Global markets stabilised overnight after US President Donald Trump backed down from his Tariff threats on 8 European allies tied to his Greenland bid, causing a relief rally across equities while US bond markets remain cautious.

US: Tech and Small Caps Lead the Relief Rally

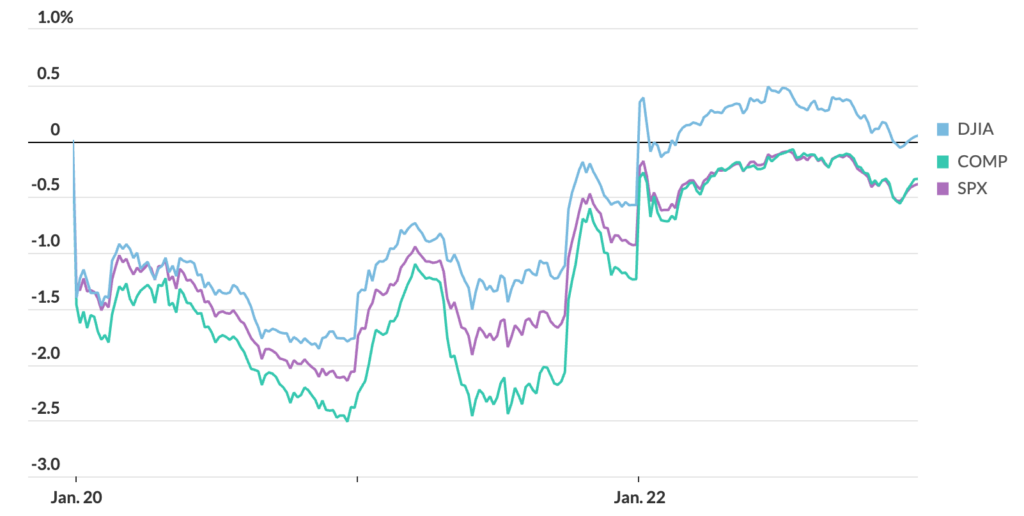

US stocks extended their rebound as threats of additional tariffs on Europe dissipated returning investor risk appetite. The Nasdaq climbed 0.9%, while the Russell 2000 rose 0.8% to a fresh record, continuing its long streak of outperforming the S&P 500. The S&P 500 gained 0.6% and the Dow Jones gained 0.6% in a broad-based upswing. Russell outperformance YTD and over the past year is still marked, with the small-cap benchmark rising by 8.4% compared to 0.8% for the S&P 500 this year and 18% vs 13.6% over the past year.

Source: FactSet

Rotation dynamics were apparent: chip stocks rallied on the momentum of positive, while investors also eyed opportunities outside mega-cap tech, including infrastructure and energy, on signs of broader liquidity and easing geopolitical risk in Europe, Russia and the Middle East.

European: Trade Relief Drive Broad Rebound

European markets staged a sharp recovery as tariff fears faded. The DAX jumped 1.25%, led by autos, while France’s CAC 40 and Italy’s FTSE MIB both rose around 1.2%. On the back of greater trade certainty, trade-sensitive sectors such as luxury goods and automakers outperformed, reversing earlier losses earlier in the week.

Price action suggests markets are pricing out immediate escalation rather than dismissing the issue as resolved. Investors welcomed the removal of near-term tariff and invasion threats but remain cautious about the durability of broader US–Europe relations.

FX and Safe Havens: Stabilisation, Not Full Risk Reset

The dollar index steadied near 98.8 after a 2-week low earlier in the week as the reduced “uncertainty” premium allowed currencies like the euro and sterling to hold firm. While easing tariff fears reduced pressure on the greenback, currency markets are still signalling caution instead of optimism and conviction.

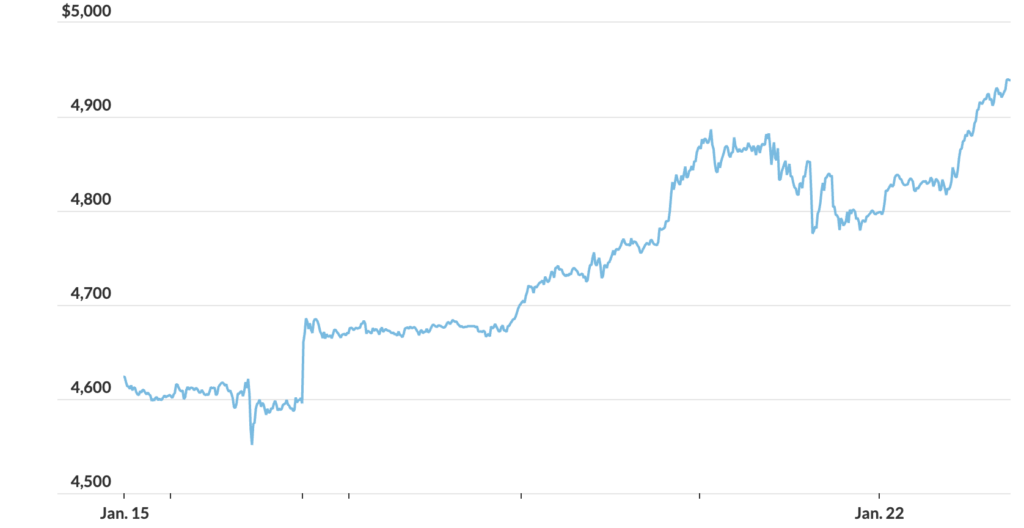

Gold and silver having reached to new and near record highs, retraced slightly and has cooled modestly but remains elevated, reflecting strong demand for hedges and safe-havens. These demands have cooled and eased but not entirely unwound, a sign that investors are trimming tail-risks to an extent but not abandoning protection entirely.

Gold contracts Source: FactSet

ASX: Poised to Track Global Relief, with Rotation in Focus

The ASX is set for a more firr open, following the rebound in global risk sentiment following Davos. Futures point to modest gains after several sessions of headline-driven selling earlier in the week causing the ASX to drop almost 0.5% over the week.

Gold miners remain in focus after bullion’s surge to fresh highs, while energy and cyclicals may see some benefit if investor risk appetite continues to improve. Investors are still likely to remain selective, with lingering global policy uncertainty and elevated bond yields still acting as a constraint on broader multiple expansion.

What to watch

- Market leadership: Whether small caps can sustain outperformance versus mega-caps as volatility subsides. Watch the Russell vs S&P and other traditional mega-indexes.

- Bond yields: Equities have rebounded, but yields remain elevated, a key test of how durable risk appetite really is. Keep an eye on foreign pension funds exiting their positions in US bonds and treasuries.

- Safe-haven signals: Gold holding near record levels would suggest lingering distrust in policy stability.

- Policy headlines: Any renewed escalation, changes fiscal policy or central-bank independence could quickly re-price risk.