The clean narrative (“stocks down, crypto down”) keeps breaking because crypto is being pulled by three different forces at once:

1. Macro is back in the driver’s seat, but not in a straight line

When markets get spooked, you normally see a flight to USD and bonds. But recent “Sell America” style moves show investors can dump US equities and USD at the same time, and yields can rise instead of fall. That matters because crypto often trades like a liquidity barometer, not a neat “fear gauge.”

Investor edge: stop treating “risk off” as one thing. If the stress is US-specific (policy, credibility, geopolitics, fiscal concerns), correlations can flip.

2. Flows matter more than headlines

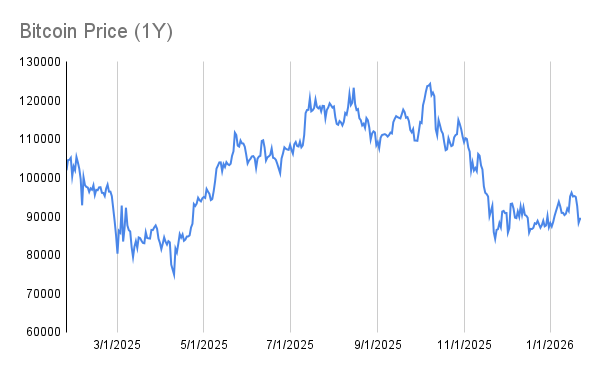

Spot Bitcoin ETFs have become a real transmission mechanism. When you get heavy ETF outflows, it can drag spot price action even if the longer-term story hasn’t changed. Bloomberg has reported a sharp wave of outflows over the past month that fed into volatility.

Investor edge: in this cycle, flow is often the catalyst, and narratives are the explanation people attach afterwards.

3. The corporate “treasury trade” is a hidden leverage point

The market is increasingly focused on public companies that hold large crypto treasuries. The risk isn’t “Bitcoin breaks,” it’s players getting forced if equity and credit windows shut. That’s why index-provider treatment (and the threat of exclusions) matters: it can create forced flows in or out. Reporting around MSCI’s approach to these companies has become a market sensitivity.

What Australian Investors Should Keep on the Radar

Regulation: Australia is still tightening definitions and obligations.

ASIC’s own guidance makes it clear digital assets can fall under existing financial product frameworks depending on structure and how they’re offered. There’s also been active policy work on expanding the licensing perimeter for digital-asset platforms and custody.

Where Bitcoin Could Be Headed Through 2026

Rather than anchoring on price targets or short-term narratives, the more useful question for investors is what conditions would justify bitcoin being structurally higher, range-bound or vulnerable over 2026.

From today’s vantage point, three pillars matter most:

The Structural Floor Is Higher Than Past Cycles

Bitcoin enters 2026 with materially different plumbing than previous cycles.

Spot Bitcoin ETFs have permanently changed demand dynamics by:

- Allowing regulated, passive capital to access BTC

- Smoothing volatility through steady inflows rather than retail surges

- Anchoring Bitcoin into asset-allocation discussions alongside equities and gold

At the same time, new supply continues to shrink following the 2024 halving. That does not guarantee upside, but it raises the price level required to clear the market during periods of stress.

The implication: large drawdowns are still possible, but the conditions required to cause them are now more severe than in prior cycles.

2026 Becomes a Test of Bitcoin’s Macro Role

The defining question over 2026 is not adoption, it’s behaviour.

Bitcoin will be tested in three environments:

- Falling global rates: supportive for non-yielding assets

- US-specific fiscal or political stress: where Bitcoin may decouple from risk assets.

- Equity drawdowns driven by valuation, not recession: where correlations can break.

If Bitcoin continues to trade as a leveraged risk asset in benign conditions but holds value during US-centric stress, its claim as a macro hedge strengthens materially. If that test fails, it remains primarily a liquidity-driven asset.

The Likely 2026 Outcome: Wide Ranges, Not Straight Lines

Based on current market structure, the most realistic expectation for 2026 is:

- Higher average price levels than prior cycles

- Persistent volatility

- Sharp rotations tied to liquidity, not narratives.

This is not a market designed for passive optimism. It rewards investors who understand when flows matter more than stories.