A Market Built on Resilience

Australia’s venture capital market has shown remarkable resilience in 2025 despite global headwinds. While deal activity has slowed from the boom years of 2021 and 2022, the ecosystem continues to evolve, reflecting a shift toward quality, operational strength, and financial discipline.

The Australian venture landscape is adapting to higher interest rates, persistent inflation, and a more selective funding environment. This “flight to quality” has seen investors prioritise startups with clear profitability pathways, strong governance, and sustainable growth models. The era of “growth at all costs” has faded, replaced by measured capital allocation and long-term planning.

Global Backdrop: From Abundance to Accountability

Internationally, venture markets have transitioned from abundance to accountability. With capital tightening, investors are deploying funds more strategically. In Australia, this has translated into greater scrutiny and longer fundraising cycles, particularly for startups bridging the gap between seed and Series A rounds.

Venture capital firms are now conducting deeper due diligence, emphasising resilience, margin quality, and realistic growth assumptions. This is shaping a more professionalised investment landscape, one that rewards fundamentals and operational excellence.

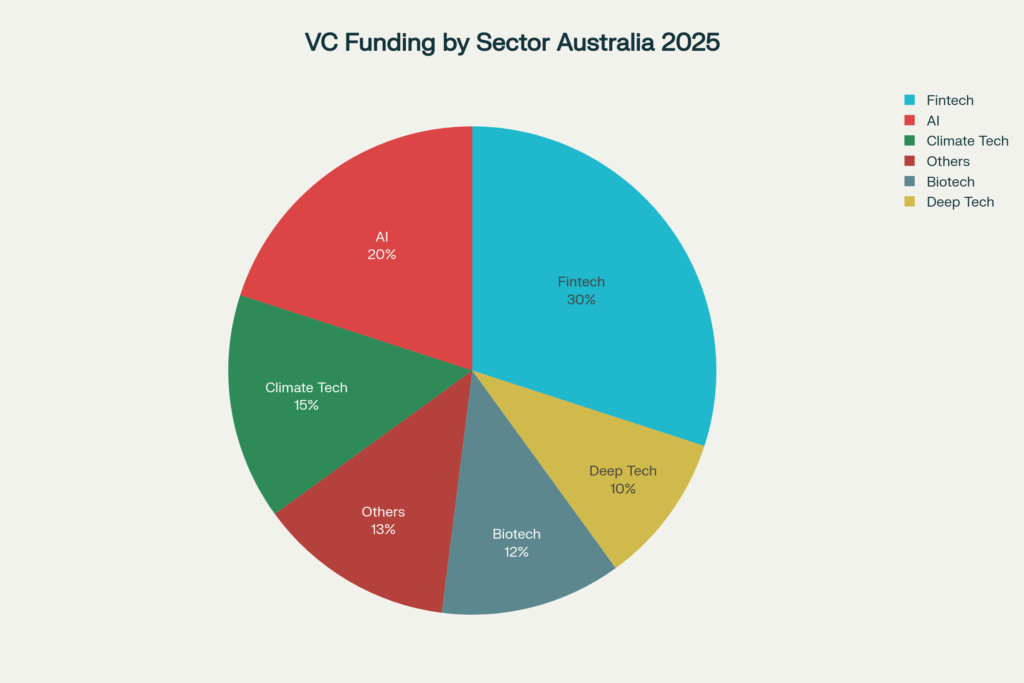

Sector Insights: AI, Fintech and Climate Tech Lead

Fintech has reclaimed its leadership position in Australian venture funding, posting strong deal flow in the second quarter of 2025. However, AI integration has become a defining trend across nearly every major sector. More than half of new software startups now embed AI into their products, signalling that artificial intelligence is no longer a differentiator but a baseline expectation for competitiveness.

Climate technology, deep tech, and biotech continue to attract meaningful capital. These sectors align with global priorities in sustainability and health innovation, ensuring Australia’s ecosystem remains globally relevant.

Early-Stage Focus and Funding Trends

A defining feature of 2025 has been the shift back to early-stage investing. Pre-seed and seed rounds dominate deal flow, as VCs look to shape the next generation of scalable startups. Deal sizes are smaller than pandemic-era highs, but investor confidence remains strong, with most expecting stable valuations through the rest of the year.

The decline in venture debt usage underscores a cautious yet optimistic tone. Founders are focusing on balance sheet health and capital efficiency, while investors reward disciplined growth and sound governance.

Challenges: Competition, Diversity and Exit Liquidity

Despite its strengths, Australia’s venture ecosystem faces persistent challenges. Startups are competing against larger, capital-rich markets such as the US and China, particularly in AI innovation and frontier technology.

Diversity also remains a structural issue. Women-led startups accounted for only 11% of total funding in Q3 2025, underscoring the need for broader inclusion initiatives and equitable access to capital.

Liquidity remains tight, with IPOs and trade sales still limited. Many VCs are relying on secondary transactions and private equity buyouts to deliver returns. While the exit window is expected to widen modestly into 2026, it remains a key focus area for institutional and family office investors.

Investor Performance and Market Positioning

Australia’s venture capital funds have quietly outperformed many global peers in 2025. Strong governance frameworks and a focus on portfolio profitability have helped deliver steady returns, even in volatile conditions.

According to PitchBook and AVCAL, total assets under management across private equity, venture capital, and private credit held steady at approximately A$139 billion, supported by growing interest from Asian institutional investors and family offices.

This inflow of international capital reinforces Australia’s reputation as a stable, innovation-driven market with disciplined fund managers capable of navigating complex macroeconomic environments.

A Mature, Sustainable Ecosystem

The Australian venture capital market is entering a new phase, one defined by sustainability, governance, and selectivity. Rather than chasing growth at any cost, investors are focusing on building durable, revenue-generating businesses.

This “VC paradox” — fewer deals but higher quality, may ultimately strengthen the ecosystem. By balancing optimism with discipline, Australia is positioning itself as a credible global hub for innovation, capable of nurturing world-class startups while managing risk effectively.