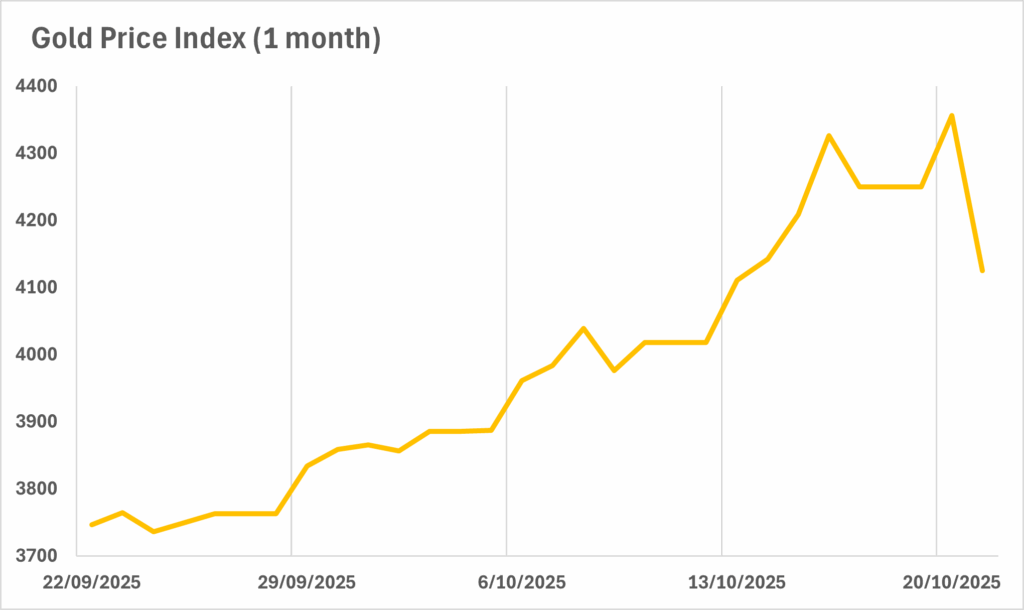

After setting a record on Tuesday, the S&P/ASX 200 fell ~0.7% to ~9030 on Wednesday as the precious-metals surge finally met resistance. Gold dropped as much as 6.3% (biggest intraday fall in over a decade) and silver slid up to 8.7%, triggering broad profit-taking across materials. The sell-off looked predominantly technical, momentum had outrun valuation, rather than a shift in macro data. Offsetting some of the pressure, Energy caught a bid after Woodside reported higher quarterly production (50.8 mmboe) and raised guidance; Financials were modestly higher with Pinnacle moving on an alternatives expansion in Japan.

Large-cap gold names including Newmont, Bellevue, Ramelius and Genesis fell roughly 9-11% on the day. Rare earths reversed the prior session’s rally despite a new US-Australia US$3bn critical-minerals framework, a classic “sell the news” retrace as traders banked gains. Stock-specific standouts: 4DMedical (first commercial CT:VQ deployment at Stanford post-FDA clearance), Cettire (ex-US revenue +18% with AOV $907 despite tariff drag, Sigma/Chemist Warehouse (quarterly sales +17.9%) and Adairs (guidance tweak but shares up on positioning).

Market Session Snapshot

ASX 200 ~9030 (-0.7% d/d); Materials led decliners after gold (-6.3% intraday) and silver (-8.7% intraday) snapped their runs. Brent less than US$61/bbl and WTI ~US$58/bbl after an API-indicated ~3mb US crude draw. Woodside rose ~3.5% on production/guidance; Financials edged higher as Pinnacle outlined a stake in Advantage Partners. Rare earths gave back part of the prior day’s policy-driven pop

Price action looked like profit-taking and position-trimming rather than macro stress. Breadth was negative inside Materials, with high beta gold leading declines, while Energy and Financials attracted rotation capital. Intraday dispersion widened, companies with clean balance sheets and clear guidance outperformed peers with higher operating leverage. Expect higher day-to-day volatility in miners as positioning normalises and momentum signals reset.

Sector Implications

Gold Miners

Expect a consolidation phase. The medium term-thesis (central-bank buying, ETF inflows, easing prospects) is intact, but short-term positioning was stretched. Dispersion inside the group should widen; low-cost, net-cash producers with defensible all-in sustaining costs (AISC) should hold up better than high-cost or development heavy names.

Rare earths/critical minerals

Policy support improves bankability over the next 12-24 months, but near-term equity performance will hinge on funding terms, project readiness and offtakes, not headlines. Expect choppier trading with higher sensitivity to capital-markets updates and permitting milestones.

Energy

With API indicating a US crude draw, oil ticked higher, aiding Woodside and peers. That said, broader balances still point to ample supply, so rallies may be range-bound unless inventories tighten more persistently, Balance sheet quality and capital discipline remain the differentiators.

Financials/asset managers

Gradual bid continues as investors rotate toward yield and fee visibility. M&A into alternatives (e.g. Pinnacle’s move on Advantage Partners) is a live theme as managers diversify revenue and duration of fees.

Investor Takeaways

Keep sizing tight in high-beta miners while this shake-out runs its course. In gold, prioritise companies with a wide AISC-spot spread, net cash, and clean quarterlies; avoid chasing beta without balance-sheet support. In rare earths, focus on names with line-of-sight to funding and credible build schedules rather than purely thematic exposure. For energy, use strength to upgrade quality (low leverage, disciplined capex) rather than lean into price beta. Select idiosyncratic growers – like 4DMedical at the commercialisation inflection or Chemist Warehouse exposed Sigma with structural script/OTC tailwinds, can work even if the index consolidates.

Potential Outlook

The base case is sideways index action with rotation. Volatility in precious metals likely remains elevated; a stabilisation day or two for gold would help reset sentiment across Materials. Watch the US oil inventory trend, project financing headlines in critical minerals, and local earnings pre-announcements. If gold steadies and rare-earths news flow turns to concrete funding steps, Materials can re-base; otherwise expect continued dispersion. Portfolio stance: leaning quality over beta, keeping some cash optionality, and use volatility to upgrade into cash-generative, low-leverage producers rather than chase snap-back rallies.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.