This Speculative Investment Analysis Lindian Resources (ASX: LIN) examines whether the company can convert the Kangankunde Rare Earths Project from a Tier-1 geological asset into sustainable cash flow. Lindian has moved beyond exploration narrative and into execution phase, where funding structure, construction discipline and rare earth pricing will determine long term shareholder returns.

Lindian Resources is no longer trading on geological promise alone. Kangankunde in Malawi has progressed through licensing, ownership consolidation and strategic partnership alignment. The market is now asking a different question.

Can Tier-1 scale translate into durable economics?

Company Overview

Lindian Resources Ltd is an ASX-listed critical minerals developer focused almost entirely on the Kangankunde Rare Earths Project in southern Malawi. The deposit is a carbonatite hosted monazite system containing a maiden resource of approximately 261Mt at 2.2% TREO.

On contained rare earth oxides, it sits firmly in global Tier-1 territory. Stage 1 targets production of around 15,300 tonnes per annum of high-grade rare earth concentrate. Pre-production capex is estimated at roughly US$40m. Mine life is forecast at about 45 years.

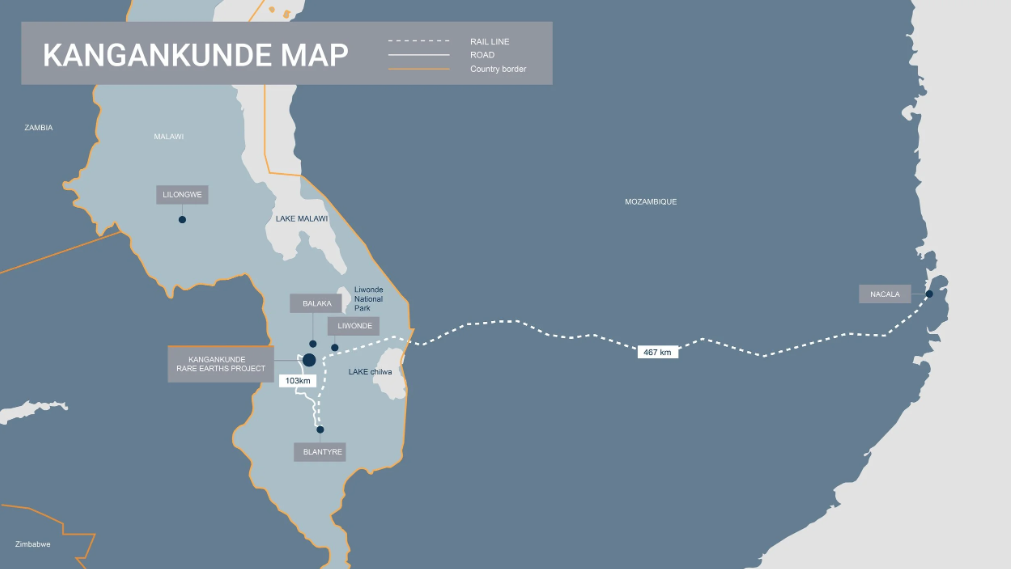

The orebody’s low thorium content is a competitive advantage. It simplifies permitting and downstream marketing. Location also matters. Southern Malawi offers road access and export pathways via established regional logistics corridors.

Since acquisition in 2022, Lindian has progressed rapidly through feasibility, licensing and early works. The company’s strategy is clear, establish a low cost, long life magnet rare earth supply outside China and capture structural demand from EVs, wind turbines and electrification..

Board and Leadership Reset

As Kangankunde matured, the board evolved. Robert Martin transitioned into an executive chairman role in March 2025, focusing on financing and offtake execution. The board includes experienced resource financiers such as Warwick Grigor and Blake Steele, alongside directors with international networks and technical exposure.

On the operational side, Alwyn Vorster was appointed CEO in June 2024. His background includes leadership roles at Hastings Technology Metals and BCI Minerals. The shift is material. The company has moved from promotion and acquisition toward delivery and construction oversight.

Markets reward execution teams differently than exploration stories.

Investment Thesis

The core thesis is straightforward.

Lindian offers leveraged exposure to non-Chinese magnet rare earth supply, backed by a globally significant orebody and improving strategic validation. However, investors are paying for future execution in a volatile commodity. Key pillars underpinning the thesis include:

Full ownership consolidation: Lindian completed the final US$10m payment to acquire 100% of Kangankunde ahead of schedule. Governance is simplified. Vendor overhang is removed.

Stage 1 to Stage 2 scaling pathway: Stage 1 establishes initial concentrate production. Malawi regulators have approved licence expansion from 900ha to 2,500ha. This supports long term production growth.

Strategic funding and offtake: A long term strategic partnership with Iluka Resources provides third party validation. The A$91.5m placement and underwritten options issue materially strengthened the balance sheet.

Macro tailwinds: Magnet rare earths remain central to EV and renewable supply chains. Geographic diversification away from China remains strategically important.

Commodity cyclicality: Rare earth pricing remains volatile and policy sensitive. Earnings could be uneven even under successful execution.

The opportunity is clear. So are the risks.

Historical Performance

Lindian’s share price history reflects its transition from explorer to developer.

Five year returns exceed 1,900%. Twelve month gains have ranged between 347% and 380% depending on measurement. The volatility has been extreme. Calendar year performance illustrates the pattern. Strong gains in 2019, 2021 and 2022 were followed by a sharp 46% decline in 2024. The stock rebounded in 2025 with gains near 190%. Re-ratings have followed milestones.

Operationally, Lindian remains pre-production. Revenue is negligible. Losses have averaged roughly 40% growth annually over five years as development expenditure increased. This is typical for a development stage miner.

Asset Quality and Portfolio Focus

Kangankunde dominates the investment case. The project hosts approximately 261Mt at 2.19% TREO, with strong magnet rare earth content including Nd, Pr, Dy and Tb. Target concentrate grades sit near 55% TREO with low deleterious elements.

Industry observers regularly rank it within the global top-tier undeveloped rare earth assets. Stage 1 establishes production capability. Stage 2 aims to expand throughput under the enlarged mining licence.

It is effectively a single asset story.

Financial Position and Funding

Lindian remains loss making. Recent twelve month losses were in the single digit millions. Return on equity sits near -16%. The A$91.5m placement and ~A$5m underwritten options issue significantly bolstered liquidity. This capital supports Stage 1 development and Stage 2 studies. Distribution remains unlikely until stable production and cash generation are achieved.

Future funding structure will be critical. Project level debt, offtake linked prepayments or structured facilities could reduce dilution if managed prudently. Equity dilution remains a live risk.

Fundamental Valuation Framework

Traditional earnings multiples are irrelevant at this stage. Valuation is better assessed through risk adjusted NPV modelling. Assumptions around rare earth pricing, capital intensity and ramp up timing drive outcomes.

Stage 1 capex of ~US$40m is modest relative to global peers. Long mine life and high grades support lower quartile cost potential. Qualitative factors are strong. Resource scale, grade, low thorium and licence approvals reduce geological risk. Corporate risk remains elevated given pre cash flow status.

Investors should focus on milestone delivery, funding structure discipline and cost control. Geology alone does not create value.

Capital Structure

The share register reflects a typical ASX small cap developer profile. Institutional ownership has increased following the recent placement. Dilution has occurred. There is no meaningful long term operating debt. Future project finance decisions will influence equity requirements. The Iluka partnership introduces optionality around structured funding solutions. Balance sheet discipline will shape shareholder returns.

Key Risks

- Project execution risk: Construction delays or cost overruns could require additional equity at unfavourable prices.

- Commodity price risk: Rare earth pricing is cyclical and influenced by Chinese policy and global EV demand.

- Country risk: Malawi has been supportive, but regulatory frameworks can evolve.

- Funding risk: Further capital will likely be required before steady state production.

- Single asset concentration: Any setback at Kangankunde would materially impact valuation.

Outlook and Conclusion

Lindian enters 2026 as a transformed company. It is no longer an exploration concept. It is a development stage rare earth contender. Full ownership, licence expansion and strategic alignment with Iluka materially strengthen its position.

Analyst consensus valuation targets sit in the A$0.90 to A$1.00 range, implying potential upside of roughly 125% from A$0.42, subject to execution and pricing assumptions. Entry zones around A$0.30 to A$0.35 offer greater margin of safety ahead of construction catalysts.

For investors comfortable with high beta development risk, Lindian provides leveraged exposure to the structural rare earth theme. Near term performance will likely be driven by funding structure clarity, construction progress and offtake execution. Ultimately, the story now shifts from geology to delivery.

If management converts Tier-1 scale into stable concentrate production without excessive dilution, Kangankunde’s second act could prove more valuable than its discovery phase.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.