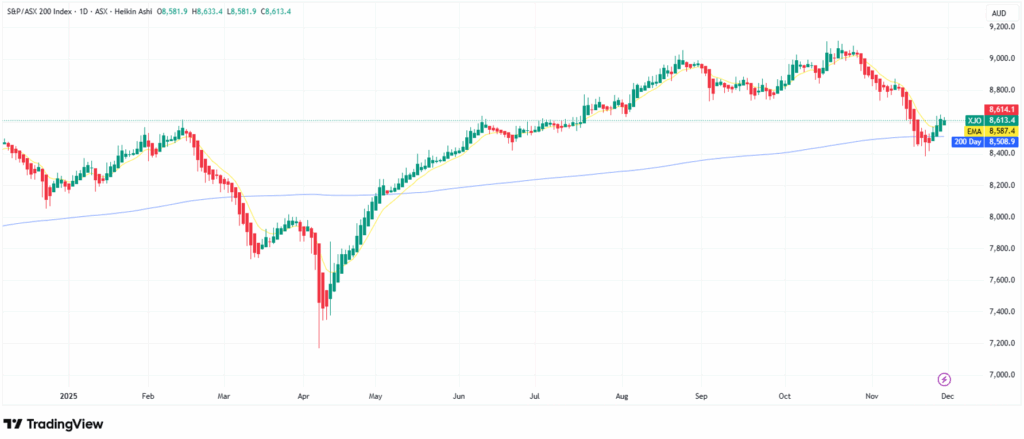

The ASX 200 has pulled back sharply from its late October high above 9,100 and recently stabilised near the 200 day moving average around 8,500. This retreat of roughly 6 to 7 percent has reset investor positioning without breaking the market’s broader uptrend. As the index holds support, the question for investors is whether this is a normal reversion to trend or the early stage of a deeper de rating. With inflation proving sticky and the Reserve Bank of Australia maintaining a more constrained stance than global peers, the next move in the ASX 200 will be heavily shaped by the path of prices and funding costs.

The Macro Backdrop, A Balancing Act for the RBA

Inflation remains uncomfortably above the Reserve Bank’s target band and that continues to limit the room for early rate cuts in 2025. This has created an awkward divergence. Global markets are positioning for a soft landing supported by rate cuts, while Australian risk assets must grapple with the reality of higher domestic funding costs for longer.

Consensus still expects mid single digit earnings growth across 2025 and 2026, with resources, healthcare and parts of technology doing more of the lifting than the banks. The bigger risk for the ASX 200 is not a collapse in earnings, but multiple compression if investors decide stubborn inflation will limit valuation expansion. In this environment, investors need to be clear about how much of their expected return comes from earnings rather than a re-rating.

Technical Structure Signals Support, Not Capitulation

The current behaviour around the 200 day moving average remains a useful guide. Earlier this year, pullbacks in April and July held above this line and eventually pressed higher, keeping the sequence of higher lows intact. The recent decline has tested the same area without a decisive weekly breakdown.

The 8,600 to 8,700 range now acts as the market’s regime marker. A move back above this zone, supported by rising short term averages, would reinforce a base case of consolidation inside a longer term advance. A clean break and hold beneath the 200 day moving average, especially if market breadth weakens, would shift the conversation toward a deeper correction into the low 8,000s and a more defensive portfolio stance.

Sector Trends, Pressure on Banks and Optionality in Resources

Financials remain at the centre of the local equity narrative. Margin compression, credit quality questions and growing political attention on regional banking access all weigh on sentiment. Capital positions are sound, but any evidence of slowing loan momentum or rising arrears could trigger further earnings downgrades. Bank exposures deserve tighter position sizing and close monitoring.

Resources, infrastructure and energy transition themes continue to offer optionality if global growth proves resilient. Diversified miners with solid balance sheets and disciplined capital allocation still provide leverage to iron ore, copper and lithium, while listed infrastructure names with inflation linked revenue can offer protection if domestic price pressures remain sticky.

A Portfolio Framework for Wide Outcome Ranges

Forecasting a single ASX 200 year end level for 2025 matters less than recognising the wide range of plausible outcomes. A more grounded approach is to adjust risk exposure around the index’s behaviour at major technical and macro reference points.

While the ASX 200 trades above the 8,600 to 8,700 region, investors can justify maintaining or gradually building exposure to quality cyclicals and selected growth names. If the index breaks below that level and remains there with a declining 200 day moving average, portfolios should shift toward defensives, predictable cash flows and higher cash buffers.

In this type of market, it is essential to distinguish valuation risk from structural business risk. Paying a full but reasonable multiple for well governed companies with strong balance sheets is very different from backing businesses that still face material regulatory, funding or governance uncertainty. The latter deserve smaller position sizes and stricter risk controls, even when headline valuations appear cheap.

Implications for 2025 and 2026

Right now, the ASX 200 looks more like a market holding support than one surrendering to a full capitulation. Earnings expectations are steady, the technical picture still resembles an ageing but intact uptrend, and macro debate is focused on the pace of future rate relief rather than the risk of an abrupt recession.For investors who can tolerate volatility, this supports a selectively constructive stance centred on balance sheet strength, quality names and disciplined position sizing.

Over the next 12 to 18 months, domestic inflation and the RBA’s reaction will remain the major drivers of index valuations. A scenario where inflation gradually falls without damage to employment favours a slow grind higher led by resources, infrastructure and durable growth names. A stickier inflation outcome would reward investors who used this support level to refine exposures rather than chase every rally.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.