Nestlé SA is moving ahead with plans to sell a stake in its €5 billion ($5.8 billion) water division, which includes well‑known brands such as Perrier and S.Pellegrino. The company has previously faced shareholder criticism for spreading its focus across too many business segments instead of prioritising core divisions. Speculation about a potential sale has circulated in European financial markets for some time, and Nestlé now appears to be formally advancing the process.

Sale process and parties involved

The Swiss multinational has appointed Rothschild & Co as its financial adviser, and the sale process is expected to begin in the coming months. The deal has already drawn early interest from several private‑equity firms, including Blackstone, Platinum Equity, One Rock Capital Partners, PAI Partners, and Clayton, Dubilier & Rice.

Deal Structure

Sources state that this is not a complete disinvestment. However, the deal is structured to be a leveraged buyout. Nestle has started taking clubbed first-round bids, and the process is supposedly underway. Bankers are preparing €2 billion to €3 billion in debt financing to support a potential transaction, according to recent reports. The funding is expected to take the form of leveraged loans issued in both euros and US dollars.

Reason for selling

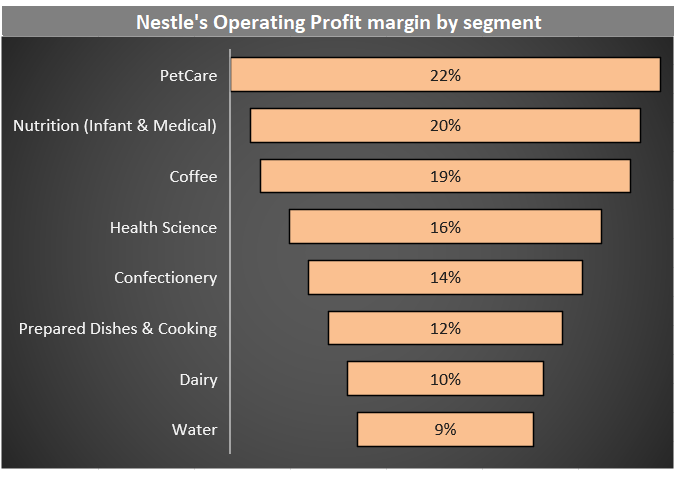

While Nestlé’s water division is well positioned and has a strong consumer base in the market, the firm seems keen on selling. The division had sales of around $4bn in 2024, and the operating margins stood at 9.3% and 3.5% of the firm’s revenue from operations. This happens to be the lowest margin across all segments. Secondly, the company hopes to focus on core areas of business and streamline its operations.

Why are private equity firms interested?

Private‑equity interest in Nestlé’s water division is no coincidence; it fits the profile of exactly the kind of asset these firms target. Once you consider the underlying economics, strategic positioning, and scope for operational improvement, the attraction becomes clear. Stable cash flow and strong brand positioning are some of the reasons that come to mind. The PE firms could also use it to their advantage in terms of cost restructuring and integrating it with companies in their portfolio, which would benefit them in supply chain optimising.

Nestlé is narrowing its portfolio so it can concentrate investment on higher‑margin global brands like KitKat, Nescafé, and Nespresso. Analysts see this shift as part of a broader industry move away from low‑margin bottled‑water businesses and toward more profitable premium beverage categories.