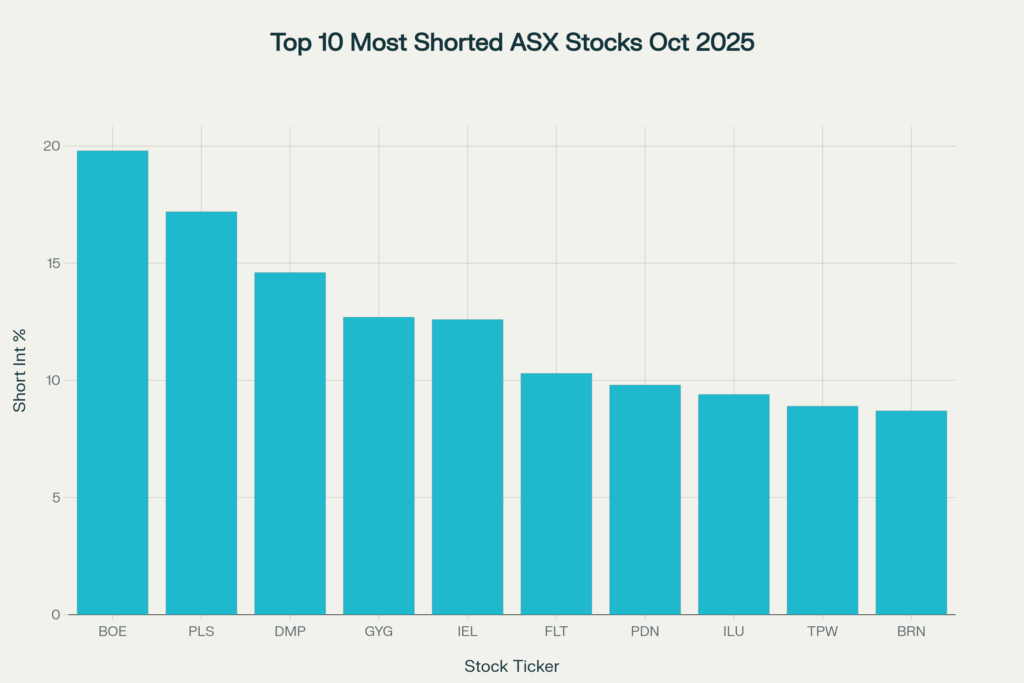

Short sellers are tightening their grip on the ASX as the year winds down, and our ASX short interest analysis for October 2025 reveals where bearish sentiment is building. Institutional investors are increasing positions in uranium, lithium, and consumer stocks, a sign that confidence in some of the ASX’s biggest names may be slipping.

While short selling is often misunderstood, it remains one of the most visible indicators of market sentiment. In simple terms, it reflects where institutional investors believe valuations have run ahead of fundamentals. Let’s look at the most shorted ASX names, why they’ve been targeted, and what this pattern says about risk appetite on the market.

Top Five Most Shorted ASX Stocks — October 2025

| Rank | Code | Company | Short Interest (%) |

| 1 | BOE | Boss Energy Ltd | 19.8 |

| 2 | PLS | Pilbara Minerals Ltd | 17.2 |

| 3 | DMP | Domino’s Pizza Enterprises | 14.6 |

| 4 | GYG | Guzman y Gomez Ltd | 12.7 |

| 5 | IEL | IDP Education Ltd | 12.6 |

The Bearish Theses Behind the Shorts

Boss Energy (BOE):

Nearly 20% of Boss Energy’s shares are shorted, highlighting doubt about the uranium producer’s long-term trajectory. Concerns over post-2026 supply contracts and softening uranium prices have prompted hedge funds to question whether the nuclear energy optimism arrived too early.

Pilbara Minerals (PLS):

The lithium sector remains a short-seller favourite. At 17% shorted, Pilbara reflects waning enthusiasm for battery metals amid weaker EV demand in China and an influx of new supply. The long-term story remains intact, but traders are focused on short-term earnings compression.

Domino’s Pizza Enterprises (DMP):

Once an ASX growth story, Domino’s continues to face cost inflation and operational fatigue. With short interest above 14%, investors are signalling limited confidence in the company’s offshore strategies and margin recovery timelines.

Guzman y Gomez (GYG):

Following its much-anticipated IPO, Guzman y Gomez has quickly become a battleground stock. Its valuation remains rich relative to peers, and short sellers, at 12.7%, appear doubtful that the company can deliver the growth required to justify its price-to-earnings ratio.

IDP Education (IEL):

Short positions at 12.6% show pressure on the global education giant, with tighter visa rules and weaker student flows impacting sentiment. Some analysts argue that management’s guidance is overly optimistic given policy uncertainty across key Asian markets.

Market Context: A Defensive Tilt by Institutions

Institutional traders have been rotating into defensive positioning as macro conditions soften. Slower Chinese demand, persistent inflation, and elevated bond yields have created a backdrop where cyclical sectors, particularly lithium, uranium, and retail, are vulnerable.

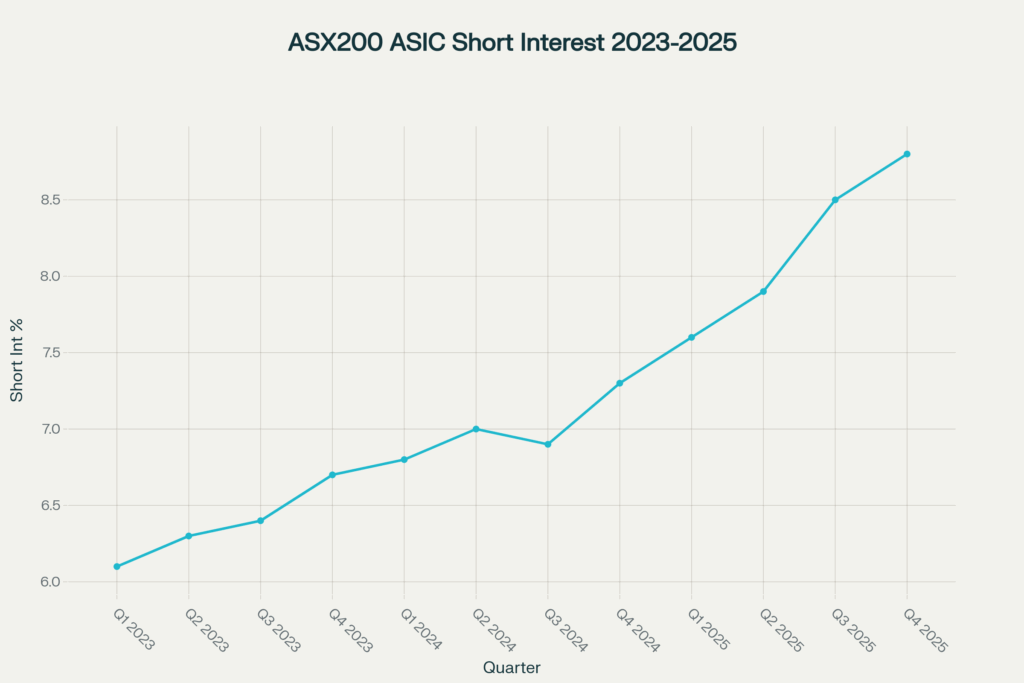

According to FNArena, aggregate short interest across the ASX200 has reached its highest point since early 2023, a clear signal that professional investors are bracing for subdued FY26 earnings.

Squeeze Watch: When Shorts Backfire

Heavily shorted stocks like Guzman y Gomez and Pilbara Minerals are attracting attention from contrarian traders betting on a potential rebound. If a positive catalyst appears, such as stronger-than-expected results or supportive policy news, short sellers may be forced to cover positions quickly, driving a “short squeeze.”

A short squeeze happens when rising prices pressure short sellers to buy back borrowed shares, intensifying the rally. With trading volumes and borrow costs rising, Guzman y Gomez stands out as a candidate for such a move before year-end.

Understanding Short Selling and Market Signals

Short selling involves borrowing shares, selling them on market, and buying them back later at a lower price to capture the difference. Despite its reputation, it plays a vital role in maintaining market efficiency, adding liquidity, and exposing overvalued stocks.

In Australia, ASIC publishes short interest data daily, offering retail investors a rare window into institutional sentiment. Tools like ShortMan and FNArena allow investors to track these figures. A sharp rise in short interest often signals professional caution, while a sudden decline can imply improving sentiment or a pending rally.

Investor Watchpoints: Key Takeaways

- Rising short interest in cyclical and resource sectors reflects broad caution heading into FY26.

- Watch borrow costs and days-to-cover ratios, as elevated values heighten short squeeze potential.

- Rapid declines in short percentages can hint at sentiment shifts or early positioning ahead of rebounds.

In short, analysing short interest data is more than reading pessimism, it’s about understanding the tension between conviction and risk. The most shorted names often mark where the market is most uncertain, and for long-term investors, that uncertainty can sometimes present opportunity.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.