In early 2026, Warner Brothers Discovery’s (WBD) board unanimously accepted the bid from Netflix. Netflix sweetened the pot to purchase WBD’s film/TV studios and HBO Max. Their cable network is to be spun off into a separate entity called Discovery Global. There were 2 talking points that made this deal worthwhile for the board. First, Netflix switched the offer from a mixture of cash and stock to an all-cash deal. Second, the bid is not for the entire company but specific divisions of the company. While this looks great on paper, analysts fear that this will draw the attention of the government and have antitrust implications.

The Ramifications of the deal

Firstly, this deal has a vertical element, with Netflix acting as a content distributor and Warner Bros. Discovery (WBD) as the content producer. This could create foreclosure risks if competing streaming platforms get restricted from accessing WBD programming. However, the more significant antitrust issue arises from the transaction’s horizontal integration. The merger would concentrate market power within the subscription video-on-demand (SVOD) sector. This could weaken competitive pressure, limit consumer choice, and disadvantage subscribers. As a result, horizontal competition concerns are likely to pose the greater regulatory challenge. Before we dive into the main antitrust issues, one must know what the PNB presumption is.

The Philadelphia National Bank (PNB) Presumption

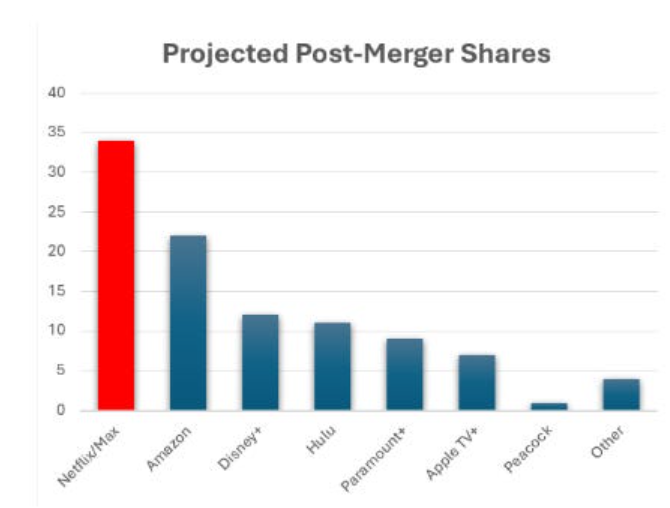

The PNB Presumption establishes that a merger that ‘significantly increases market concentration and results in a firm with a large market share is presumed to be anticompetitive and unlawful. ‘In other words, if a merger substantially lessens competition based on market structure alone, regulators do not need to prove actual harm; the burden shifts to the merging parties to show the deal will not harm competition. There are merger and market concentration metrics in place, such as the Herfindahl–Hirschman index, used to track the impact of the market from a post-merger perspective. In essence, if the post-merger market share goes above 30%, the PNB presumption is triggered.

The Antitrust Implications

Both the government and the merging parties define the relevant market in ways that yield post‑merger shares above 30 percent, thereby activating the PNB presumption under either approach. The parties, however, advance a broader concept of the competitive landscape, not to override the presumption, but to persuade the court to more broadly define competitors and alternative sources of rivalry when determining the merger’s potential antitrust impact.

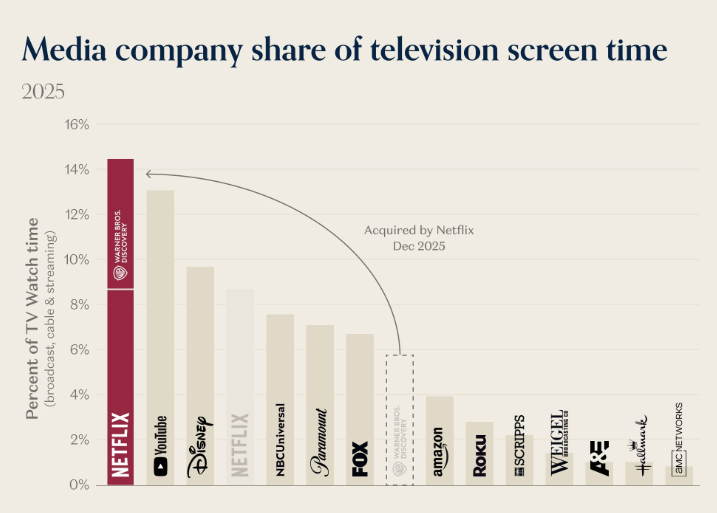

What Happens if Companies like YouTube and TikTok Are Market Relevant?

A handful of analysts contend that YouTube is not market relevant in the context of Netflix’s market share. Another view is that YouTube competes closely enough with SVOD platforms to be considered within the same market. Under the standard market definition framework, the key question is whether a hypothetical monopolist controlling all SVOD services could successfully implement a small but significant price increase. If a substantial number of consumers were to substitute them for their closest alternative outside the SVOD category, such as YouTube, then the price increase would not be profitable. In those circumstances, competition authorities and courts are required to include that substitute within the relevant market.

What if the Department of Justice (DOJ) or the Federal Trade Commission (FTC) raises concerns over the antitrust implications of the merger? In my opinion, Netflix should plead their case as YouTube being a competitor given the market landscape. Not just in the case context, but actually in the sense that YouTube actually poses a threat to their business. Will there be tension and scrutiny from the government? As it happens, Netflix is facing a grilling from the government with various hearings. How they tackle the antitrust remains to be seen.