Company Overview, Legacy and Recent Move

Washington H. Soul Pattinson and Company Limited, commonly known as Soul Patts, is one of Australia’s most enduring and diversified investment groups. From its pharmacy origins in the early 1900s, the group has evolved into a sophisticated, value-oriented investor active across public equities, private equity, credit and property, with a long-term focus on capital growth and steady dividends. The full acquisition and merger integration of Brickworks Limited is a recent strategic milestone, expanding Soul Patts’ industrial and building materials exposure while simplifying historical cross-shareholdings.

Investment Philosophy and Strategy

Soul Patts follows a disciplined, value-driven investment philosophy, underpinned by permanent capital that allows patient, cycle-aware decision making. The company targets compounding businesses with resilient cash flows and governance structures that support long-term growth. Its strategy balances listed, liquid positions with private and credit investments to deliver diversified income and capital appreciation. The Brickworks integration provides scale benefits and greater operational leverage in industrial markets.

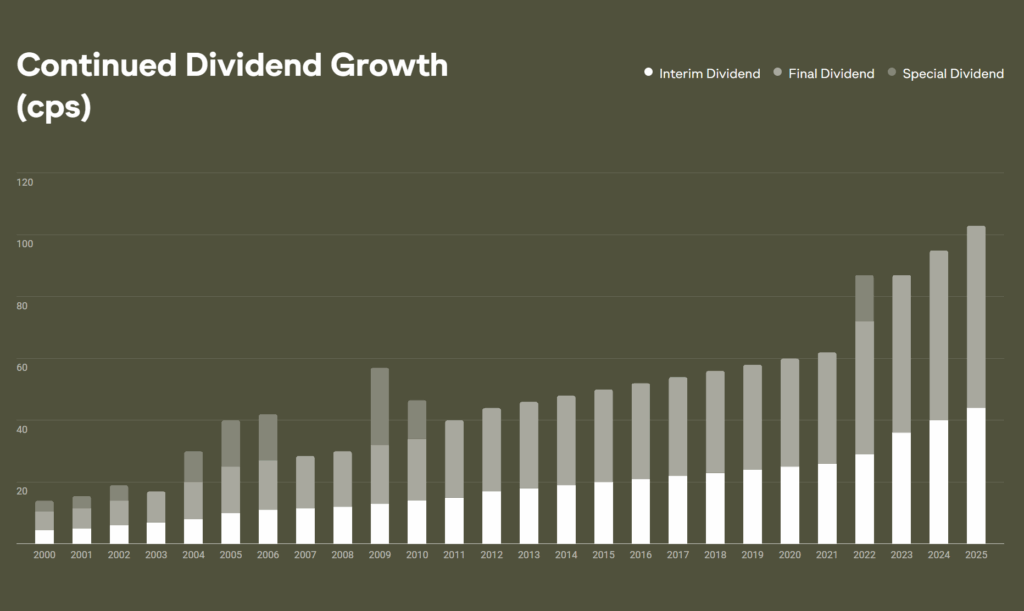

Historical Performance and Dividend Record

Soul Patts has a notable track record of consistent shareholder returns and dividend reliability. The company has paid dividends every year since 1903, and has increased dividends annually since 2000. This reflects a rare long-term commitment to distributions. The Brickworks merger is expected to generate medium- to long-term synergies, consolidate capital structures, and improve group-level cash flow dynamics, supporting ongoing dividend policy.

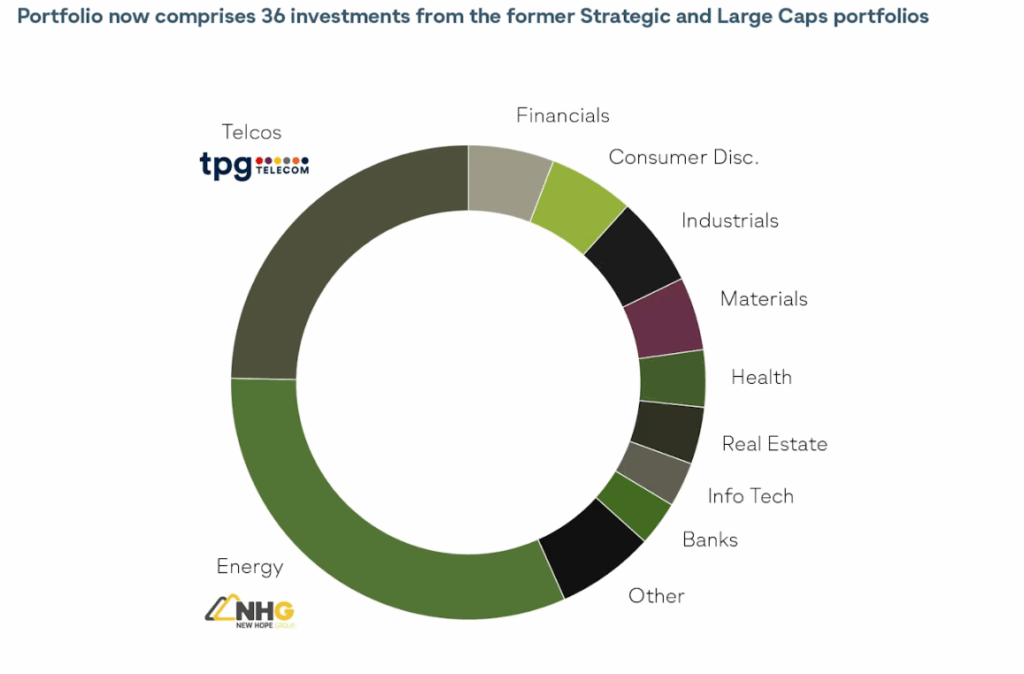

Portfolio Composition and Key Holdings

The group’s portfolio spans telecommunications, natural resources, financial services, building materials and property, combining large-cap listed equities with private equity and credit exposures. Significant holdings include established listed names and a meaningful industrial platform via Brickworks. Soul Patts manages the portfolio actively, with mark-to-market valuation practices and governance involvement where it can drive value enhancements.

Recent Acquisitions and Realisations

The Brickworks merger, which removed cross-holdings, improved transparency and allowed a refinancing of Brickworks’ debt, strengthening the balance sheet. Historically, Soul Patts has shown discipline in realisations and reinvestment, recycling capital into higher conviction opportunities while preserving liquidity for opportunistic deployments.

Financial Health and Dividend Policy

Soul Patts reports strong operating margins and steady cash flow, which underwrite its dividend program. Recent metrics include a trailing twelve-month dividend near $0.99 fully franked, with a payout ratio around 63%. The group’s FY24 results reflected merger-related gains and underlying operational strength, with positive free cash flow supporting both reinvestment and distributions.

Fundamental Analysis

Profitability and Margins

Soul Patts demonstrates robust profitability, with operating margins above 40% and gross margins around 66%. This reflects the high-margin nature of large parts of its portfolio, and the earnings mix post-merger. These margins are indicative of efficient cost structures at the group level, supported by stable income from listed holdings, and yield-generating private and credit investments.

Earnings Quality and Cash Flow

Earnings per share have recently moderated to around $1.60 due to merger accounting and revaluation timing. However underlying cash generation remains strong, with consistently positive free cash flow. The quality of earnings is reinforced by recurring cash returns from long-term holdings and contracted-like revenues within industrial segments post Brickworks integration.

Valuation and NAV Considerations

Soul Patts typically trades with reference to its net asset backing, and the simplification from the Brickworks merger reduces structural discounts that previously complicated valuation. The company’s NTA is a useful floor for valuation, especially given the diversified mix of marketable securities and fair-valued private holdings. Investors should watch the NTA trajectory as merger synergies crystalise and revaluations occur across the industrial asset base.

Return Metrics and Dividend Sustainability

Return-on-equity and cash return metrics remain attractive for the sector, underpinned by a long dividend history and payout that is supported by realised gains and recurring portfolio income. The declared fully franked dividend and positive free cash flow, signals sustainable shareholder distributions in the medium term, assuming stable market conditions and successful merger integration.

Key Fundamental Risks

Integration execution risk at Brickworks, cyclical exposure in building materials, and public market valuation volatility can affect mark-to-market NTA and near-term earnings. Regulatory changes and macroeconomic shocks such as rapid interest rate moves may also pressure asset valuations and financing costs, although the company’s diversified asset mix and active risk management mitigate these risks.

Risks and Considerations

Key risks include integration complexity from the Brickworks merger, sector cyclicality in building materials and mark-to-market sensitivity across listed holdings. Additional considerations include regulatory changes and macro factors like interest rate shifts or inflation that can influence portfolio valuations and cost of capital.

Outlook and Conclusion

Soul Patts combines a century-long dividend track with a modern diversified investment platform. The Brickworks merger enhances industrial exposure and simplifies ownership structures, creating clearer pathways for capital deployment and value realisation. For investors seeking a blend of income and capital growth, Soul Patts presents a compelling, conservatively managed vehicle.

We assign a 3-star rating to SOL. This reflects a balanced view on its stable dividend profile, tempered by merger integration risks and moderate near-term growth outlook.

Disclaimer

The Investor Standard provides general information for education and research only. It is NOT personal advice, a recommendation, or an offer to buy/sell any security. This content has been prepared without taking into account your objectives, financial situation or needs. Past performance is not indicative of future results. Before acting on any information, consider its appropriateness and seek independent advice from a licensed financial adviser.