Global markets went down decisively as sell-offs in tech stocks, commodities and cryptocurrency intensified, reinforcing a broad investor shift into defensive positioning. The decline was driven by weak US labour data, profit taking, and rotation of investors moving out of high-beta assets, leaving major benchmarks across regions deep in negative territory again.

United States: Equities Weak, Tech Leads Declines

US equities tumbled sharply on its Thursday trading day, extending the recent sell-off in tech and growth sectors. The S&P 500 fell about and the Dow dropped 1.2%, and the Nasdaq fell by 1.6%, marking another broad down day for markets. Small caps underperformed, with the Russell 2000 down 2.1%. Tech names such as Qualcomm underperformed after disappointing forecasts, contributing to pressure on the Nasdaq. Broadly tech performed poorly with mega-cap names like Intel down almost 4% and Microsoft almost 5%. Although some names like Meta broke this trend rising 0.2%.

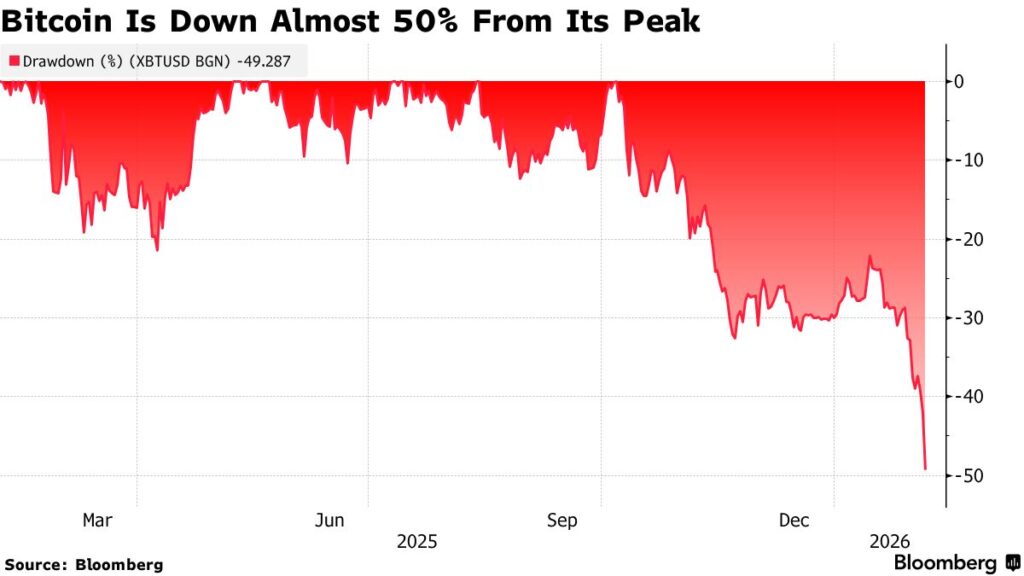

Bitcoin continued its rout, sliding over 12% in 1 day to around US$64,000 less than half of its record, weighing further on risk sentiment across digital and traditional growth assets.

Treasury yields moved lower, with the U.S. 10-year yield near 4.19%, as weak jobs data and rising unemployment claims dampened expectations for robust economic growth and tilted markets toward duration.

Europe: Markets Slump with Tech & Commodities Pressure

European equities also traded lower, reflecting the broader global risk drawdown instead of a US based slump. The STOXX Europe 600 and FTSE 100 both fell by around 1% with technology and materials names leading losses. Major markets in Germany and the UK slumped, underscoring how pervasive the sell-off was across sectors. FX markets saw the euro and sterling pressured by a stronger US dollar, as safe-haven flows into the greenback persisted.

Asia & ASX: Follow-Through Weakness Across Region

Asian markets were broadly weaker, with Japan’s Nikkei falling 0.9%, China’s Shanghai Composite down around 0.6% and South Korea’s Copsi down 4% amid continuing tech underperformance and commodities dislocation.

In Australia, ASX 200 futures pointed about 1.1% lower early Friday, tracking the global slide. The sell-off was broad-based, although defensives like staples and utilities outperformed on relative safety. REA Group’s stronger dividend and buyback announcement was a rare positive corporate note but insufficient to offset broader declines.

Commodities: Metals & Oil Slide, Broad Risk Off

Commodity markets were notably weak on Thursday. Gold prices slid 3%, pulling back from recent elevated levels even as analysts continue to raise medium-term forecasts. Silver dropped sharply again, down up to 15% at its worst, placing more pressure on the broader metals market. Copper prices fell, reflecting concerns about industrial demand particularly from CHina and risk appetite. Oil prices dropped nearly 3%, with Brent and WTI both weaker amid easing geopolitical tensions following news of US–Iran talks.

What to Watch Next

- U.S. Nonfarm Payrolls & Data: Friday’s jobs releases will be pivotal for Fed pricing and growth expectations.

- Trump Speech: Commentary from the US President could add policy clarity or volatility to markets.

- FX volatility/JPY dynamics: Continued dollar strength and yen positioning remain key for cross-asset risk flows. Markets are still watching for a possible intervention.