With US markets back open after the long weekend, investors delivered a clearer verdict on President Donald Trump’s latest tariff threat, showing weakened risk appetite led by a broad sell-off in US equities and a weaker US Dollar.

After Europe and Australia absorbed the initial shock earlier in the week, US cash trading is showing that risk appetite has weakened, with selling broad-based and a renewed rotation into traditional safe havens.

US equities markets and rates: pressure builds

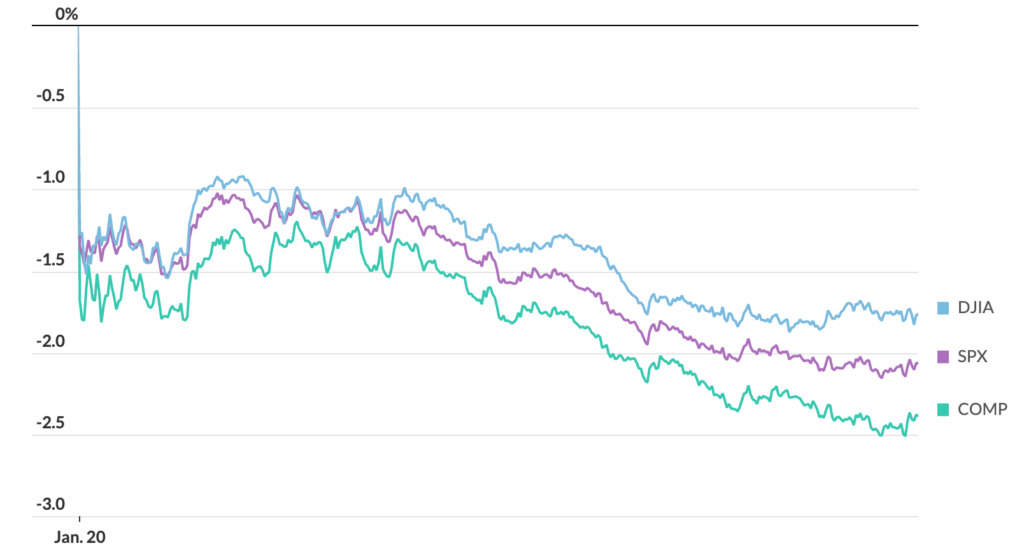

US stocks fell sharply through the New York session, led by technology. The Dow Jones shed over 870 points or 1.8% and the Nasdaq Composite and S&P 500 slid more than 2%. This marks the worst session since October for all three major averages. Large-cap growth names including Nvidia and Tesla fell more than 4%, reflecting sensitivity to higher yields and rising policy uncertainty. Volatility jumped, with the VIX rising by more than 6%, signalling a broader repricing of risk rather than a sector-specific move. These tariff threats are particularly hammering into retail and information tech stocks, with these 2 sectors performing the weakest and 2nd weakest of the S&P 500’s 11 key sectors.

Source: Factset

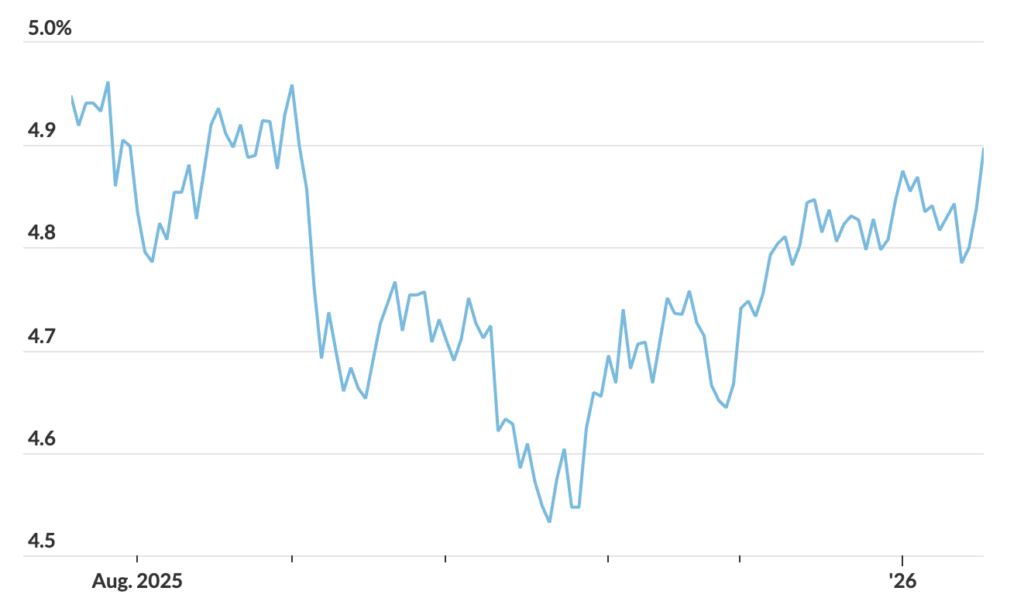

Bond markets added to the pressure. Rather than a clean flight-to-safety rally, US Treasury yields rose, with the 10-year yield near 4.28% and the 30-year close to 4.91%. Part of the move was driven by an overnight surge in bond yields in Japan, which triggered a wider global bond sell-off and tightened financial conditions. Pressure was added as Danish pension operator AkademikerPension said Tuesday that it’s exiting US Treasurys because of finance concerns over US debt which has hit US$38.5 trillion.

Yield on 30-year treasury Source: Tullet Prebon

Europe: Equities slide amid tariff uncertainty

European markets remained under pressure as investors continue to price in renewed trade and geopolitical uncertainty following the tariff threats. On Tuesday, Stoxx Europe 600 fell around 1.3%, with other major benchmarks such as France’s CAC 40 and Germany’s DAX also declining more than 1% as global risk sentiment deteriorated. Export and trade-sensitive sectors such as autos and luxury goods continue to underperform, while defensive areas showed relatively better performance. UK markets slipped as well, with the FTSE 100 down near 1.3%, reflecting broader risk aversion across the region. Denmark’s OMX Copenhagen 20 bucked the broader trend, rising about 1.15% on Tuesday with gains being led by consumer goods, healthcare and industrial sector, showing idiosyncratic drivers and selective positioning by investors as opposed to uniform risk hedging. While uncertainty continues to put pressure on European markets, investors are still trying to distinguish between political noice and local fundamentals.

Currency and safe havens: the market’s “tell”

Currency markets delivered one of the clearest signals of unease in investor sentiment. The US dollar weakened sharply, falling around 0.6% against the euro and the broader dollar index has also declined. At the same time, safe-haven assets surged, with gold pushing above US$4,750 an ounce to another record high and silver in the same direction with a strong rally.

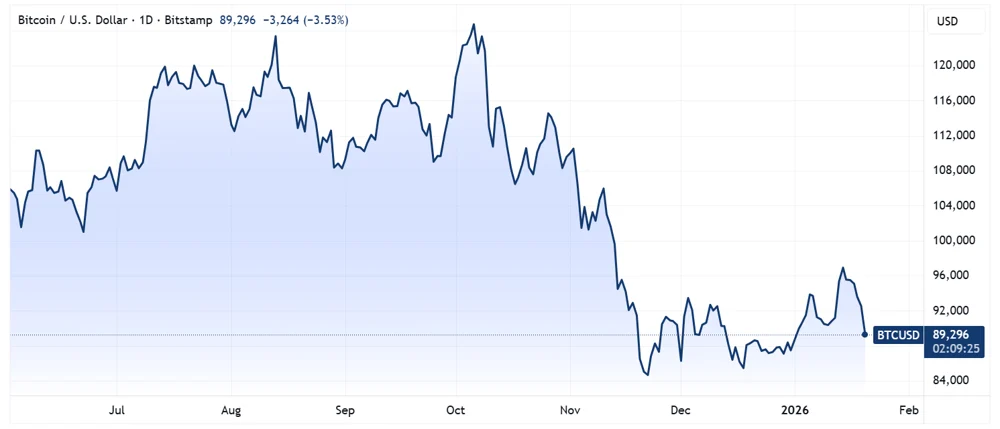

The combination of a weaker dollar alongside falling U.S. equities, rising yields and stronger havens has been described as the market’s “tell” by Evercore ISI, suggesting investors at the margin are reducing or hedging exposure to US assets amid growing policy uncertainty. Bitcoin also fell below US$90,000, further demonstrating the risk hedge tone.

Bitcoin Price Source: TradingView

ASX reflects global sentiment

The ASX has felt the spillover. The S&P/ASX 200 fell over 0.6%, weighed down by tech, major mining and the major banks stocks, while gold miners outperformed sharply on the back of surging bullion prices. The divergence highlights a familiar pattern for local markets, global risk sentiment and cross-asset flows remain dominant over direct tariff exposure.

Uncertainty being the key driver

While the direct economic impact of the proposed tariffs is still expected to place pressure, investors are increasingly focused on the uncertainty itself. Tariff sensitivity has already emerged in US retail stocks, with major names under pressure as markets price margin compression from higher import. The risk of European retaliation remains the key escalation channel as EU leaders meet in Brussels for talks in regards to retaliation on over US$100 billion worth of US imports.

Markets have seen this dynamic before. During last year’s “Liberation Day” tariffs, US markets suffered one of its sharpest but temporary declines in history, recovering over 36% since April 2025. Whether this renewed episode of tariff threats follows a similar path will depend less on rhetoric and more on how policy clarity evolves.

What to watch next?

Investors will be watching several signals closely.

- Rates: further rises in treasury yields will further tighten financial conditions and weigh on equities.

- Safe havens: continued strength in gold and silver would point to persistent demand for protection in the face of uncertainty.

- Currencies: sustained US dollar weakness against the euro and sterling would reinforce the “sell America” narrative.

- Europe: any confirmation of EU retaliation after the talks in Brussels would raise escalation risk and uncertainty.

- Earnings: guidance will matter more than results as companies respond to renewed trade uncertainty.

- IEEPA ruling: US Supreme Court rulings could threaten or reinforce the legitimacy of Trump’s threats and shift investor sentiment.

Today’s agenda for the ASX

Rio Tinto, Beach Energy, Evolution Mining, Lynas Rare Earths, Paladin Energy and Yalcoal Australia results.