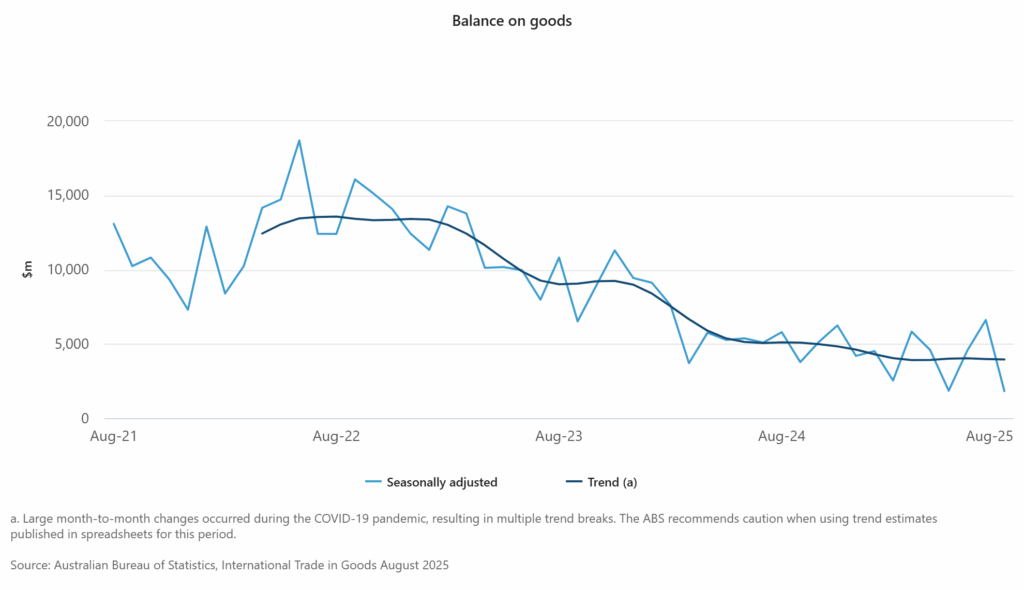

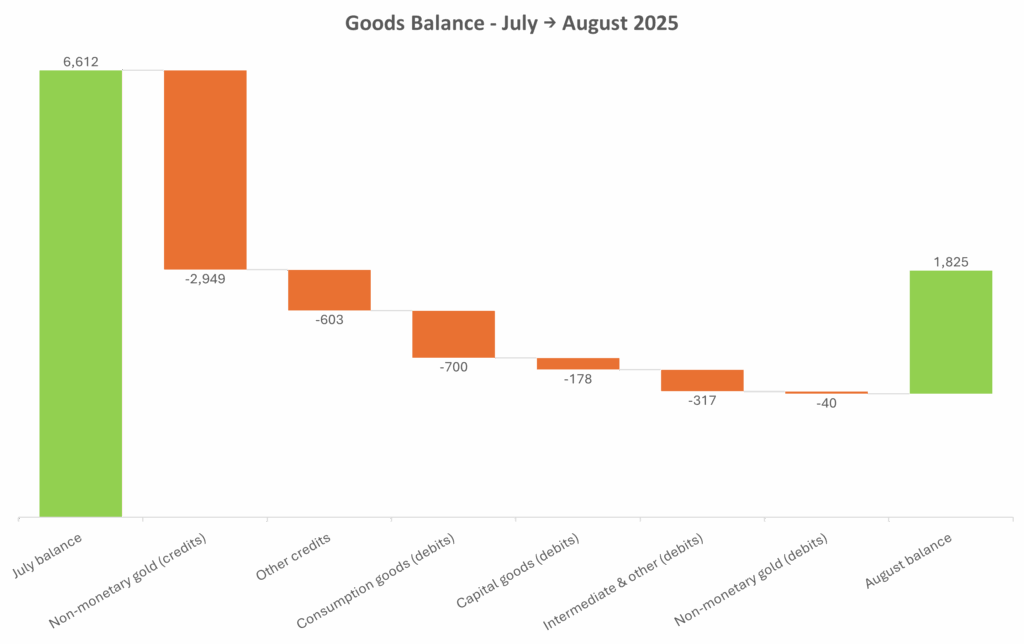

The Australian August trade surplus collapsed to A$1.8bn, down from a revised A$6.6bn in July and far below market expectations. The fall was driven by a 47% month-on-month drop in non-monetary gold exports, while imports rose across consumer goods and equipment. This confirms the Australia August trade surplus shock was driven by gold.

The Australian August Trade Surplus Shock

ABS’s latest “International Trade in Goods” release (2 Oct) shows exports down 7.8% m/m and imports up 3.2% m/m in August. Gold swung from being a positive swing factor in July to the key drag in August; on the import side, consumption goods and categories such as aircraft and telecoms lifted debits. The ABS release calendar summary also flagged the A$4.8bn deterioration in the monthly goods balance.

Gold’s volatility matters: It had helped July’s surplus hit A$7.3bn, the strongest since early 2024, before reversing in August. That underscores how composition effects can mask the underlying trade trend.

Why it Matters: Australia August Trade Surplus and the AUD

The macro signal is that a one-off gold-swing explains most of the August shock, but the broader picture points to a narrower external cushion just as domestic demand indicators stabilise. The RBA held the cash rate at 3.60% this week and struck a cautious tone on inflation, so weaker trade support narrows policy room if services inflation stays sticky.

From an FX perspective, despite the trade miss the AUD held firm into week’s end on the RBA’s “hawkish hold.” That limits import-price relief for retailers and may pressure exporters with thin FX hedging. Regionally, Australia’s slump contrasts with Indonesia’s outsized August surplus, reminding investors that commodity mix and episodic gold flows can drive divergent outcomes across APAC.

Sector Impacts: Who Wins, Who Loses

Gold miners: August’s export drop looks volume/mix driven rather than price led. ABS prices indexes recently showed non-monetary gold-prices higher in Q2 on safe-haven demand and central-bank buying. Monthly shipment timing and refinery flows can whipsaw volumes, so the headline trade weakness is unlikely to change miner fundamentals if bullion stays supported. Keep an eye on September and October flows for a rebound.

Iron ore & bulk exporters (BHP, RIO, FMG): Gold’s weakness matters little directly, but a smaller surplus makes earnings more sensitive to swings in iron-ore and LNG realisations. If AUD strength persists after the RBA’s pause, translated revenue faces a mild headwind until commodity prices or volumes offset it.

Retail importers & discretionary: Imports of consumer goods rose in August, suggesting cautious restocking into year-end. If the AUD holds near recent levels, import costs look contained, but household demand remains mixed (ABS Monthly Household Spending Indicator +0.1% m/m). Favour retailers with pricing power and clean inventories as the Christmas build begins.

Transport, logistics & air freight: The pickup in aircraft and telecom equipment imports points to capex-linked moves and inventory repositioning. That backdrop supports freight volumes even as the trade balance narrows. Watch the September print to see if the momentum persists.

What’s Next

In early November, the September goods print will reveal the Australian August trade surplus shock was a gold-timing blip or the start of a softer external position. Watch non-gold exports (iron ore, LNG) for underlying momentum in the import mix – consumer goods versus capex – for signals on demand and inventory strategy.

For FX, the AUD will likely take its cues from RBA guidance and the global USD trend rather than a single weak trade result. A second soft month alongside sticky services inflation would tilt pricing toward earlier 2026 cuts; a clean rebound would support a longer pause, keep AUD underpinned, and temper outperformance in duration-sensitive equities.