Wiring Australia for the AI Supercycle

NEXTDC sits at the centre of one of the most powerful infrastructure build outs in Australia. Demand for AI compute, sovereign cloud and high density data centre capacity is rising at a speed that traditional facilities simply cannot match. NEXTDC is one of the very few operators positioned to meet this wave head on, although it comes with the trade off of heavy capex and a valuation that assumes a long runway of execution. For growth oriented portfolios comfortable with long duration assets, NEXTDC remains one of the more compelling ways to gain exposure to the AI infrastructure megatrend.

- Wiring Australia for the AI Supercycle

- Company Overview

- Board and Leadership

- Investment Thesis

- Historical Performance

- Portfolio Composition and Key Investments

- Offshore Expansion

- Financial Health and Dividend Policy

- Fundamental Analysis

- Technical Analysis

- Capital Structure

- Risks and Considerations

- Outlook and Conclusion

Company Overview

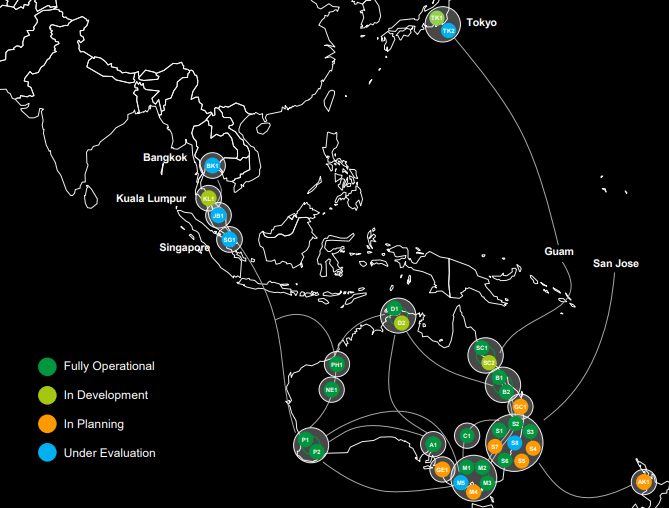

NEXTDC is Australia’s largest listed pure play data centre operator. The company provides carrier neutral colocation, interconnection and cloud infrastructure across its expanding network of more than seventeen sites across Australia, New Zealand and Asia.

Its customers span hyperscale cloud providers, large enterprises, financial institutions and government bodies. The business model revolves around long term power and space contracts, and NEXTDC increasingly positions its campuses as AI factories, engineered for high density GPU workloads, liquid cooling and sovereign data requirements. This capability is becoming a structural advantage as organisations shift from traditional compute to AI accelerated architectures.

Board and Leadership

NEXTDC is led by CEO and Managing Director Craig Scroggie, who has guided the business since 2012 and built the company from a domestic colocation operator into a regional AI infrastructure platform. His tenure and industry depth provide continuity at a time when execution risk is rising.

The board, chaired by Douglas Flynn, brings governance oversight and capital allocation discipline across a development pipeline that stretches into the billions. In 2025, NEXTDC added experienced directors including Deborah Page and Jamaludin Ibrahim, strengthening board capability across telecommunications, infrastructure and capital markets. This mix supports a long term strategy in an increasingly competitive landscape.

Investment Thesis

NEXTDC is a high conviction, growth oriented infrastructure story with exposure to the AI and sovereign cloud build out. Although the business carries balance sheet risk and relies on sustained access to capital, its positioning within Australia’s AI infrastructure ecosystem is unique.

Key pillars underpinning the thesis include:

AI and Data Sovereignty Supercycle

Australia’s data centre capacity is expected to more than double between 2024 and 2030. AI workloads require high density, liquid cooled environments that few operators can deliver at scale. NEXTDC’s NVIDIA certified, sovereign compliant campuses are designed specifically for this shift, creating a multi year demand tailwind.

OpenAI Partnership and the S7 AI Campus

In December 2025, NEXTDC announced a partnership with OpenAI to develop a seven billion dollar, 550MW AI optimised campus at S7 in Western Sydney. It is one of the most significant digital infrastructure projects ever proposed in Australia, and it positions NEXTDC at the core of a decade long AI investment cycle. The announcement drove an eleven percent intraday spike in the share price, reflecting the scale of the opportunity as well as the magnitude of execution required.

Embedded Contracted Growth

NEXTDC continues to report record booked utilisation, strong contracted pipelines and rising customer density. FY24 and FY25 delivered solid revenue and EBITDA growth, with FY25 revenue at approximately $427 million and underlying EBITDA at roughly $217 million .

The Trade Off: Capital Intensity and Funding Risk

Capex reached one billion dollars in FY24 and approximately 1.7 billion dollars in FY25. With an estimated need of fifteen billion dollars over the next decade, NEXTDC remains sensitive to credit markets, equity valuations and project timing.

The investment case therefore hinges on NEXTDC converting heavy capex into high margin, long duration cash flows while maintaining access to funding. If the company executes, the upside is substantial. If capex blows out or funding conditions tighten, returns compress quickly.

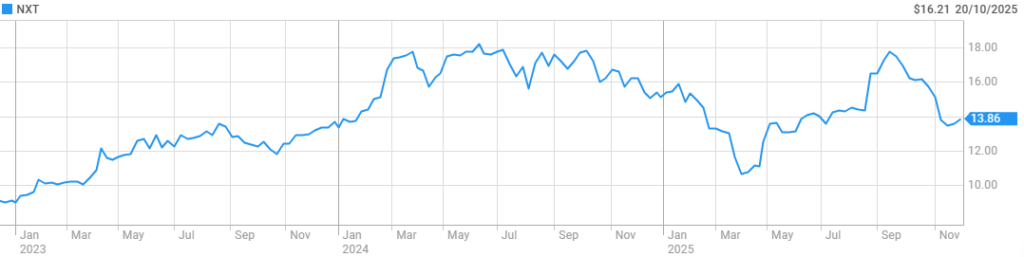

Historical Performance

NEXTDC has delivered consistent revenue and EBITDA growth over multiple years, driven by new facility launches and rising utilisation. Free cash flow remains negative due to ongoing development. FY24 underlying EBITDA was roughly $204 million, rising to around $217 million in FY25.

However, statutory earnings have been volatile. FY25 included a larger post tax loss due to higher interest costs linked to the new $2.9 billion syndicated facility. Despite this, the share price has materially outperformed the broader ASX over the past five years, albeit with drawdowns around macro risk off periods.

Portfolio Composition and Key Investments

NEXTDC’s portfolio is its network of data centre campuses. These include major hubs in Sydney, Melbourne, Brisbane and Perth, as well as edge locations and development sites in Auckland, Kuala Lumpur and Tokyo.

Offshore Expansion

The KL1 facility in Kuala Lumpur opens in the second half of FY26 with ten megawatts already contracted. The Tokyo site, expected to commence construction before the end of 2025, adds another strategic anchor in a high growth Asian market. These investments support diversification, strengthen relationships with global hyperscalers and build optionality across multiple AI growth corridors.

Financial Health and Dividend Policy

NEXTDC operates with solid EBITDA margins but carries significant leverage due to sustained capex. The balance sheet includes the $2.9 billion syndicated facility, giving the business the liquidity it needs for development but also increasing interest costs.

The company does not pay dividends and is unlikely to do so in the medium term. All operating cash is directed toward expansion. For investors seeking income, NEXTDC is not the appropriate vehicle. For those pursuing capital growth, this reinvestment cycle is precisely what drives the long term valuation.

Fundamental Analysis

NEXTDC trades on elevated multiples relative to near term earnings. This is typical for asset heavy, long duration growth names with contracted future cash flows. The valuation debate centres on three factors:

- The speed at which contracted capacity converts into revenue

- The returns generated on multi billion dollar AI campuses

- The impact of rising construction and energy costs on margins

The bull case is simple. If utilisation ramps cleanly, NEXTDC compounds EBITDA at a level that supports a premium EV EBITDA multiple.

The bear case is equally clear. If capex overruns, funding costs rise or customer pricing shifts, project IRRs compress.

Technical Analysis

Technically, NXT trades in a medium term uptrend with consistent support across major moving averages. RSI remains in the low to mid fifties, suggesting the stock is in a steady trend rather than an overheated push. MACD remains positive, and volume patterns show institutional accumulation on pullbacks.

Key resistance levels sit in the low twenty dollar range. Support is clustered just below current levels, offering a defined framework for active investors.

Capital Structure

NEXTDC’s capital structure is deliberately geared. Debt has increased due to multi billion dollar development commitments, supported by syndicated facilities. Equity issuance remains a tool the company will use when required, and joint ventures offer another path to reduce balance sheet pressure for mega projects.

The company’s priority is flexibility, ensuring the development pipeline can proceed without breaching prudent leverage metrics.

Risks and Considerations

Key risks include:

- Execution and funding risk across mega projects

- Rising energy and cooling costs, plus grid capacity constraints

- Competitive intensity from Equinix, AirTrunk and hyperscale self build strategies

- Regulatory pressure, sustainability constraints and cyber risk

NEXTDC’s long runway of growth is compelling, but successful delivery requires precise execution.

Outlook and Conclusion

NEXTDC is one of the most important AI infrastructure plays on the ASX. The combination of sovereign cloud demand, AI accelerated workloads and the OpenAI partnership creates a structural multi year opportunity. Execution and funding remain the central risks, but the long term growth curve is powerful.

For growth oriented investors, NEXTDC stands out as a high conviction infrastructure growth name rather than a defensive yield play. Investor Standard maintains a twelve month price target of $18.50.

Rating: BUY

For portfolios positioned for the AI data centre supercycle.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.