In its first policy decision of 2026, the RBA raised the official cash rate by 25 basis points from 3.60% to 3.85%, marking the central bank’s first hike since November 2023 as inflation proves more persistent than expected rising from 3.4% to 3.8% from the November to December quarter with a mean trim of 3.3%, above the RBA’s 2-3% target. Markets had largely priced in the move following a series of hotter-than-anticipated price prints and a tight labour market, with unemployment falling in December despite expectations or it to stall or rise. The decision still marks a notable shift from the easing bias seen through much of 2025.

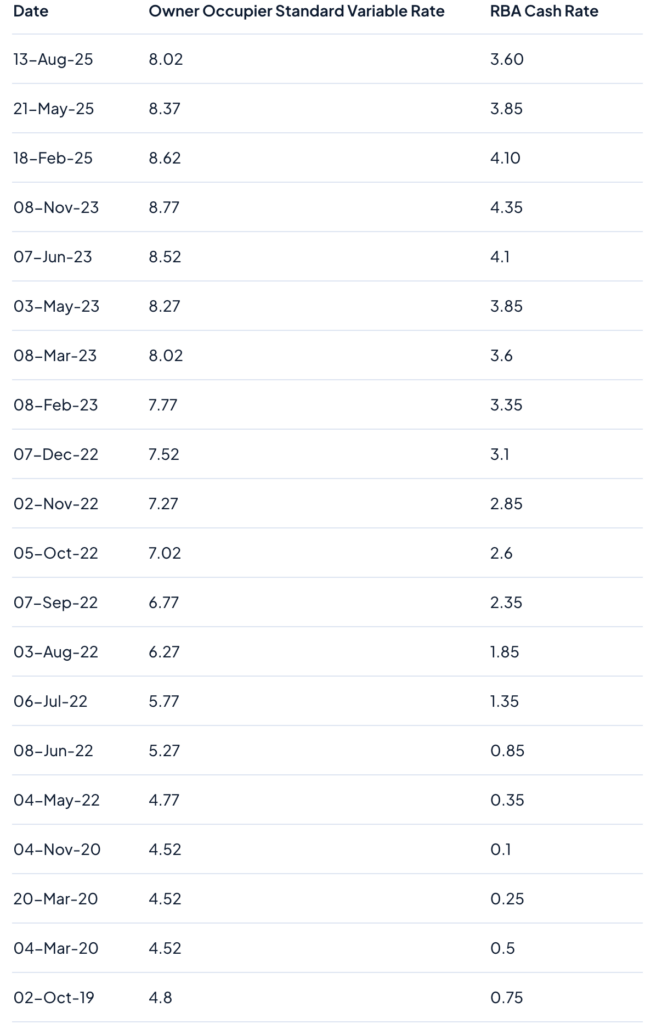

RBA Cash Rate since the COVID-19 pandemic

Why the Hike Happened

- Persistent Inflation Above Target: Inflation has surprised to the upside in recent months with YoY doubling from 1.9% to 3.8% from July to December. Core readings and broader price pressures remaining elevated despite earlier expectations that price growth would ease. This has strengthened the case for a rate increase to keep inflation anchored.

- Strong Economic Momentum: Alongside inflation, labour market indicators and household spending have shown resilience, giving policymakers confidence that the broader economy can absorb a modest tightening without derailing growth. Real wages have seen 8 consecutive quarters of YoY growth, the longest streak since 2016 and unemployment fell from 4.3% to 4.1% from November to December.

- Market Expectations Had Shifted Sharply: Major banks and economists had shifted forecasts toward a rate rise, with projections from Westpac, ANZ, CBA and NAB coalescing around a 25 basis-point hike to 3.85% a consensus that had been building in the weeks leading up to the decision.

Market Reaction

- Equites: Australian share markets dipped modestly as rate-sensitive sectors reacted to expectations of higher borrowing costs and slower consumer spending.

- Aussie Dollar: The AUD initially strengthened on the back of the rate decision and higher yields, although gains were later tempered by broader commodity market weakness.

- Fixed Income: Bond yields rose as markets repriced the tightening cycle, signalling that this hike may not be a one-off if inflation remains stubborn.

- Mortgages: While many borrowers are currently buffered by fixed-rate contracts, variable-rate repayment expectations have risen, with analysts projecting noticeable increases in monthly costs for new and existing loans. Property price growth may also slugger with higher rates.

Policy Outlook

This decision marks a clear departure from the RBA’s easing trend over the past year, a cycle in which the cash rate was cut repeatedly over 2 years from 4.35% to 3.6% and positions monetary policy on a “higher-for-longer” footing at least in the near term.

Governor Michele Bullock and the Monetary Policy Board have emphasised that future decisions will remain data-dependent, but today’s lift indicates a willingness to act when inflation trajectories diverge from expectations.

Economists are now debating whether this move signals the start of a new tightening cycle or a single pre-emptive insurance hike. Some forecast further increases if core inflation remains sticky, while others argue the RBA’s next moves will depend heavily on incoming growth and labour data.

What Investors Should Watch Next

- Inflation Data: Headline and core inflation prints due in the coming months will be critical in shaping the next policy steps.

- Wage Growth: If wage pressures re-emerge, the RBA may be more inclined to act again especially when combined with incoming income tax cuts.

- Household Spending and Housing: Consumer behaviour and property price trends will determine how monetary tightening filters through the economy.

- FX and Bond Markets: Australian bond yields and the AUD’s performance will provide early signals of broader financial market confidence or stress.

- Next Meeting: The next RBA meeting will be on March 16-17 2026.