Business Overview

Infratil Limited is a New Zealand–based global infrastructure investment company with a diversified portfolio spanning digital infrastructure, renewable energy, healthcare, and transport. With group assets exceeding NZ$15 billion as of March 2025, Infratil operates across Australasia, the United States, the United Kingdom, Europe, and Asia through an active ownership model managed by Morrison & Co.

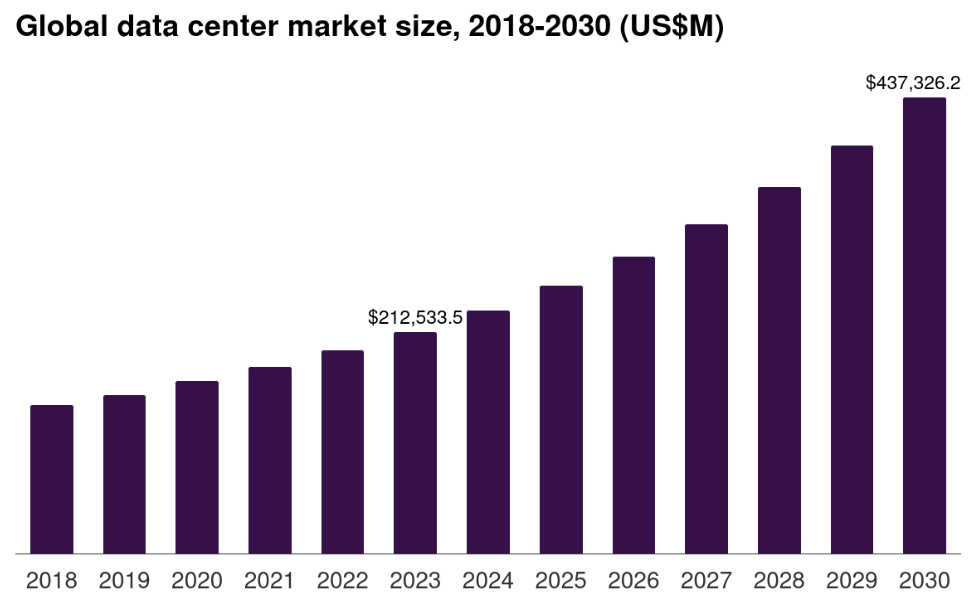

The portfolio is strategically weighted toward high-growth sectors, around two-thirds in digital infrastructure and roughly one-fifth in renewables, reflecting management’s focus on structural growth drivers such as data centre expansion, the global energy transition, and the surge in digital connectivity. Infratil’s inclusion in the S&P/ASX 200 index in 2025 broadened its Australian investor base and enhanced liquidity and institutional visibility.

Business Model

Infratil operates as an active infrastructure investment platform targeting 11–15% shareholder returns over rolling 10-year periods. Its approach centres on acquiring undervalued or growth-oriented infrastructure assets, enhancing their performance through operational improvements and strategic initiatives, and recycling capital via selective divestments to fund new opportunities.

Morrison & Co acts as the external manager, responsible for origination, due diligence, and asset management. This structure enables Infratil to leverage deep sector expertise while maintaining cost discipline through its management fee framework. The company’s thematic investment focus, spanning AI-driven data centre demand, renewable energy transition, and demographic-led healthcare growth, anchors its long-term portfolio strategy.

Key revenue drivers include proportionate EBITDAF contributions from operating assets, capital gains from portfolio optimisation, and dividend income from investments. Infratil maintains flexibility through a balanced mix of debt and equity funding while preserving investment-grade credit metrics across its portfolio companies.

Company Analysis

Portfolio Composition and Performance

- CDC Data Centres (ANZ): The core value driver and largest portfolio component, CDC has secured ~100MW of new capacity with ongoing valuation uplifts. The platform targets a doubling of FY25 earnings by FY27.

- Longroad Energy (US renewables): Supported by stable U.S. tax incentives, Longroad is expanding its utility-scale solar presence, including contracts with Meta in Texas, underpinning a multi-year growth pipeline.

- Gurīn Energy (Southeast Asia renewables): The first solar site in the Philippines is operational, with progress on Indonesia–Singapore renewable export planning.

- One NZ (telecommunications): Performing above expectations amid a challenging macro backdrop; operational efficiencies and the full-year impact of the 2024 acquisition support continued momentum.

- Healthcare and Airports: Qscan (diagnostic imaging) and Wellington International Airport add diversification and provide stable, cash-generative infrastructure exposure.

Financial Performance

FY2025 delivered proportionate operational EBITDAF of NZ$986 million, up 8.6% year-on-year and near the top of guidance. Growth was driven by strong contributions across core platforms despite inflationary and operational headwinds. FY2026 guidance points to continued EBITDAF growth of approximately 9%.

Operational Metrics

CDC achieved NZ$173.9 million EBITDAF (vs NZ$140.8 million in the prior year), while One NZ’s full-year contribution supported group earnings. Qscan recorded double-digit earnings growth with 1.45 million scans across 74 clinics.

Investment Thesis

Bull Case

Infratil’s value proposition rests on CDC’s sustained earnings expansion, driven by structural AI-related demand for hyperscale data centres in Australia and New Zealand. CDC’s targeted doubling of FY25 earnings by FY27, underpinned by contracted capacity growth and consistent independent revaluations, provides strong earnings visibility.

Portfolio simplification and increased control of CDC demonstrate disciplined capital management. The renewable energy platforms, Longroad and Gurīn, are well-positioned to capture value from the energy transition, supported by favourable policy and financing environments.

Inclusion in the ASX 200 expands the investor base and enhances trading liquidity, while the active management model allows Infratil to continuously recycle capital and optimise value across cycles.

Bear Case

Execution risks remain material, particularly around CDC’s hyperscale developments. Rising construction costs, power availability constraints, and grid connection delays could affect delivery timelines. A prolonged higher interest rate environment could compress infrastructure valuations and elevate funding costs.

Geographical diversification introduces exposure to regulatory and geopolitical uncertainty, particularly U.S. policy risk for renewables and complex permitting frameworks across Southeast Asia. Currency volatility also remains a consideration for reported earnings and NAV.

Valuation

Current Metrics

- Market capitalisation: AU$10.5–12.0 billion

- Price-to-Sales: 3.1x (vs peer average 14.6x; industry average 1.9x)

- EV/EBITDA: 22.2–24.4x

- Price-to-Book: 1.4–1.9x

Peer Comparison

Infratil trades at a notable discount to diversified financial peers on a P/S basis (3.1x vs 14.6x average) but at a modest premium to the broader infrastructure industry (1.9x). Its higher multiple relative to traditional financials is justified by its infrastructure-heavy, growth-oriented exposure.

Relative to pure-play infrastructure peers, particularly in the data centre space, Infratil and NextDC are trading below historical AI-era valuation multiples, suggesting potential upside as investor focus returns to digital infrastructure growth themes.

Catalysts

Near Term (6–12 months)

- Interim results on 13 November 2025, offering refreshed guidance and operational metrics.

- CDC contracting updates and revaluations tied to AI-driven demand momentum.

- Additional asset recycling or simplification announcements.

Medium Term (12–24 months)

- CDC project delivery milestones supporting FY27 earnings targets.

- Longroad monetisation opportunities under the U.S. tax credit framework.

- Gurīn’s Southeast Asian renewable export initiatives.

- Enhanced liquidity following ASX 200 and potential MSCI index inclusion.

Risks and Headwinds

Operational: Cost escalation, supply chain disruptions, and construction timing risks affecting CDC and renewable projects.

Market/Financial: Interest rate sensitivity, FX translation risk, and capital market conditions impacting funding flexibility.

Regulatory/Political: U.S. renewable policy shifts, Southeast Asian permitting complexity, and evolving ESG disclosure requirements.

Investment Outlook and Rating

Infratil offers a balanced blend of infrastructure defensiveness and growth through its digital and renewable energy focus. CDC remains the dominant value engine, with a credible roadmap to double earnings by FY27. Renewables provide structural upside, while healthcare and transport assets underpin steady cash flow.

Execution discipline and continued portfolio optimisation support management’s long-term 11–15% return target. While macro headwinds, particularly interest rate and execution risks, remain, Infratil’s positioning in core growth themes provides resilience and medium-term upside potential.

Investment Rating: Outperform

Infratil’s exposure to AI-led data centre expansion, coupled with disciplined capital allocation and index inclusion benefits, supports a constructive investment view over the next 12–24 months.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.