Business leaders turn cautious

Australian industry leaders are increasingly uneasy about the year ahead. Around 40% now expect business conditions to weaken in 2026 compared with 2025, according to the Australian Industry Group’s latest outlook survey. That pessimism persists despite growing enthusiasm around artificial intelligence and digital productivity tools.

The message is not uniformly negative. Instead, it reflects an economy pulling in two directions. Costs continue to rise, margins remain thin, and global uncertainty lingers. At the same time, technology investment is viewed as one of the few credible levers for protecting profitability.

For investors, the survey offers a useful temperature check on where confidence is eroding and where capital is still being deployed.

Cost pressures dominate executive thinking

The defining theme of the survey is cost. Rising input prices, energy bills, insurance and wages are compressing margins across manufacturing, construction and services. As a result, profitability expectations deteriorated sharply, with net sentiment falling to negative 18%.

That matters. Margins across many industrial sectors are already thin. There is limited room to absorb further shocks without cutting investment or employment.

AI stands out as the lone source of optimism

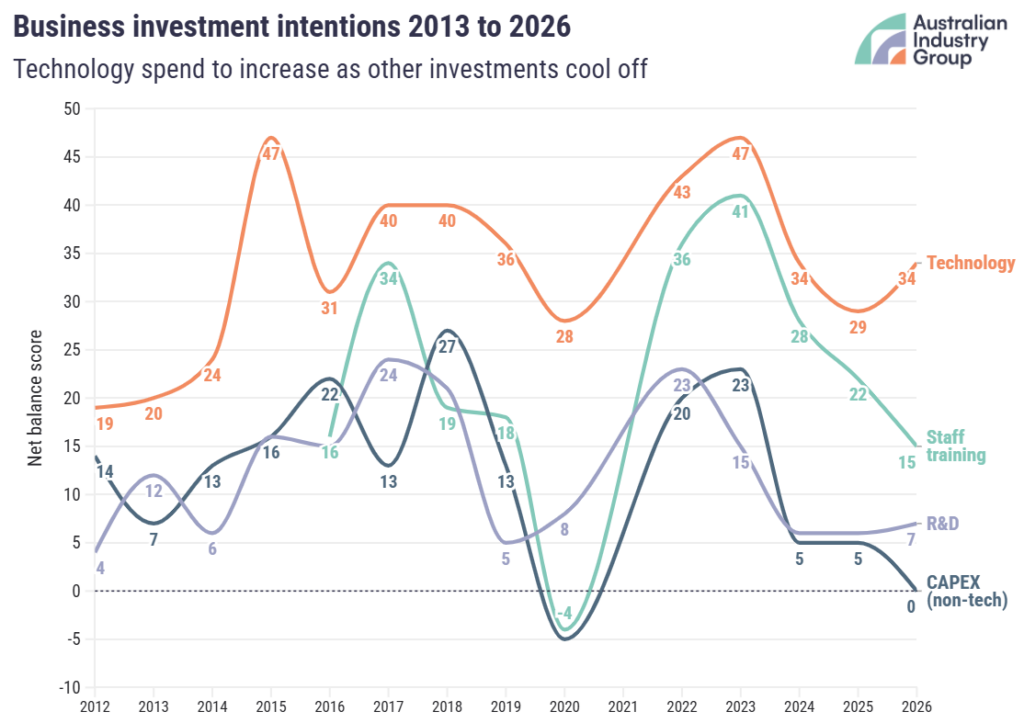

Against this backdrop, artificial intelligence is the clear outlier. Survey respondents remain strongly positive on technology investment, especially AI driven automation and analytics.

Executives increasingly see AI as a way to offset wage growth and improve output per worker. That belief is reshaping capital allocation. Hiring intentions softened, with employment expectations slipping to a modest net positive. Traditional capex plans also cooled.

Firms appear willing to delay expansion, but not digital transformation. This favours software, data and automation over heavy plant and labour intensive growth.

Sector divergence becomes clearer

The survey highlights growing gaps between sectors. Mining and resources remain relatively confident, posting a net positive revenue outlook of 12%. Commodity demand and long dated project pipelines continue to support sentiment.

Business services also show resilience, with a net positive outlook of 8%. Consulting, technology and AI advisory work are cushioning broader softness.

Construction and retail face the most pressure. Costs are rising faster than pricing power, increasing the risk of margin contraction and project delays.

What this means for ASX portfolios

The tone of the survey supports a cautious but selective portfolio stance. AI enablers and digital infrastructure remain relative winners. Data centre operators like NextDC, along with SaaS companies that can demonstrate pricing power, look better placed than cost exposed industrials.

Resources exposure still makes sense, but selectivity matters. Businesses with cost pass through mechanisms, long term contracts or operational leverage should outperform. For diversified portfolios, a defensive tilt is emerging. Technology and AI proxies can form a meaningful allocation, while exposure to construction linked industrials may warrant trimming until cost pressures ease.

Risks and potential upside

The key downside risk is inflation persistence. If wages and energy prices remain elevated, capex deferrals could turn into outright cuts. That would reinforce the pessimism loop flagged in the survey.

The upside lies in execution. AI adoption that delivers rapid productivity gains could improve margins faster than expected. Early adopters in mining technology, logistics optimisation and predictive maintenance may surprise on earnings.

A balanced strategy makes sense. Preserve capital, prioritise balance sheet strength, and maintain targeted exposure to AI linked growth.

A bifurcated year ahead

Overall, the survey paints 2026 as a year of separation. Businesses unable to manage costs face growing pressure. Those that successfully deploy technology gain breathing room.