Company Overview

Bailador Technology Investments (ASX: BTI) is an ASX-listed expansion-stage technology fund focused on high-growth sectors including SaaS, digital healthcare, marketplaces, and property technology. Founded in 2010 by David Kirk, former Fairfax CEO and All Blacks captain, and Paul Wilson, an experienced investor, Bailador gives public market investors rare access to mature technology companies with strong recurring revenues and proven business models. The fund targets businesses typically generating $5 million to $100 million in annualised revenue, positioned for international growth. Bailador takes minority stakes while maintaining active board involvement, supporting portfolio companies through governance, capital strategy, and scale execution.

Investment Thesis and Strategy

Bailador’s investment philosophy revolves around providing growth capital to expansion-phase companies that have established product-market fit but need funding to accelerate scaling. This stage captures the high-growth opportunity of tech investing while avoiding early-stage startup risk.

The approach combines:

- Careful selection of scalable SaaS and digital business models

- Active governance through minority ownership positions

- Follow-on funding for expansion opportunities

- Realisation of value through trade sales or IPOs

This model balances risk and reward, offering investors diversified exposure to high-performing technology assets with a clear pathway to liquidity and income.

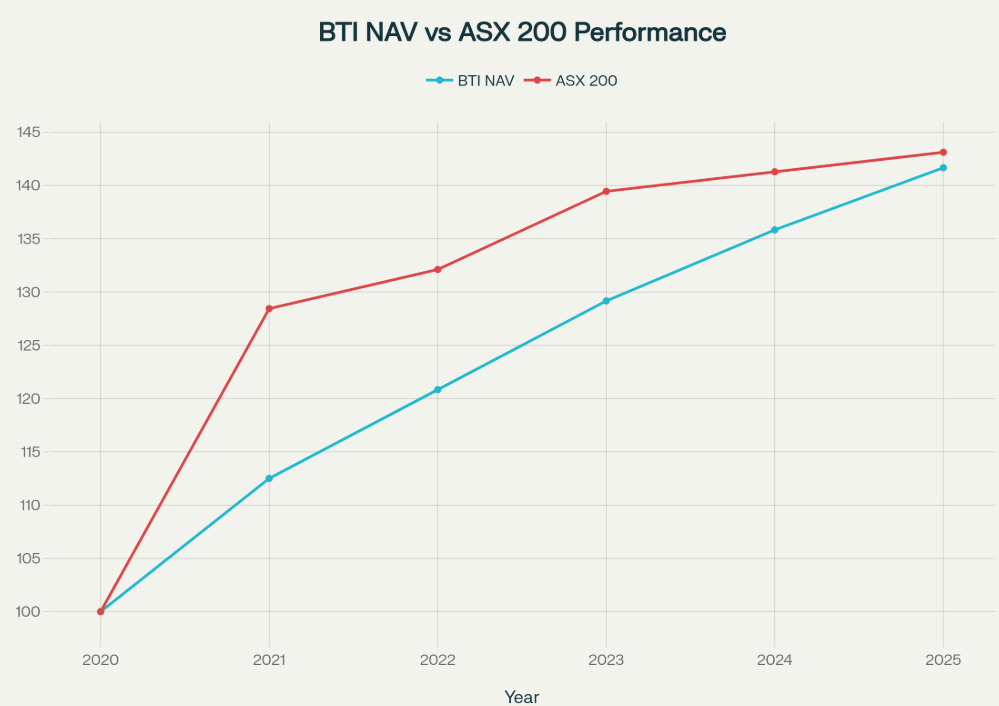

Historical Performance and Portfolio Growth

Since listing on the ASX in 2014, Bailador has built a strong performance record underpinned by disciplined investment and consistent portfolio growth.

In FY25, Bailador reported:

- Net profit after tax: $19.3 million

- Portfolio return (after tax and fees): 7.8%

- Dividend yield: 8.1% (grossed-up, fully franked)

- Net Tangible Asset (NTA) per share: $1.64

- Capital deployed: $40.8 million

- Portfolio revenue growth: 47%, reaching $592 million

- Recurring revenue: Approximately 87%

The private portfolio achieved an internal rate of return (IRR) of 33%, highlighting Bailador’s ability to identify scalable, high-margin businesses. Companies such as Updoc (digital health), PropHero (property technology), and Hapana (fitness software) all recorded material valuation uplifts during the year.

Acquisitions and Portfolio Realisations

Bailador’s strategy has delivered a track record of value realisation through strategic acquisitions and exits.

- DASH / Integrated Portfolio Solutions: In 2024, Bailador invested an additional $10 million to support DASH’s acquisition of IPS, expanding its footprint in wealth management software.

- Instaclustr: Sold to NetApp (NASDAQ: NTAP) in 2022, generating $118 million in proceeds — one of Bailador’s most successful exits.

- SiteMinder: Partial exit in 2025 realised $20 million, highlighting disciplined capital management.

- Rezdy: In 2023, Bailador partnered with a US private equity firm to acquire the travel booking platform, maintaining exposure to future value creation.

- Viostream: Exited in 2023 through a sale to Bloom Equity Partners.

These transactions demonstrate Bailador’s ability to identify, scale, and exit high-quality technology investments while recycling capital into the next generation of growth opportunities.

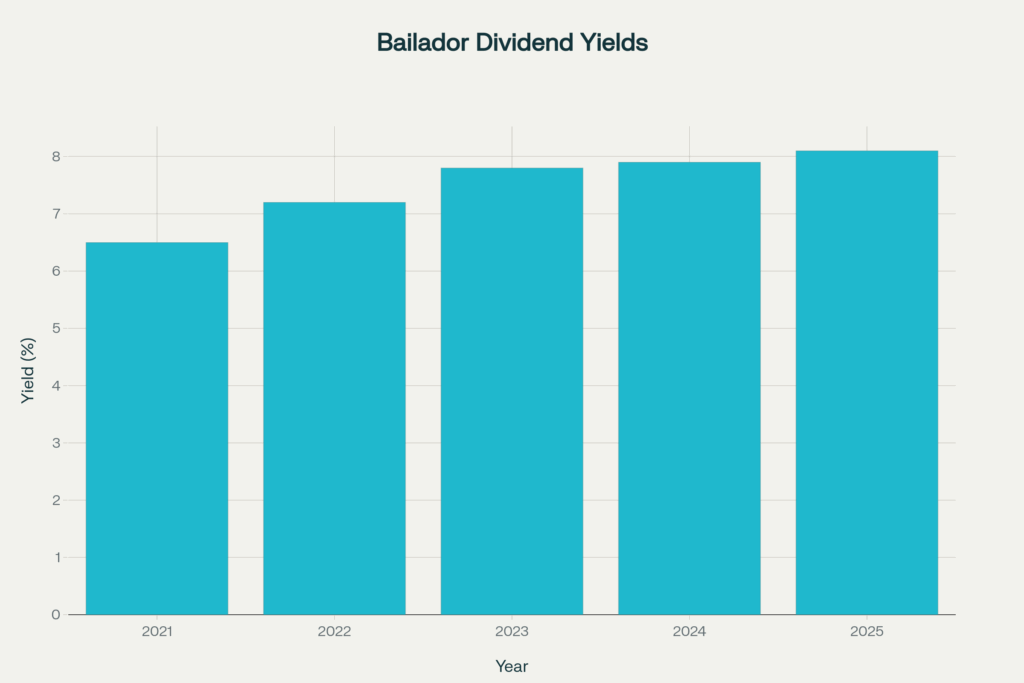

Financial Health and Dividend Policy

Bailador maintains a strong financial position, ending FY25 with $15 million in net cash and maintaining a disciplined approach to capital allocation. Approximately $40.8 million was invested across existing and new portfolio companies during the year.

The fund’s dividend policy targets consistent, fully franked distributions of around 4% of pre-tax NTA, providing investors with reliable income. The FY25 final dividend of 3.6 cents per share equated to a grossed-up annual yield of 8.1%, underscoring Bailador’s hybrid positioning as both a growth and income investment.

Fundamental Analysis

Valuation Metrics:

- NTA per share: $1.64 (FY25)

- Price-to-NTA: Trades close to 1.0x, suggesting a fair market valuation relative to assets

Growth Drivers:

- Portfolio revenue growth of 47% in FY25

- High recurring revenue component (~87%)

- Sustainable profitability and scalable business models

Balance Sheet Strength:

- Net cash of $15 million provides flexibility for future investments

- Efficient capital deployment supports portfolio expansion

Dividend Sustainability:

- Fully franked yield of 8.1%, supported by realised gains and recurring revenue

- Balanced reinvestment strategy ensures ongoing capital growth

Risks and Considerations

While Bailador’s focus on expansion-stage technology companies drives growth potential, it also introduces risks typical of the sector.

- Sector concentration: Exposure to technology valuation cycles

- Liquidity risk: Portfolio realisations can be long-dated

- Execution risk: Dependence on portfolio company performance

- Currency and regulatory risks: Global operations expose companies to external factors

Despite these, Bailador’s active management and governance involvement help mitigate downside exposure.

Outlook and Conclusion

Bailador Technology Investments continues to deliver consistent growth, strong portfolio performance, and attractive income. Its focus on high-quality, scalable digital businesses positions it well for long-term value creation.

With disciplined capital management, a strong cash position, and exposure to recurring revenue streams, Bailador remains one of the most compelling ways for ASX investors to access technology expansion opportunities while benefiting from reliable dividends.

For investors seeking both growth and income, Bailador offers a balanced, high-conviction vehicle within Australia’s evolving technology investment landscape.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.