Global markets moved cautiously on Monday as investors have started to price US President Donald Trump’s threats of a 10% tariff hike against 8 European nations, with Europe and Australia absorbing the initial impact while US markets remained closed on Monday in observance of Martin Luther King Jr. Day.

European Equities and FX Markets Reaction to Trump Tariff

European equities opened lower, showing the first real price discovery. The Stoxx Europe 600 fell by 1.2%, its sharpest decline in over 2 months with the decline being led by trade-sensitive sectors such as autos, luxury goods and industrials. Losses were most pronounced in Denmark, where the OMX Copenhagen 20 shed nearly 3%, reflecting the country’s central role as the sovereign in its dispute with the US over Greenland. Automakers including BMW, Volkswagen and Mercedes-Benz were among the weakest performers, dropping over 3% each, while luxury groups such as LVMH and Kering also sold off heavily.

European markets have begun to price in investor sentiment

Currency markets reflected the rise in trade uncertainty. The Euro and Sterling have weakened against the US dollar, while haven currencies such as the Swiss franc strengthened. The move suggests investors are beginning to price in slower growth in both the European Union and the United Kingdom and heightened policy risk, even as broader FX reactions are remaining constrained. Sustained currency weakness would tighten financial conditions and reinforce a more defensive market posture.

ASX, US Markets and Metals Reaction to Trump Tariff

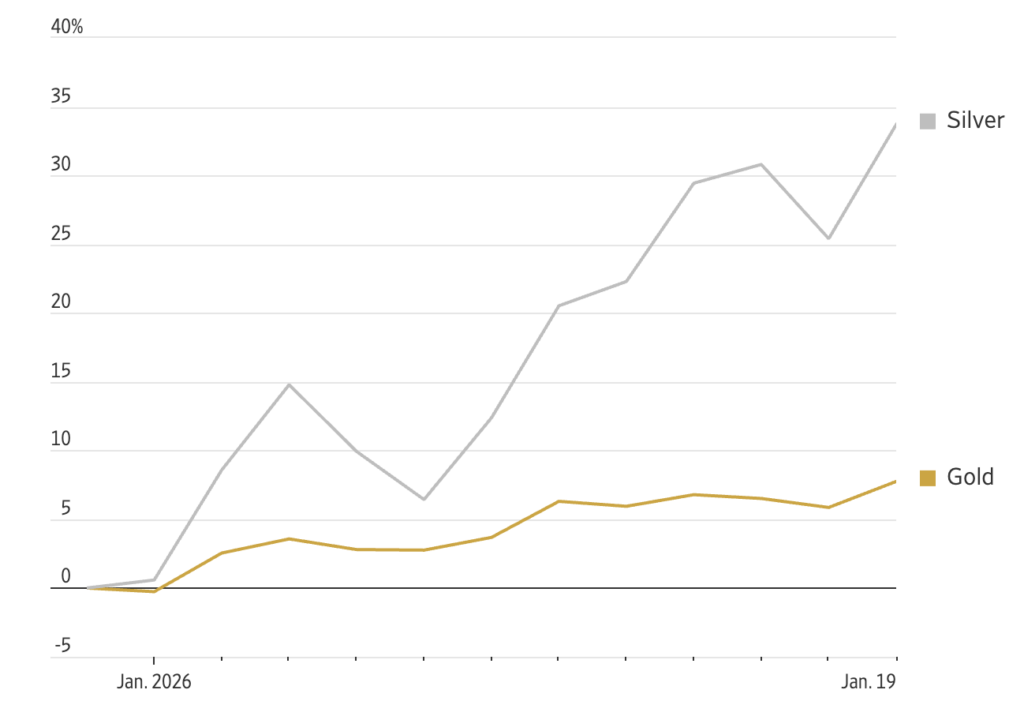

In Australia, the ASX 200 fell 0.3%, weighed down by tech stocks and the big 4 banks stocks as global risk sentiment softened. Tech names underperformed as investors reduced exposure to higher-beta sectors, while bank shares eased amid weaker equity momentum. By contrast, gold miners outperformed sharply, tracking a surge in precious-metal prices as investors sought safe havens. Gold rose to a fresh record above US$4,690 an ounce, while silver also touched new highs, underscoring the defensive shift in positioning as reflected in FX markets.

Source: Factset

US equity futures pointed to a cautious opening on Tuesday. Contracts tied to the S&P 500 and Nasdaq were down close to 1%, indicating that the tariff threat has unsettled sentiment beyond European markets. Bond markets sent a more mixed signal as opposed to a classic flight-to-safety rally, US Treasury yields remained elevated near key technical levels, suggesting investors are balancing haven demand against concerns that tariffs could raise import prices and muddle up the inflation outlook.

Source: Factset

Investors are still divided on how seriously to take the latest threat. Some argue investors have become conditioned to tariff rhetoric after previous threats and episodes proved less economically damaging than feared. Others argue that uncertainty itself, particularly the risk of European retaliation over US imports and the use of the EU’s Anti-Coercion Instrument, could weigh on corporate investment and investor confidence if the standoff escalates particularly as NATO countries have started to deploy troops to Greenland, the White House having not ruled out the use of force and the escalation to 25% tariffs if the issue isn’t resolved by June 1 2026.

What To Watch Next

Investors should keep an eye out a handful of near-term catalyts

- European market follow-through will be critical in determining whether Monday’s sell-off stabilises or deepens, particularly among exporters and industrials. This will really price in investor sentiment and whether they’re taking the threats seriously.

- FX moves in the Euro and Sterling will remain a key barometer of growth risk. Currency should be seen as a transmission channel. In trade shocks, the euro and sterling often react quickly as markets price in growth risk and policy uncertainty, while safe-haven demand can support the USD and Swiss Franc.

- Watch Brussels where EU officials are meeting to consdier potential retaliation, including levies on over €93 billion of U.S. goods under the EU’s Anti-Coercion Instrument.

- Sustained strength of gold and silver signals greater demand for safety amid trade tensions and uncertainty, while a reversal or slowing growth would reflect fading risks and greater confidence.

- Lastly, investors will look to US markets reopening on Tuesday and legal developments around Trump tariff authority under the International Emergency Economic Powers Act, all of which will shape how durable and credible these threats prove to be.