Company Overview

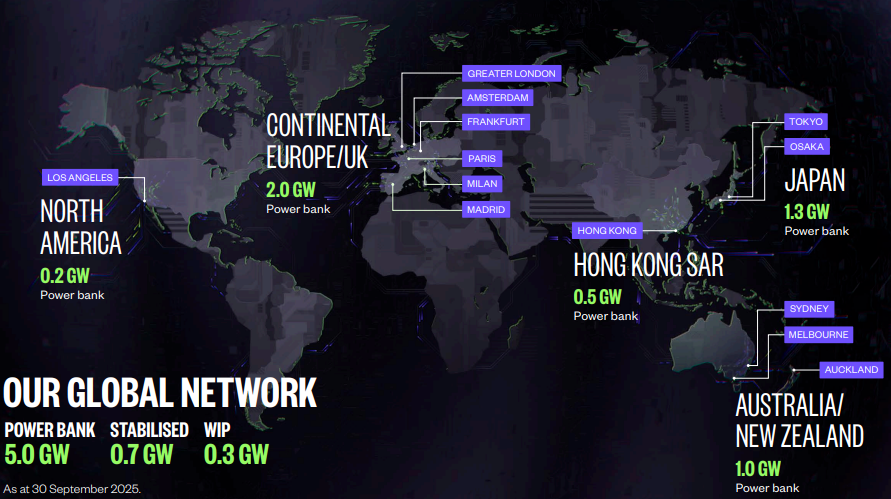

Goodman Group is a global owner, developer and manager of industrial logistics assets and data centres. They focus on major gateway cities that underpin ecommerce, cloud computing and AI demand. Its strategy centres on sustainable properties in supply constrained infill locations close to population centres and transport infrastructure. This positions Goodman as a critical landlord to global blue chip tenants.

As at FY25, Goodman managed a total portfolio of approximately $85.6 billion, supported by occupancy of 96.5% and like for like net property income growth of 4.3%. The Group’s capital efficient model blends development, long term partnerships and asset management, allowing it to recycle capital and scale into higher growth themes such as hyperscale data centres alongside its core logistics platform.

Board and Leadership

Goodman benefits from rare founder led continuity. CEO Greg Goodman has led the business since 1998 and remains deeply involved in capital allocation, development discipline and strategic direction. Chair Stephen Johns provides governance and capital markets depth, supported by a board with strong expertise across infrastructure, global real estate, logistics and institutional capital. Executive leadership including Deputy CEO Anthony Rozic and Danny Peeters adds long standing operational experience, particularly across global development and partnership execution.

Investment Thesis

In simple terms, Goodman offers leveraged exposure to long duration global demand for logistics and data centres, backed by conservative gearing and visible development earnings.

Structural demand tailwinds

Ecommerce penetration, near shoring and just in case inventory strategies continue to drive demand for modern logistics facilities in land constrained global cities. Vacancy remains tight, rental growth steady and tenant quality high. At the same time, AI and cloud computing are driving a multi decade build out in data centre capacity, where Goodman is increasingly deploying its development expertise into higher return digital infrastructure.

Data centre optionality accelerating

Goodman has delivered approximately 0.8GW of data centres and powered sites over the past 15 years, with around 0.7GW retained and managed through its partnerships, fully leased to hyperscale and colocation customers. Management expects new projects commencing in FY26 to lift data centre work in progress to roughly 0.5GW by June 2026, materially increasing the earnings and valuation contribution from this segment.

Large and visible development pipeline

Across logistics and data centres, Goodman has referenced a development and construction pipeline of approximately $17.5 billion through to June 2026, underpinned by pre leasing and supply constrained locations. This supports guidance for mid to high single digit operating EPS growth, including a FY26 target of around 9% OEPS growth from a FY25 base of $2.31 billion in operating profit and 118 cents OEPS.

Balance sheet strength

Debt to equity remains in the low 20% range, supported by approximately $6.6 billion of liquidity and long dated diversified funding. This provides flexibility through cycles and firepower to fund high conviction projects without balance sheet stress.

Recent Developments That Matter

In January 2026, Goodman lodged plans for Project Atlas. A roughly $5 billion data centre redevelopment at Eastern Creek in Western Sydney, targeting up to 500MW of power capacity. This reinforces management confidence in AI and cloud driven demand. Separately, Goodman and CPPIB announced a $14 billion European data centre partnership, with an initial $3.9 billion commitment across Frankfurt, Amsterdam and Paris, targeting 435MW of power capacity. These initiatives support a higher growth narrative but also introduce execution, power supply and regulatory risks that investors must price in.

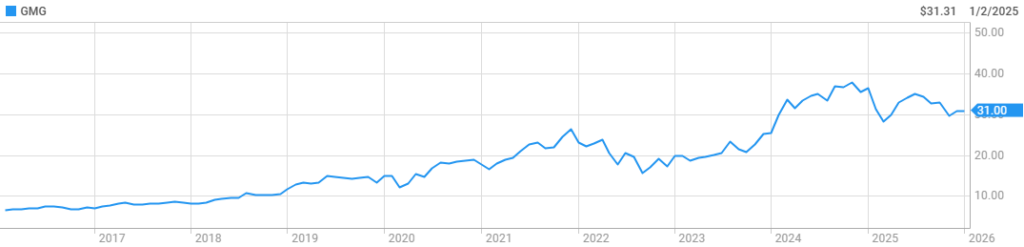

Historical Performance

Goodman has outperformed the broader A REIT sector over the past decade. Driven by its development led earnings model and exposure to structural growth themes. FY25 operating profit rose 13% to $2.31 billion, operating EPS increased 9.8% to 118 cents. NTA lifted 25% to $11.03, supported by $1.6 billion of valuation gains across the platform. Occupancy remains strong at 96.5% with like for like NPI growth of 4.3%, highlighting tenant demand resilience despite a higher rate environment.

Portfolio Composition

Goodman’s portfolio spans logistics warehouses, last mile distribution facilities and a rapidly growing data centre footprint across Australia, Asia, Europe and North America.

Key projects include

• Project Atlas, a 500MW Sydney data centre campus

• Project Mars, a proposed 90MW Sydney development

• A $14 billion European data centre partnership with CPPIB

Alongside this sits a global logistics portfolio with development work in progress of approximately $12.9 billion across 57 projects.

Financial Health and Distributions

Goodman maintains a conservative capital structure. Shareholder equity is approximately $23.3 billion against total debt of around $5.2 billion. Liquidity remains strong, funding is largely unsecured and long dated, and priority secured debt is minimal. Goodman retains earnings to fund growth, reflected in a FY25 distribution of 30 cents per security . This reinforces its status as a growth REIT rather than an income vehicle.

Risks to Monitor

• Rising real yields compressing valuations.

• Data centre execution, power availability and cost overruns.

• Regulatory scrutiny around energy usage.

• Premium valuation leaving little room for disappointment.

Outlook and Conclusion

Goodman enters FY26 with strong momentum and a A$12.9 billion development work in progress pipeline.

Portfolio occupancy remains high, supporting stable earnings through a volatile macro environment. Guidance for around 9% OEPS growth reflects disciplined execution across logistics and data centres.

Core logistics assets benefit from supply constrained locations and embedded rental growth. Data centres now represent a second growth engine tied to AI and cloud demand. Projects like Atlas, Mars and the CPPIB partnership reinforce Goodman’s institutional positioning.

GMG remains a growth focused REIT rather than an income vehicle. The share price will stay sensitive to rates, cap rates and development execution. Balance sheet strength and ample liquidity provide downside protection through cycles.

For active investors, patience is warranted at current levels. Long positions are attractive on pullbacks to the A$30.00 to A$30.50 support zone. Stops below A$29.50 help manage downside risk. Initial upside targets sit near A$33.00 to A$34.00 resistance. Successful data centre execution supports longer term upside above A$37.00.

Overall, Goodman remains a high quality real assets compounder with global scale. Pullbacks driven by macro noise continue to offer opportunities for long term investors.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.