Momentum week: equities break out fresh highs as momentum broadened, oil slid hard on supply nerves, and gold powered toward record territory, an alignment that keeps quality growth in focus, tilts Europe back into play and argues for caution on crude-sensitive names.

Macro and Markets – Momentum week equities breakout

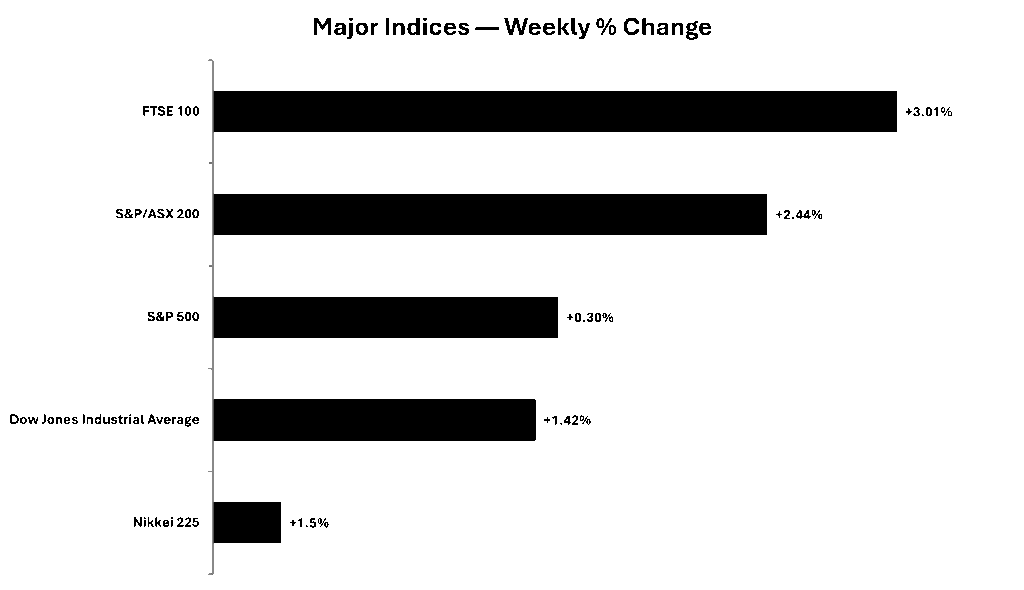

U.S. equities ended the week at or near record closes as the 10-year Treasury yield eased, loosening financial conditions and supporting multiples. Breadth improved modestly, with mega-cap tech still leading but more participation from financials and select cyclicals. Europe outperformed on the week, helped by healthcare resilience and firm bank earnings expectations. In Australia, the ASX 200 held near highs with tech and healthcare leadership.

Commodities and FX

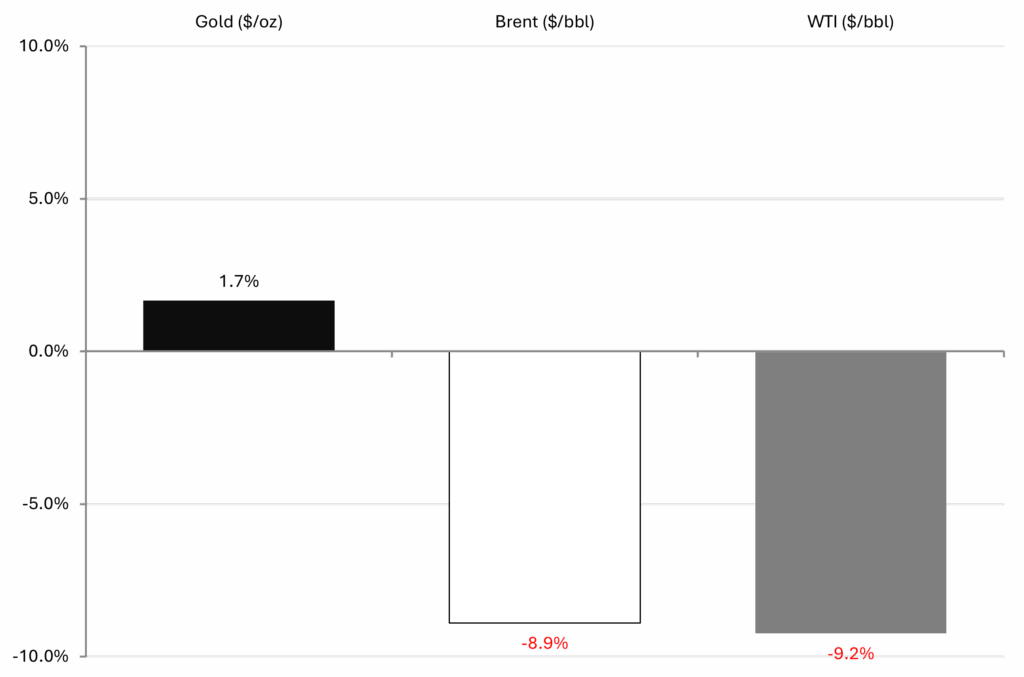

Brent crude fell sharply, reflecting potential OPEC+ supply flexibility and softer demand signals into year-end. WTI tracked the move, pressuring energy equities and upstream beta. Gold hovered near an all-time high as policy risk, central bank demand, and an easier dollar underpinned bids. The U.S. dollar softened versus Europe; USD/JPY stayed firm as policy divergence persisted. Lower real yields and a softer dollar favoured non-U.S. risk and precious metals.

What to Watch – Research Insights

Quality growth and easing yields: The week’s softer long-end yields coincided with gains in quality growth names. Historically, periods of falling real yields have aligned with stronger multiples for firms with durable cash flows. This may help explain leadership concentration and why dips around rate spikes have been short-lived.

Europe’s improving participation: European benchmarks outperformed, with healthcare and banks contributing. When non-U.S. markets join leadership, dispersion across regions tends to rise – useful for stock pickers screening for earnings resilience and capital return policies.

Energy vs. crude sensitivity: A sharp Brent/WTI decline pressured energy equities. Refiners and chemicals can at times diverge from upstream beta depending on crack spreads and feedstock costs – an area to monitor for relative performance shifts rather than a single-direction call on oil.

Gold’s regime signals: gold trading near record levels alongside softer dollar and policy risk suggests a regime influenced by central bank demand and hedging needs, not just real rates. Pullbacks toward prior breakout zones have been focal points for positioning in past cycles.

Duration as a portfolio variable: Some investors track intermediate-duration exposure as a volatility dampener during equity drawdowns. Movement of the 10-year around widely watched levels (e.g., ~4.1%-4.3%) often correlates with factor rotation between growth/defensive cohorts.

Risks and Watchlist (Next 1-2 Weeks)

- Macro prints: CPI/PPI, jobs, and PMIs. Hot data could reprice cuts and pressure multiples.

- Earnings: Early U.S. banks set tone on credit costs, deposit betas, and buyback cadence.

- Supply: Treasury action sizes and bid-to-covers for duration sentiment.

- Energy: Any OPEC+ policy shift or supply disruption would challenge the short-crude view.

- China demand: Metals and cyclicals remain sensitive to incremental policy framework.

Bottomline For Investors

In a momentum week equities breakout backdrop, softer yields, renewed inflows, and a sharp oil resent supported risk this week. The base case favours quality growth leadership with selective rotation into Europe. Keep a gold core, stay tactical on energy, and use rate spikes to rebalance into duration. This mix preserves upside participation while keeping drawdown protection in play.