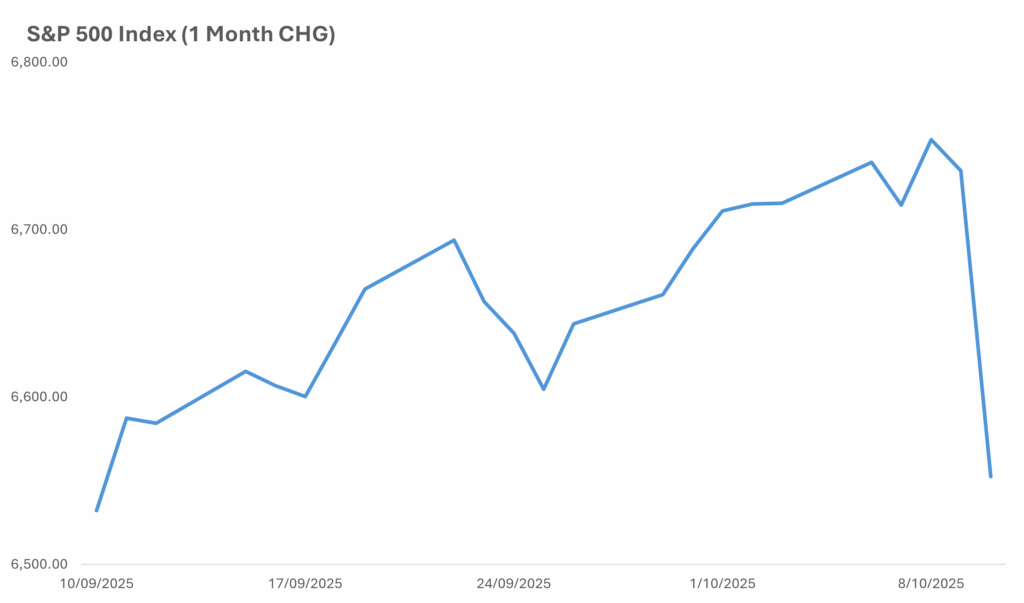

Wall Street closed the week sharply lower after fresh tariff threats on China triggered an afternoon air-pocket. The S&P500 fell around 2.7% on the day, the Nasdaq about 3.6%, and the Dow roughly 1.9% as reported in the U.S. Friday trade. Oil slid close to 5%, copper fell about 4%, the VIX jumped above 21, and the U.S. 10-year yield eased to ~4.03% while spot gold pushed back above US$4,000/oz, classic risk-off with a haven bid.

What Happened: Tariff shock, strong USD hit risk assets

A social media post from the U.S. President floated much higher tariffs on Chinese imports and fresh export controls. Program and systematic flows met thin afternoon liquidity and amplified the move into the close. FX confirmed the shift in risk: the dollar strengthened broadly, with AUD marked down ~1.3% to ~US$0.647 while USD/JPY pushed higher. Into the close, crypto also cracked, with bitcoin briefly under the $US110,000 mark.

From tariff shock to strong USD pressure

The market has been leaning into a soft-landing narrative and falling term yields; an abrupt policy headline that implies supply-chain friction and slower global trade challenges that assumption. Strategists split on the durability of the shock.

We doubt this equity correction will last long.

James Reilly, Capital Economics

Said James Reilly of Capital Economics, noting major U.S. benchmarks remain close to recent highs. Charlie Ripley at Allianz IM added that big threats don’t always translate into big actions and that the shift in sentiment on U.S. – China trade is:

Unlikely to upend the fundamentals supporting the market’s recent run up.

Charlie Ripley, Allianz IM

Others counselled caution: Marko Kolanovic warned investors to prepare for more “systemic” selling when trading resumes, and a TD securities credit note argued the process could “take a long time to play out,” preferring defensives and less China-exposed revenue.

Global Sector Implications

Technology and higher-beta growth bore the brunt of de-risking, led by mega-cap AI-exposed names. Energy lagged as Brent and WTI dropped on the week, while refiners and petrochemicals could hold up better than upstream if crude stays soft. Miners were hit alongside safe-haven bid. Defensives such as healthcare, staples, and utilities outperformed in relative terms as yields fell and equity risk premia widened.

Australia Lens – Economy and ASX

The immediate transmission into Australia runs through three channels:

- AUD and financial conditions: A stronger USD and softer AUD typically cushion exporters’ earnings and lift translated revenues, but raise the cost of USD inputs and imported inflation. If FX remains weak into the RBA’s data window, it can complicate the disinflation path.

- Commodities and China exposure: Iron ore pricing will be sensitive to any escalation in U.S. – China tensions that feeds into Chinese growth expectations. Resource names with direct China revenue (bulk miners, base metals, lithium) carry headline risk. Lower oil is a tailwind for transport and parts of consumer discretionary.

- Rates and housing: The drop in U.S. 10-year yields (if echoed in ACGBs) eases local long-end rates and supports A-REITs and interest rate sensitive growth. Mortgage resets remain a watch item, but a stable long end helps valuation support.

What This Means For Aussie Investors

In the near term, a tilt toward quality defensives while the tape resets could be plausible; healthcare and staples offer relatively steady earnings if tariff rhetoric lingers. Preference on domestic earners over China-linked cyclicals until there is clarity on policy, as businesses with limited China revenue and genuine pricing power should hold up better. If crude remains under pressure, downstream energy and fuel-intensive industries are placed better than upstream; cheaper fuel is a tailwind for airlines and logistics. Exporters with U.S. dollar revenue may see translation gains with AUD around the US$0.65 mark, but hedge discipline and exposure to USD-denominated inputs still matter, though relief at the long end partially offsets via capital charges and A-REIT collateral values.

Outlook

The baseline is chop: headline sensitivity stays high into earnings season and upcoming data prints. If policy talk cools, a “buy-the-dip” setup is plausible.

We have barely scratched the surface of this 4th Industrial Revolution.

Dan Ives, Wedbush

Dan Ives of Wedbush wrote, arguing Big Tech demand into year-end remains intact. The risk case is a policy feedback loop that dents capex plans and export orders; in the path, defensives and USD-earners outperform while China-exposed cyclicals lag. Either way, the best near-term signal set is simple: AUD trend, Brent path, U.S. 10-year direction, and the note from U.S. mega-cap guides over the next fortnight.