality compounder category, but at a valuation that leaves little room for missteps.

Company Overview

Cobram Estate Olives, formerly Boundary Bend Limited, is an ASX-listed agribusiness focused on premium extra virgin olive oil. Its flagship brands include Cobram Estate and Red Island, both positioned at the higher end of the category.

The company operates olive groves, milling, bottling, and distribution assets across Victoria, South Australia, and California. This geographic footprint provides exposure to two of the world’s most attractive EVOO markets and helps diversify climatic and production risk.

Cobram’s vertically integrated structure allows it to control quality across the entire value chain, from grove management through to branded retail sales. Revenue is generated from packaged branded oils, bulk oil sales, and value-added products, with branded packaged sales delivering the highest margins and most stable demand profile.

Board and Leadership

Cobram’s leadership reflects its founder-led, asset-intensive roots, balanced by growing commercial sophistication. Co-founder Robert McGavin serves as Non-Executive Chair and remains a significant shareholder, aligning board decisions closely with long-term capital discipline. Joint-CEO Leandro Ravetti oversees technical production and agronomy, while Joint-CEO Sam Beaton leads finance, capital allocation, and mergers and acquisitions. The broader board includes non-executive directors with experience across consumer brands, finance, and governance, supporting the company’s transition from growth-at-all-costs to disciplined, cash-focused execution.

Investment Thesis

The Cobram Estate investment case rests on three core pillars.

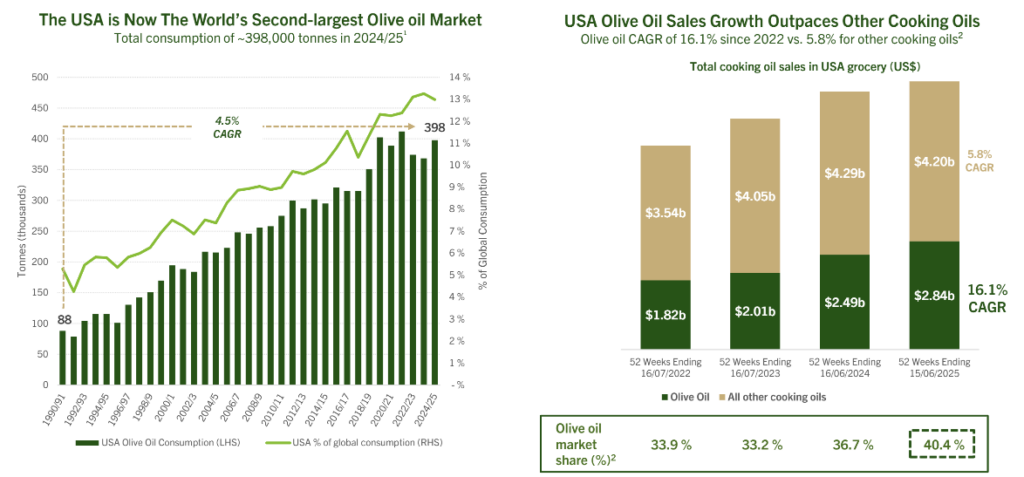

First, structural growth in premium olive oil consumption continues to support long-term demand. Health awareness, plant-based eating trends, and substitution away from refined oils all favour high-quality extra virgin olive oil.

Second, operating leverage is now emerging. Years of upfront investment in groves, irrigation, and processing infrastructure have weighed on returns historically, but those assets are now maturing and driving record margins and cash flow.

Third, US expansion offers a meaningful growth runway. The acquisition of California Olive Ranch is large relative to Cobram’s existing footprint and has the potential to materially lift scale, margins, and brand reach if integration is executed well.

In FY2025, Cobram delivered revenue of approximately A$243 million, EBITDA of A$116 million, and net profit of A$50 million. EBITDA margins approaching 48% are exceptional for an agribusiness and reflect the power of branded, vertically integrated production.

The US$173.5 million California Olive Ranch acquisition more than doubles Cobram’s Californian grove area and adds established US brands, distribution relationships, and research capabilities. If integration succeeds, Cobram could emerge as the largest olive oil producer in the United States, with improved pricing power and shelf presence across major retailers.

Historical Performance

Cobram’s financial transformation over the past five years has been significant. Revenue grew from A$169.5 million in FY2023 to A$242.6 million in FY2025, representing a compound annual growth rate of around 20%. Over the same period, operating margins expanded from 23.8% to 47.9%, while net margins rose above 20%.

Net profit increased from A$7.7 million to nearly A$50 million in just two years, supported by higher yields, improved utilisation, and stronger branded sales. Operating cash flow followed earnings higher, reaching A$58.1 million in FY2025 and providing greater financial flexibility.

Portfolio Composition and Key Assets

Cobram’s asset base is best viewed through both geography and product mix. Australia remains the core earnings contributor, supported by large-scale groves, processing facilities, and strong brand recognition. The United States is the key growth engine, with California assets expanding rapidly and set to grow further through the California Olive Ranch acquisition.

Key assets include irrigated groves, modern milling and bottling facilities, and a portfolio of premium consumer brands. Branded packaged sales provide higher margins and greater earnings stability, while bulk oil sales offer flexibility to manage production variability. The California Olive Ranch transaction materially shifts Cobram’s portfolio toward the US market and enhances its global relevance within the premium olive oil category.

Financial Health and Capital Allocation

Cobram’s balance sheet reflects its recent expansion phase. Total assets are approximately A$812 million, with total liabilities of around A$446 million, resulting in net gearing of roughly 75%. While elevated, this leverage is supported by strong cash flow and interest cover of around 6x. The company does not currently pay dividends, preferring to reinvest cash into grove expansion, infrastructure, and US growth. This capital allocation strategy positions Cobram as a growth-oriented investment rather than an income vehicle over the next several years.

Fundamental and Valuation View

From a quality perspective, Cobram screens strongly. Returns on equity and invested capital have improved materially, margins are among the highest in the agribusiness sector, and brand strength provides a durable competitive advantage. However, valuation is demanding. At recent prices, Cobram trades around 19x EV to EBITDA, with a trailing P/E near 27x and a forward multiple above 40x. These levels imply successful integration of California Olive Ranch and continued strong growth in branded US sales. Any execution misstep, weather disruption, or cost pressure could trigger a sharp re-rating.

Technical Considerations

The share price has been in a strong uptrend, rising roughly 90% over the past twelve months. Price remains well above key moving averages, confirming positive medium- and long-term momentum. That said, RSI readings near extreme levels suggest the stock is technically overbought in the short term. Consolidation or a pullback would not be unusual following such a strong run.

Key Risks

Cobram remains exposed to agricultural risks, including weather variability, drought, frost, and pests. Input costs such as labour, energy, and fertiliser also impact margins. Execution risk around the California Olive Ranch acquisition is significant, given its size relative to the group. Valuation risk is elevated, with market expectations already high.

Outlook and Conclusion

Cobram Estate has successfully transitioned into a high-margin, cash-generative agribusiness with a premium brand portfolio and expanding international footprint. The combination of maturing assets and US expansion provides a credible pathway to sustained earnings growth.

However, the current share price reflects a near-perfect outcome. For The Investor Standard, Cobram is best viewed as a long-term compounder, but one that demands patience and disciplined entry timing. A pullback toward the A$2.00 to A$2.30 range would offer a more attractive risk-reward balance. If integration of California Olive Ranch proceeds smoothly and US branded sales continue to outperform, upside toward A$3.20 to A$3.50 over the next 18 to 24 months appears achievable.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.