High-Grade Gold with Little Room for Error

This Bellevue Gold investment analysis examines a company sitting at the sharp end of the ASX gold developer-to-producer spectrum, a genuinely high-grade underground orebody now in production, but one that has tested investor patience through operational missteps, guidance cuts and equity dilution. The core question for investors is whether improved operating performance, a repaired balance sheet and full exposure to a strong Australian dollar gold price can outweigh recent credibility damage and ongoing execution risk.

Company Overview

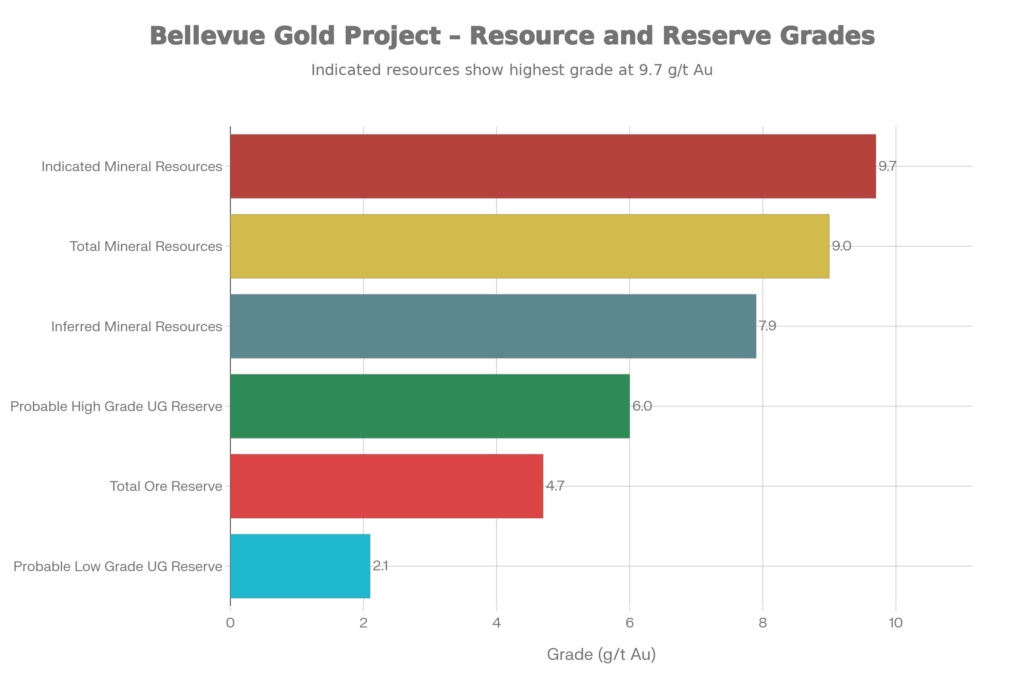

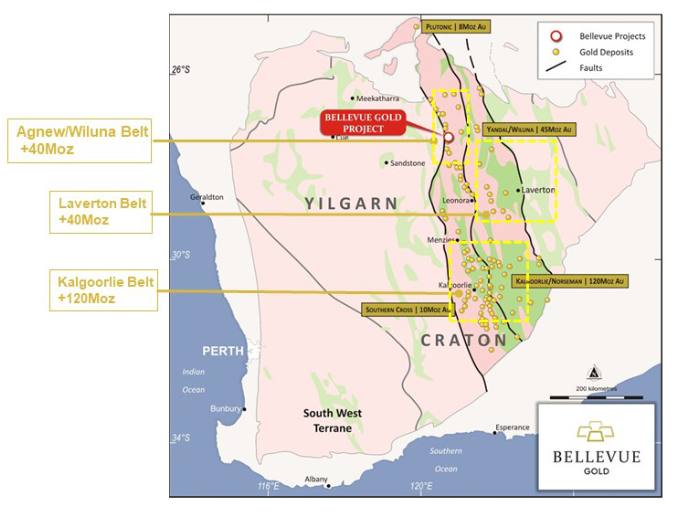

Bellevue Gold Limited is a West Perth based gold producer focused on the Bellevue Gold Project in Western Australia’s Goldfields, located north-west of Leinster. The project hosts total Mineral Resources of 11.0Mt at 9.0 g/t gold for 3.2Moz, with Ore Reserves of 9.32Mt at 5.0 g/t for 1.51Moz, ranking it among the highest-grade gold mines currently operating in Australia.

Gold production commenced in late 2023, with the company now transitioning from construction into optimisation and early cash generation. The long-term strategy is to lift production from the current ramp-up phase toward a sustainable 200,000 to 250,000 ounces per annum profile, supported by underground development, existing infrastructure and exploration upside at depth.

Board and Management

Bellevue is led by Managing Director and CEO Darren Stralow, appointed in late 2021, who brings deep experience across Western Australian underground gold operations. The broader executive team and board have an average tenure of around three to five years, providing continuity from the discovery and feasibility phase alongside newer appointments with operational depth.

In 2025, the board was strengthened with the appointment of experienced mining engineer Leigh Junk, explicitly aimed at bolstering operational oversight as the asset scales. Non-executive directors contribute expertise across project financing, capital markets and ESG, particularly relevant given Bellevue’s capital history and its focus on electrification and responsible underground mining.

Investment Thesis

The Bellevue investment case rests on three core pillars. First, Bellevue controls a rare, high-grade Australian underground gold mine with meaningful reserve life and further exploration upside. Second, the balance sheet has shifted from stressed to net cash positive following equity raisings and the restructuring of the hedge book. Third, the company now operates under a moderated and more credible production growth plan that should translate into rising free cash flow if execution improves.

That said, recent execution missteps have been material. Production shortfalls in early 2025 saw cash and gold on hand fall sharply to approximately $49 million as at March 2025, triggering a guidance downgrade and an equity raising to shore up liquidity and close near-term hedge positions. The $156.5 million equity raise, combined with a revised mine plan, restored financial flexibility but diluted shareholders and dented management credibility.

Encouragingly, subsequent quarters have shown a marked recovery. By June to September 2025, cash and gold on hand had increased to roughly $152 to $156 million, against bank debt of around $100 million, placing Bellevue back into a net cash position of approximately $50 to $56 million. Combined with a scaled-back growth trajectory, including FY26 guidance near 150,000 ounces and FY27 around 190,000 ounces, the reset lowers the bar for delivery. Within The Investor Standard framework, Bellevue is best viewed as a leveraged Australian dollar gold exposure with genuine asset quality, where much of the early ramp-up disappointment is now reflected in the share price, but where investors must still be compensated for operational and cost risk.

Historical Performance

Bellevue transitioned from explorer to developer after consolidating the historical Bellevue mine and drilling out a high-grade resource between 2017 and 2021. By 2021, resources had grown to approximately 3Moz at nearly 10 g/t, supported by low-cost discoveries and strong feasibility outcomes.

On market, BGL has been volatile. The share price rallied strongly into 2024, peaking near $2.10 in May, before retreating as commissioning challenges and cash burn emerged. Production misses and capital raisings through 2024 and 2025 compressed the valuation, pushing the stock back below $1 at points, even as gold prices strengthened.

Asset Base and Key Investments

Bellevue remains a single-asset company. Its value is concentrated entirely in the Bellevue Gold Project, including multiple underground lodes and satellite areas within the broader mining lease. Core value resides in the high-grade underground reserve of 6.83Mt at 6.1 g/t for 1.33Moz, supported by a smaller open pit and an extensive resource base that remains open at depth.

Capital investment is focused internally, particularly on additional underground access such as the Tribune decline, which increases mining fronts and operational flexibility. The company has also invested in electrification and battery-electric underground equipment to reduce operating costs and emissions over time. The absence of multiple operating assets amplifies both upside and risk.

Financial Health and Capital Allocation

Bellevue has moved from a capital-hungry developer to an early-stage producer with improving free cash flow. FY2025 revenue reached approximately $510 million, reflecting the first full year of production. After a period of heavy cash burn through late 2024 and early 2025, the equity raise and revised plan have stabilised the balance sheet. Debt now sits around $98 to $100 million, down from over $200 million a year earlier, with no mandatory principal repayments until 2027. Net cash currently sits just above $50 million.

Bellevue does not pay a dividend and is unlikely to do so in the near term. Capital priorities remain underground development, plant optimisation, debt management and balance sheet resilience.

Risks to Monitor

Key risks include ongoing underground execution risk, cost inflation in Western Australia, single-asset concentration, potential future dilution if performance slips, and full exposure to spot gold prices following hedge book closure.

Outlook and Price Target

Bellevue now sits as an emerging Australian gold producer with a globally competitive grade profile, improving cash flow and a more conservative growth plan through FY28. Near-term focus is squarely on delivering into guidance, building cash and further de-risking the mine plan. BGL last closed at $1.51 on 12 December 2025. Sell-side consensus targets cluster around $1.60 to $1.70. Within The Investor Standard framework, a reasonable 12-month indicative price target is $1.70, assuming Bellevue delivers toward the mid-point of FY26 guidance, Australian dollar gold remains supportive and balance sheet repair continues.

Upside is attractive for investors comfortable with operational volatility, but downside remains material if execution disappoints again, making position sizing and ongoing monitoring essential.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.