Financial markets are ending 2025 in a strangely comfortable place: equities near highs, bond yields off their peaks, gold breaking records, and the consensus story leaning toward a clean Fed easing cycle and soft landing.

Under the surface, the picture is more complicated. Inflation is lower but not “done,” central banks are easing but still cautious, and some parts of the market are being priced as if the next two years will be unusually smooth.

For investors, the risk now is less about a sudden shock and more about a slow mispricing of 2026-27.

Where We Are: “Goldilocks-ish” on the Surface

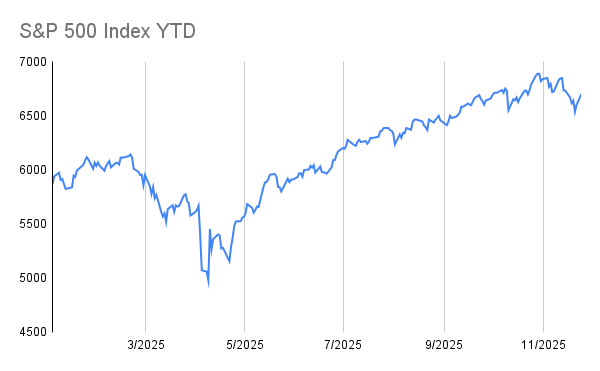

The S&P 500 is trading around 6,750, up roughly low-teens on a 1-year basis and not far off all-time highs. The rally has broadened somewhat beyond mega cap tech, but market leadership is still heavily influenced by AI and large-cap growth.

On the rates side:

- The Fed funds rate now sits at 3.75-4.00% after two 25 basis points cuts this year.

- The 10-year U.S. Treasury yield has eased to around 4%, down from the 4.5-5% range seen earlier this year

Gold, meanwhile, has broken into a different regime. Spot is trading around US$4,150-4160/oz, near two-week highs, with markets now pricing an 80-85% chance of another Fed cut in December, driven by softer U.S. data and dovish Fed commentary.

Equity investors see easing financial conditions. Gold investors see real rates heading lower. Bond traders see cuts, but a controlled, on-crisis cycle. On paper, it looks like a near-perfect setup.

That’s precisely why you should be uneasy.

The Core Macro Tension: Inflation Isn’t Done, But the Market Is Trading as If It Is.

Globally, headline inflation has cooled toward the ~3% range across most developed markets, but core and services inflation are still stickier than central banks would like.

In the U.S., Fed officials have already cut twice, but recent minutes show a clear desire to not unleash a full pre-committed easing cycle. The tone remains dovish-biased, but with an explicit pushback against the idea of a “guaranteed rate-cut path.”

At the same time, QT looks set to end earlier than previously expected, with the Fed preparing to halt balance sheet runoff around early 2026. That combination, mild cuts plus an early end to QT, is exactly what supports a “Goldilocks” narrative.

The problem is markets may be extrapolating too much:

- Multi-asset houses like Pictet are already arguing that markets have overestimated the likely extent of Fed rate cuts and that U.S. yields may need to move back up if growth surprises on the upside.

- A separate analysis warns that politically-pressured rate cuts in a still-solid economy could create a “sugar rush” in 2026 – short-term growth at the cost of higher inflation and weaker long-term stability.

In other words: the risk now is not that the Fed doesn’t cut. It’s that it cuts into an economy that doesn’t need as much easing as markets are pricing.

Equities: New Highs with Old Vulnerabilities

Despite a late-November wobble driven by a sharp sell-off in Nvidia and AMD on AI competition concerns, the broader U.S. market has been resilient. Eight of eleven S&P sectors were up on the day of that sell-off, with communication services and healthcare services leading.

This tells you two things:

- AI is still the marginal narrative driver. When Nvidia falls 6-7% and AMD 9% in a day on competition headlines, it doesn’t break the market, but it exposes how concentrated expectations remain.

- Breadth is improving, but not fully health. Cyclicals, defensives and quality growth are contributing more, yet multiples in U.S. large caps still bake in a benign path for earnings, rates and geopolitics.

From an allocation standpoint, a few themes standout:

- U.S. equities: still attractive, but valuation rich vs history and peers.

- Emerging markets: select managers (e.g. Pictet) are more constructive here than on U.S. stocks, citing better starting valuations and the prospect of a weaker dollar.

- Europe and the UK: structurally cheaper, but more exposed to policy and growth missteps.

If you’re long U.S. beta here, you’re implicitly long policy execution, that the Fed threads the needle without re-igniting inflation or choking growth.

Bonds and Gold: Someone Is Wrong

The current configuration is unusual:

- Gold at record levels, supported by expectations of aggressive rate cuts and lower real yields.

- 10-year yields still near 4%, not crisis-levels, and only modestly below their long-term average.

- Fed funds 4.75-4%, with markets pricing another cut in December and more in 2026.

These three things can coexist for a while, but not indefinitely. Either:

- growth disappoints and yields fall further, validating gold, or

- growth holds up, yields back up, and the recent bond rally and some of the gold strength get retraced.

Right now, multi-asset allocators are starting to lean toward the latter. Pictet, for example, has moved U.S. Treasuries to underweight, arguing that yields have fallen “too far” relative to the macro backdrop.

For a professional portfolio, the takeaway is:

- Duration: be careful about adding too much long duration here purely on the “Fed cuts” story.

- Gold: retain as a portfolio hedge. but recognise that some of its move is speculative positioning, not just macro hedging.

Positioning Ideas for 2026 Risk

For institutional or sophisticated investors, a few high-level positioning thoughts:

- Treat the current environment as late-cycle, not early-cycle: Earnings, margins and employment have held up better than feared. This is not the start of a new low-rate world; it’s a mid-course correction in policy.

- Equities: barbell quality and selective cyclicals: Quality growth with pricing power and clean balance sheets, cyclicals and EM where valuations still offer genuine risk premia.

- Rates maintain flexibility, not a heroic duration call: The asymmetry in bonds is narrower now. Focus on curve shape and relative value rather than outright big duration bets.

- FX: anticipate a weaker dollar over a 2-3 year horizon, but with noise. As Fed cuts accumulate and QT ends, the structural case for a softer USD grows, with EUR and AUD plausible beneficiaries.

- Risk management scenario-test a “sugar rush then hangover” path: Map what your book looks like if:

- 2026 growth is stronger than expected,

- Fed cuts more than is strictly necessary, and

- 2027 inflation comes back with a second wave.

That path doesn’t need to be your base case to be relevant. It only needs a 20-30% probability to matter for risk.

Takeaway

Markets have moved from fearing a hard landing to almost assuming a soft one. The Fed has eased, QT is nearing an end, gold is at highs, and equities are pricing a “just right” combination of growth and disinflation.

For investors, the opportunity now is not in guessing the next 25 bps decision, it’s in positioning portfolio’s for the possibility that the consensus is again one step too optimistic about how smooth the next two years will be.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.