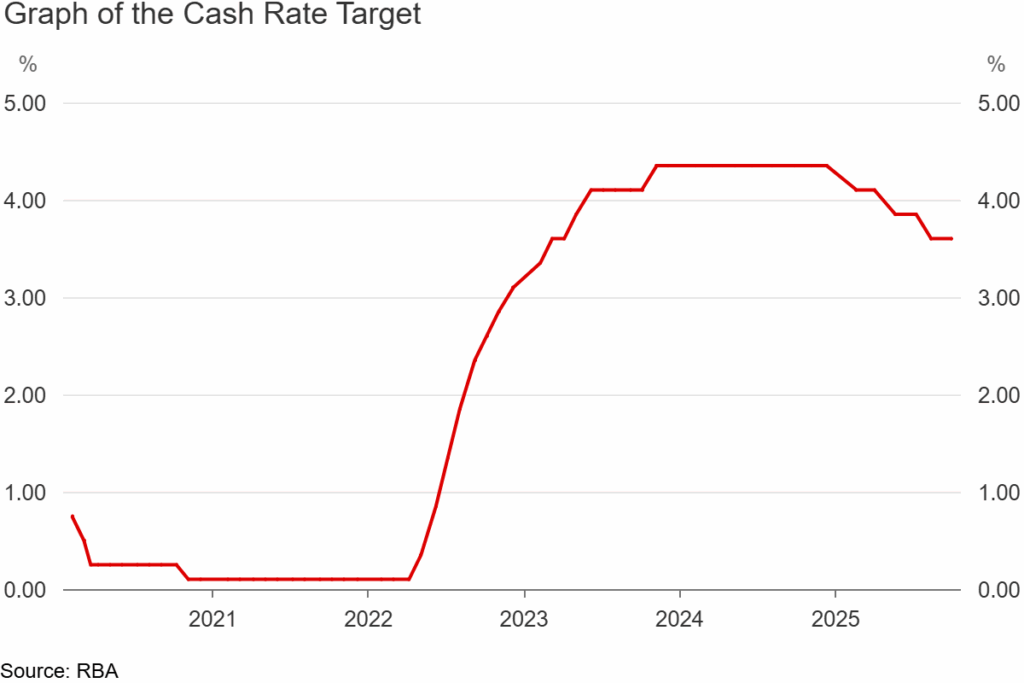

The Reserve Bank of Australia (RBA) holds the cash rate at 3.60% in its latest meeting, opting for caution in the face of persistent inflation and economic uncertainty. The “wait and see” approach signals that the RBA is prioritising data over bold moves, even as markets hope for further cuts.

Steady Rate, Steady Tone

In its September meeting, the RBA opted to keep its key rate unchanged, citing persistent inflationary pressures and the lagged impact of prior cuts. While inflation recently ticked to 3.0% (YoY), the central bank emphasised the need to see consistent disinflation across sectors before resuming cuts. Earlier this year, the RBA had delivered multiple 25-basis-point cuts, but those moves are still filtering through the economy. The Board’s statement flagged global uncertainty and domestic wage growth as risks to a more aggressive easing pace.

A Tightrope Walk Between Growth and Inflation

- Policy bandwidth is shrinking: With inflation pressures showing signs of stickiness, the RBA has less flexibility to cut aggressively without risking a rebound in price growth.

- Longer duration stocks reprice: Sector allocations may shift further toward yield-generating and value names, as discount rates inch higher.

- Mortgage market in limbo: Borrowers are stuck between stagnant rates and elevated debt servicing , any cut will be closely watched.

- Pre-commitment signals matter more: The RBA will be judged not just on moves, but how it frames future action. Next CPI prints (Oct, Nov) and wage data become strategic pivots.

Investor Implications: RBA Holds Rates in October 2025

Banks face mixed implications from the RBA’s decision to hold rates. A steady lending environment and resilient mortgage demand support activity, but net interest margins see little upside without further rate moves. Investors shift their attention to asset quality and capital returns instead of margin expansion.

In real estate and housing, the rate pause does little to cool the strong price momentum seen in capital cities. Lower borrowing costs in 2025 have already stoked demand, and September home prices rose at their fastest pace in a year, with Brisbane, Perth, and Sydney leading gains. A continued pause may reinforce the view that policy remains supportive for housing, further attracting investor capital into residential developers and REITs exposed to urban centres.

For consumer and discretionary sectors, the impact is more challenging. Household budgets remain pressured by elevated mortgage repayments and stickly inflation services. With no immediate relief from further rate cuts, spending on discretionary categories such as retail, autos, and leisure could remain muted heading into the holiday period.

The growth and technology space may also face valuation headwinds. These companies are typically more sensitive to shifts in discount rates and investor expectations of future rate cuts. By delaying the prospect of further easing, the RBA’s cautious stance could keep a lid on valuations in long-duration growth names, while yield-oriented and cash-generating businesses are better positioned to outperform.

What’s Next: Data Will Drive the Next Move

- October / November CPI prints – If inflation retreats meaningfully, rate cuts may reappear on the horizon.

- Wage and labour market data – persistent strength could delay easing plans.

- Household consumption and credit growth – strong consumption or credit expansion my embolden markets to price in cuts again.

- RBA forward guidance – Future statements or “dot plots” may reveal the Board’s next tilt.