Australian Consumer Spending Trends Driving GDP Growth

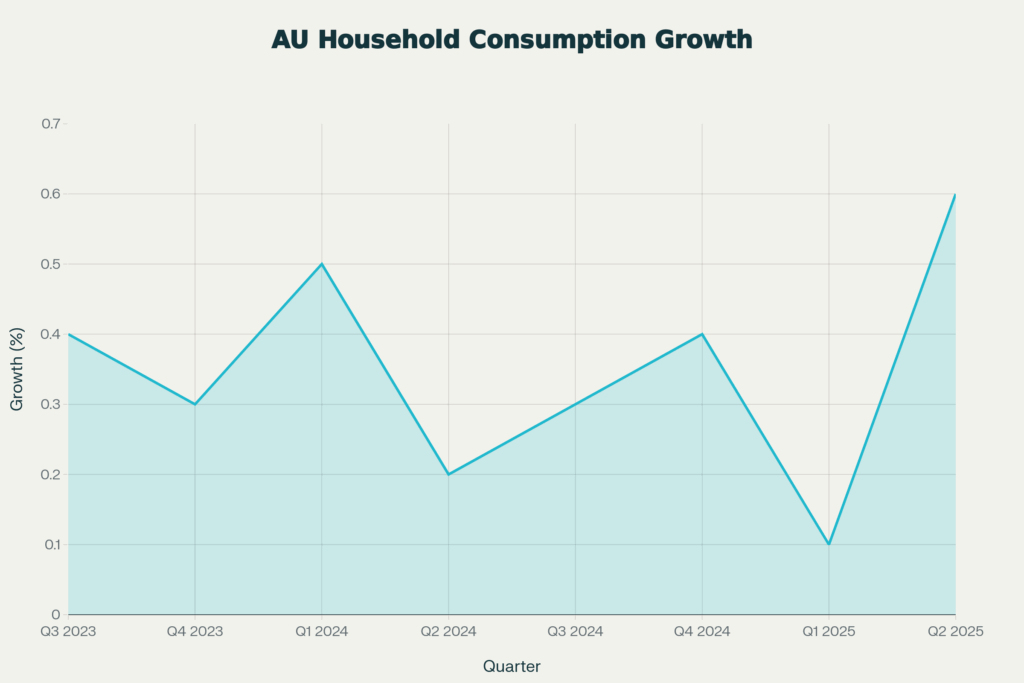

Australia’s latest economic data shows a clear resurgence in household demand, and it is now a major force behind the stronger than expected 0.6 percent GDP growth recorded in Q2 2025. This rebound in consumer spending is more than a short lived upswing. It marks an important shift in economic momentum and provides investors with valuable insight into which sectors may deliver the next leg of growth.

- Australian Consumer Spending Trends Driving GDP Growth

- Australian Consumer Spending Trends Driving GDP Growth

- A Turn in Consumer Confidence

- Hospitality Strengthens as Australians Return to Experiences

- Service Sectors Benefit From Digital Adoption

- Investment Lens, Where the Opportunities Are Emerging

- Looking Ahead

Australian Consumer Spending Trends Driving GDP Growth

Australia’s latest economic data shows a clear resurgence in household demand, and it is now a major force behind the stronger than expected 0.6 percent GDP growth recorded in Q2 2025. This rebound in consumer spending is more than a short lived upswing. It marks an important shift in economic momentum and provides investors with valuable insight into which sectors may deliver the next leg of growth.

A Turn in Consumer Confidence

This recovery follows a period where Australians tightened their budgets in response to higher interest rates and persistent inflation. Recently, however, the Reserve Bank of Australia has begun easing monetary policy and targeted tax relief has boosted disposable income. As a result, households are more confident and are spending again across a broader range of categories.

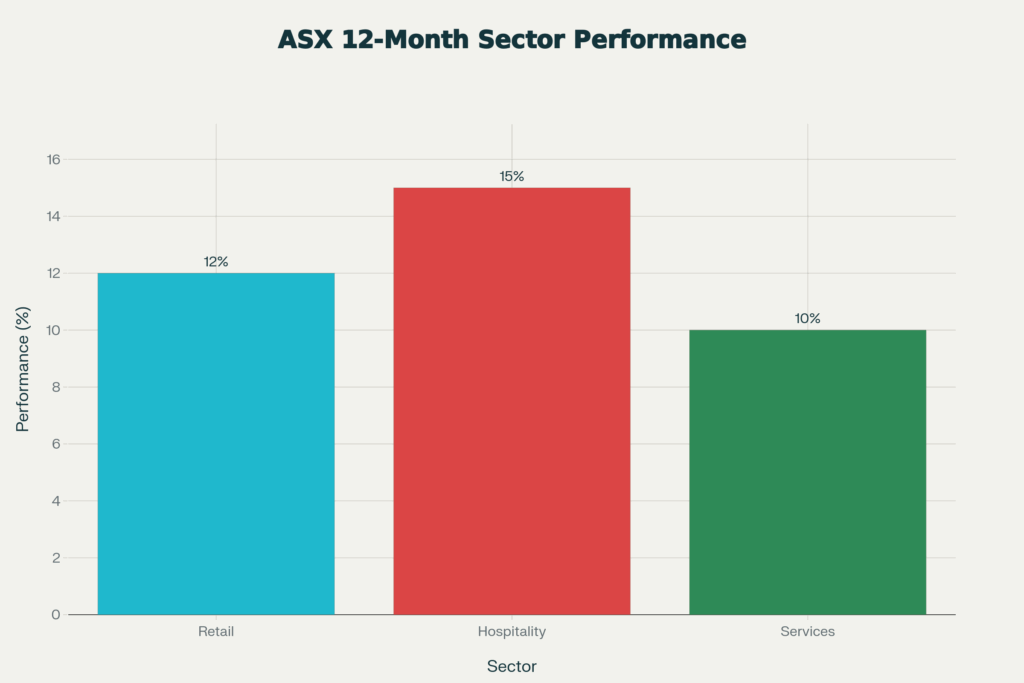

Retail is showing meaningful improvement, from everyday essentials to discretionary purchases like apparel, electronics and leisure products. Online channels continue to expand alongside traditional retail stores, with many ASX listed names reporting stronger sales volumes and improved margins. Consumers are also choosing sustainable and locally sourced products more often, which is shaping inventory choices and brand positioning for retailers.

Hospitality Strengthens as Australians Return to Experiences

The hospitality sector has become one of the clearest beneficiaries of this spending shift. Cafés, restaurants and entertainment venues are seeing more consistent foot traffic as Australians prioritise experiences and social events again. Operators that modernised their businesses during the downturn, adopting digital ordering, contactless payments or expanded delivery, now sit in a stronger position to capture this renewed demand.

Service Sectors Benefit From Digital Adoption

Growth is also flowing through service industries, including health, education, fitness and financial services. Many of these businesses invested in digital transformation during the past few years, and those efforts are now paying off. Telehealth, online learning platforms and digital finance tools are meeting consumer expectations for convenience and flexibility. Financial services groups with strong wealth management and lending offerings are also benefiting as households feel more secure about their financial position.

Investment Lens, Where the Opportunities Are Emerging

For investors, the most compelling opportunities are appearing in companies that combine resilient balance sheets with strong execution in digital strategy, customer engagement and sustainability. Mid cap ASX names in retail and hospitality that adapted early are starting to separate themselves from competitors. The rise in household consumption also lifts service sectors that offer recurring revenue and scalable digital models.

These consumer spending trends are becoming an important guide for portfolio positioning. Companies that can continue to innovate, meet changing customer expectations and operate efficiently are better positioned to capture the tailwinds from stronger domestic demand.

Looking Ahead

The momentum in household consumption highlights Australia’s broader economic resilience in a period marked by offshore uncertainty. As policy settings evolve and consumer behaviour continues to shift, investors will benefit from tracking where confidence builds, where spending accelerates and which sectors sustain the strongest growth. Australia’s consumer landscape is changing, and the companies that can match this pace of change are likely to lead the next phase of market performance.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.